Thrilled to announce our partnership with INFOPRO, an expert AI-driven banking solutions company in Malaysia! Together, we’re joining forces to empower smarter credit and digital transformation across the region’s banking sector.

Brankas Blog

We talk about Industry Insights, Open Banking, FinTech trends, and more

Thrilled to announce our partnership with INFOPRO, an expert AI-driven banking solutions company in Malaysia! Together, we’re joining forces to empower smarter credit and digital transformation across the region’s banking sector.

Our CEO and Founder, Todd Schweitzer, has been recognized as one of the Fintech Frontiers Emerging 35 winners by Fintech News Network. This prestigious award celebrates the most innovative and impactful fintech founders across the ASEAN region who are shaping the future of finance.

When Saudi Arabia unveiled its Open Banking Lab in early 2023, it marked more than just a technical milestone, it reflected the country’s tangible commitment to reshaping financial services. Learn how Saudi Arabia is leading the way in open banking and fintech opportunities in the region.

Vietnam’s financial sector is rapidly transforming, and Open Finance is no longer just a concept—it’s a strategic priority. As banks and financial institutions navigate this new landscape, one critical question emerges: How can they implement an open banking system that is secure, compliant, and efficient enough to compete in this new era?

When Jordan launched its first approved sandbox pilot under the Central Bank of Jordan’s regulated Open Banking framework, it marked a major milestone in the country’s journey toward digital financial transformation. But this achievement also raises important questions: How did Open Banking begin in Jordan? Where does the country stand now? And what’s next as the ecosystem continues to evolve?

Excited to share that we are partnering with Gimasys! This strategic combination will bring a comprehensive, safe and breakthrough Open Banking solution to the banking and finance industry (BFSI) in Vietnam.

The United Arab Emirates (UAE) is at the forefront of financial innovation, with significant strides in open finance and embedded finance transforming the nation’s financial scene. These developments are not only enhancing consumer experiences but also positioning the UAE as a global leader in fintech.

Ngân hàng Nhà nước Việt Nam đã ban hành Thông tư số 64/2024/TT-NHNN, một khung pháp lý yêu cầu các ngân hàng phải triển khai các Open API chuẩn hóa. Mặc dù sự thay đổi này đòi hỏi các tổ chức tài chính phải thích ứng, Thông tư 64 cũng mang đến cơ hội chiến lược cho các công ty fintech đổi mới sáng tạo.

The State Bank of Vietnam has issued Circular No. 64/2024/TT-NHNN, a regulatory framework mandating banks to adopt standardized Open APIs. While this shift requires financial institutions to adapt, Circular 64 presents a strategic opportunity for fintech companies to innovate.

BaaS and open banking are two terms that often go hand in hand, but how are they different? Learn more about banking-as-a-service vs. open banking.

Brankas and Vilja have partnered to accelerate open banking adoption in Vietnam and ASEAN by helping financial institutions modernize core systems, adopt secure APIs, and comply with new State Bank of Vietnam regulations—enabling scalable, digital-first financial services and driving financial inclusion across the region.

BaaS enables non-bank businesses to work with fintechs to provide services through digital platforms. Learn how to build better customer experience with BaaS.

2025 holds much promise for banks, fintechs, lenders, and businesses in the MENA region. Discover what’s next for open baking in MENA’s financial landscape.

Financial data that is readily accessible helps banks assess creditworthiness, speeding up loan approvals with open banking. Learn more about how it works.

As open banking continues to gain traction, financial institutions must take a proactive approach to open banking compliance. Learn how to navigate regulations.

What is account aggregation in open banking? With this service, customers can get visibility on all their accounts and transactions in one place. Learn more.

Open banking is revolutionizing the way lenders assess risk and provide financing to SMBs. Learn how open banking is transforming small business lending.

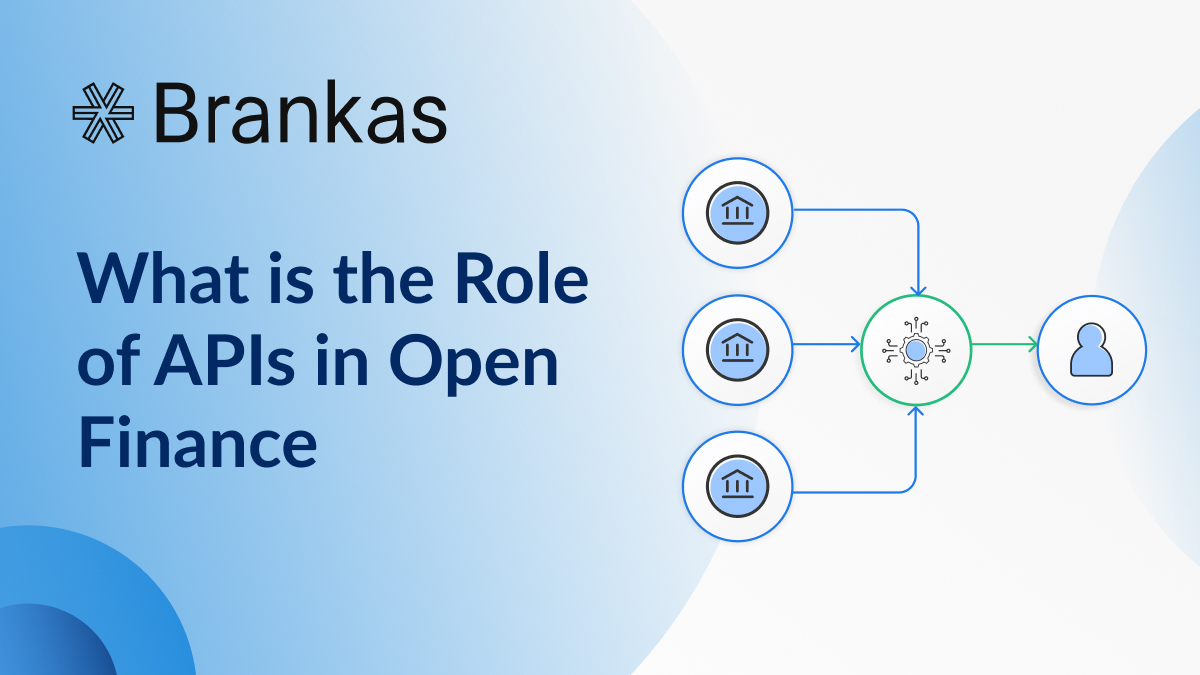

As consumers demand a more streamlined experience online, the role of APIs in open finance platforms becomes more crucial. Learn more about this shift.

Struggling with piles of invoices and delayed disbursements? Accounts payable automation with disbursement API makes invoice management hassle-free. Learn more.

Automate sending funds from any corporate bank account with Brankas. Learn more about disbursement API integration for your mobile app by reading this guide.

Payment gateway integration for your mobile app is essential to facilitating seamless transactions and customer experiences online. Read our guide to learn more.

Boost customer growth with open banking. Follow our customer retention and acquisition tips leveraging the power of open banking. Read them here.

Tired of fragmented financial services? Start enhancing customer experiences with open banking. Learn all about it with Brankas.

Discover how open banking impacts consumers by transforming the financial industry. Click here to read how it benefits users and businesses

What is the role of data privacy in open finance? Let’s discuss why open finance centers on data privacy and how companies can protect customer data.

What is first-party fraud in fintech? This is a type of fraud done by a legitimate customer. Keep reading to learn more and how to protect your business from it.

What is the difference between authentication versus authorization? Learn about each practice and how they help keep your data secure. Read it here.

Embedded finance integration solutions are taking over the fintech world. Learn more about out the types, benefits, and use cases here.

Creditworthiness greatly influences loan applications, but how do lenders determine creditworthiness to begin with? Learn more here.

How does fintech lending work and how does it make loans more accessible to individuals and businesses alike? Learn more here.

Managing payments in today’s digital economy comes with its share of risks. Learn more about payment risk management and how you can protect your organization.

E-commerce payment systems make online transactions easy and hassle-free. Learn more about current trends and predictions that will impact this technology.

The growth of alternative payment methods is reshaping the payments industry. As consumers constantly look for convenience, flexibility, and security, businesses must adapt to these changing preferences to maintain a competitive edge while enhancing customer experience.

Know Your Customer (KYC) regulations are essential for financial institutions dealing with sensitive information. Learn more about global KYC standards.

Explore the world of peer-to-peer payments, their benefits, and how they are revolutionizing personal transactions and financial interactions.

What is a lending API, how does it work, and more importantly, why does it matter? Learn all that and more here.

Stay ahead by learning how financial API integration works and the latest trends that are transforming the financial services industry.

Dive into the financial ecosystem to understand its key players, challenges, and opportunities that are transforming the fintech landscape.

Efficiency and reliability are integral factors of doing business today, especially when it comes to payroll. Many companies find handling payroll is like navigating a minefield; one mistake may result in missed deadlines, unhappy employees, and compliance issues. Welcome to the future of payroll! Businesses may now simplify their processes with the emergence of automated payroll disbursement systems to ensure timely salary payouts with less hassle.

Discover effective strategies for fintech fraud detection to protect your business from financial crime and enhance customer trust.

The Asia-Pacific (APAC) region is leading in the adoption of cashless payments, according to the World Payments Report 2025. Consequently, there is a demand for more efficient and more secure payment methods. Pay by bank solutions are increasingly transforming payments as businesses and customers in the region continually look for a more frictionless experience.

Explore how financial APIs are revolutionizing the finance sector, enhancing efficiency, and driving innovation in banking and fintech.

Brankas is excited to announce that its Brankas Disburse API is now fully operational and live with Bank Central Asia (BCA), marking a significant milestone in the evolution of instant, secure financial disbursements.

Brankas announced its open banking compliance solution now comes fully integrated with an API suite and ADVANCE.AI’s eKYC technology.

As the region enjoys rapid digital transformation, Cambodia stands out as a country to watch. Despite its historical challenges, Cambodia’s economy demonstrated resilience in 2023 and is primed for robust growth in the coming years.

The simplicity of integration, security, and pricing are among the main features to look for in an online payment gateway. In this article, Brankas discusses the top 10 online payment providers in the UAE.

Brankas today released a new report analyzing the state of open banking readiness in Southeast Asia, focusing on Thailand, the Philippines, and Indonesia.

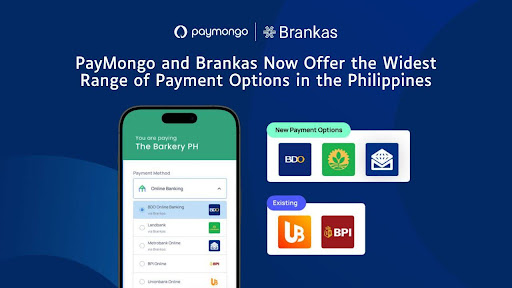

Enable seamless, secure, and direct online banking payments with Brankas through PayMongo, featuring top Philippine banks BDO, Metrobank, and Landbank.

Adopting instant payment solutions is not just a technological upgrade in the UAE; it’s a shift that is changing how businesses operate, boost their competitiveness, and drive growth.

The draft circular sets up banks and financial institutions for upcoming open banking programs by the State Bank of Vietnam, detailing requirements for authentication, encryption, API documentation, and other data security components.

Brankas today announced the integration of its Brankas Disburse API with Bank Central Asia (BCA). Businesses using Brankas Disburse API can now do bulk disbursements through their BCA corporate accounts, in addition to their Bank Permata accounts.

Open Banking, a concept that allows third-party financial service providers (TSPs) to access financial data with customer consent, has been gaining traction globally. Malaysia, recognizing the potential benefits of open banking, has made significant strides in implementing related policies.

Dubai has made major strides in improving people’s interactions with government services via integrated payment systems. These solutions combine multiple services, allowing users to conveniently pay for utilities, transportation, and healthcare from a single platform.

As the standard customer behavior continues to change, the future of digital payments and e-commerce in the UAE holds immense potential. For businesses, digital payment systems help them offer a better customer experience, lower transaction costs, and broader reach.

Open banking is revolutionizing the financial industry by enabling secure data sharing between banks and third-party providers. Rooted in regulatory frameworks like Europe’s PSD2 (Revised Payment Services Directive), it aims to enhance transparency and innovation. For consumers and banks, understanding open banking is crucial as it reshapes financial services and customer experiences.

Open banking is disrupting the financial industry. A Finastra survey of global financial entities shows that 3 in 5 banking professionals consider it a ‘must-have.’ Proponents of open banking believe it fosters competition, spurs innovation, and enhances consumer choice. Critics raise concerns about potential financial vulnerabilities and data security issues.

Brankas and Boost Capital have launched LoanLink, the first chat-based lending solution of its kind in Southeast Asia. LoanLink provides a user-friendly chat interface that facilitates seamless integration and instant loan applications. By eliminating manual processes, complex integrations, and incomplete applications, this digital-first approach enhances efficiency and reduces operational expenses.

Financial fraud is rising globally as more consumers adopt technology in their banking activities. Interpol reported fraudsters stole over $1 trillion in 2023. Criminals are finding it easier to steal banking and credit card information online as trade becomes more digitalized. Traditional fraud detection approaches, such as manual audits and investigations, have limitations in speed, precision, and scalability. Predictive analytics has emerged as a powerful tool for this escalating challenge.

A McKinsey article by Guillaume de Gantes, Hernan Gerson, and Kristine Romano states that 44% of the Philippine bankable population was unbanked in 2021. This exclusion from the formal financial system poses numerous challenges for individuals and communities. It hinders their ability to save, invest, and secure loans for various needs.

The world has witnessed a dramatic shift in how companies handle personal data since the GDPR took effect in 2018. GDPR set a new standard for transparency, accountability, and individual control over data. Its implementation has serious implications for credit scoring and consumer rights in the financial sector.

Customer trust is fundamental in digital banking. Trust forms the bedrock of the relationship between banks and customers. Customers expect their financial data to be safeguarded against unauthorized access and misuse when they entrust it to a bank. Security assurance is essential in fostering trust because it signifies the bank’s commitment to protecting customers' interests.

Loans today are no longer limited to borrowing from banks or other financial institutions. One of the fastest-growing ways to access credit is through peer-to-peer (P2P) lending platforms or websites. In 2023, its worldwide -market size was valued at almost $111 billion and is predicted to reach $ 1,168.1 billion by 2033. Technological advancements and quick access to the internet have turned P2P lending into a global phenomenon.

In the dynamic world of fintech, Southeast Asia stands as a beacon of innovation and growth. With a burgeoning population and increasing internet penetration, the region is ripe with opportunities for digital transformation in lending. Brankas' white paper, “Lending Redefined: Harnessing Digital Opportunities in Southeast Asia,” delves into these opportunities, offering a comprehensive analysis of the current landscape and future trends.

The recent Open Finance Revolution Conference brought together industry leaders to explore the transformative potential of open finance and its impact on the future of financial services. The event saw over 300 participants and featured notable sponsors including IBM, Grab For Business, Xendit, PeekUpPay, Gorriceta Africa Cauton & Saavedra, Oradian, Boost Capital, and Dobin. Additionally, a raffle was held, with the exciting prize of an Apple Watch Series 7, adding to the event’s appeal.

Personalized lending is transforming the financial landscape by offering tailored loan products that meet the unique needs of individual borrowers. Open banking provides the comprehensive, real-time information needed to craft bespoke credit offers by allowing banks to share customer data securely with authorized third parties.

The financial world is rapidly shifting because of digitalization, and traditional credit scoring methods are being challenged and reinterpreted. Historically, banks have relied heavily on conventional data sources such as credit history, loan repayments, and income levels to assess an individual’s creditworthiness.

Open banking has been a game-changer in banking and finance. Allowing third-party providers to access customer data enhances customer experience, promotes competition, fosters financial collaborative ecosystems, and enables emerging technologies integration. Fintechs and banks are embracing open banking and open finance. Will credit unions catch up?

Online banking has made managing our finances simpler and more convenient. With just a few clicks, we can check our balances, transfer money, and pay bills. As online banking grows, so do the risks of fraud. Fraudsters are finding new ways to steal money and personal information. Strong fraud management practices are vital in keeping banks and customers safe.

The finance sector was the third-highest industry to adopt AI or artificial intelligence worldwide in 2022 (Statista). Financial institutions use AI across operations, sales and marketing, and HR. “Artificial intelligence has streamlined programs and procedures, automated routine tasks, improved the customer service experience and helped businesses with their bottom line.” (USD Online)

Online loan applications made through digital channels, or digital lending, are expanding quickly. It is easy to use, quick, and available to anyone. The global market value exceeded $12 million in 2022. It is forecasted to hit $71 million by 2032 (Allied Market Research). Technology breakthroughs and consumer need for convenience have substantially increased its appeal.

Credit scoring is a statistical analysis used by lenders and financial institutions to assess a person’s or a small business’s creditworthiness. Traditional credit scoring methods rely on limited data sources, such as credit reports and payment history. These methods often exclude individuals without established credit histories, like the unbanked and underbanked.

Digitalization is ushering convenience and accessibility for everyone but heralded immense financial and reputational damages worldwide from fraud. SEON CEO Tamas Kadar said 71% of financial enterprises have reported a security incident in 2022. Fraud detection and prevention have become an essential part of business operations.

Brankas and Global Finteq today announced a strategic partnership to launch one of the first Lending-as-a-Service (LaaS) platforms in the Philippines. Established banks, rural banks, and even non-traditional financial institutions are now able to lend at scale as existing loan products can now exist outside of the traditional channels such as physical bank branches or websites.

Brankas is pleased to announce its selection as a winner in the FIS InnovateIN48 Partner Edition 2023 competition.

In May 2024, Brankas Enterprise Group Product Manager Sarah Huang attended the Malaysia mission trip hosted by the Singapore Fintech Association (SFA). Here are the major trends and insights gathered during the visit, highlighting Malaysia’s current and future plans in fintech.

Technology’s influence on modern society is undeniable, and it is now extending its reach into the most fundamental aspects of our lives—like acquiring a home. The meticulous process of verifying assets and income statements was once cumbersome and time-consuming when it came to assessing the eligibility of a prospective homeowner. Thanks to cutting-edge technology, mortgage lenders and borrowers are entering a new era of streamlined, efficient asset verification.

The process of customer onboarding in the banking sector is pivotal. Traditional customer onboarding involved a labyrinth of paperwork, in-person meetings, and extensive documentation. However, banks have been moving toward the digital frontier in recent years. The transformation enabled banks to offer a streamlined and efficient approach that simplifies onboarding and enhances the banking experience.

Open banking has reshaped how financial services are accessed and utilized. The practice of sharing financial information with third-party providers using Application Programming Interfaces (APIs) enables a more interconnected and collaborative financial ecosystem. Account Information Service Providers (AISPs) and Payment Initiation Service Providers (PISPs) are two key players in open banking.

APIs, or Application Programming Interfaces, are transforming finance today. They serve as the digital connectors that enable seamless communication and interaction between different software applications. APIs act as intermediaries to facilitate the exchange of data and functionalities.

PYMNTS’ Beyond eCommerce Fraud study in 2022 found first-party fraud costs US merchants over $89 billion yearly. The expensive loss comes from individuals who exploit chargebacks, promotions, returns, or the policies of merchant and financial service providers to obtain complimentary merchandise or payouts illicitly. Imagine an individual applying for a loan without any intention of repaying it.

Open banking is ushering in a new era where financial services are not confined within silos but seamlessly interconnected. API integration makes this possible. The integration of APIs in open banking facilitates the smooth exchange of information between different banking systems. A customer viewing transactions from various accounts in a single application or swiftly transferring funds between different banks are tangible outcomes of strategic API integration in open banking.

Brankas is the first company to secure the PJP Category 2 License for Account Information (AInS) from Bank Indonesia, marking an open banking data milestone for Indonesia and giving businesses added visibility on payment transactions.

A new player has emerged in modern finance that is shaping the way we manage and understand our financial lives – Financial Data Aggregators. What are financial data aggregators, and why do they matter in an increasingly digital financial landscape?

The world of banking stands on the cusp of transformational change. The financial landscape, once characterized by tradition and stability, has now become a dynamic arena where digitalization, shifting customer expectations, and disruptive forces propel the industry forward. In an era of unprecedented innovation, banking institutions are rewriting their strategies to maximize growth opportunities in 2024.

Understanding the intricacies of chargebacks and refunds is paramount for merchants. Chargebacks and refunds play crucial roles in customer satisfaction and maintaining a positive business image.

Imagine you are an avid online shopper. You frequently check multiple e-commerce websites to compare prices for the same product. It can be time-consuming to visit each site, find the product, and note the price. Here’s where screen scraping comes into play.

This article aims to equip business owners with the knowledge needed to proactively manage and mitigate the impact of payment reversals on their operations.

Omnichannel payment strategies are vital in today’s retail sector, where consumers seamlessly transition between physical stores and digital platforms. These strategies redefine the customer experience and play a significant role in driving sales. Integrating diverse channels, from in-store to online and mobile platforms, offers customers a cohesive and convenient journey.

Brankas Disburse API will enable drivers on new Philippine ride-hailing app PeekUp to collect earnings instantly after each ride.

The role of payment rails cannot be overstated in our increasingly interconnected world. As businesses expand globally, consumers demand instant gratification and financial innovation surges. Payment rails serve as the linchpin that holds the digital economy together. They enable e-commerce giants to process millions of transactions daily, empower individuals to send remittances across borders with ease, and underpin the rise of cutting-edge financial technologies.

Subtle yet significant changes are reshaping how we engage in transactions. Gone are the days of laborious payment processes; today, we take seamless, effortless transactions for granted. But have you ever wondered about what makes this possible? It is called embedded payments. It is a part of the daily lives of almost everyone, and it is worth exploring how this unassuming technology has quietly transformed business.

Business payments have experienced a significant transformation in recent years. A 2022 study conducted by the Association for Financial Professionals (AFP) in partnership with J.P. Morgan unveiled a compelling shift within organizations in the United States.

The terms “push payment” and “pull payment” in financial transactions are fundamental dynamics that dictate how money moves between entities. Understanding these payment mechanisms is a concern for financial professionals, individuals, and businesses navigating the modern financial landscape.

Staying ahead in banking means embracing innovations that enhance efficiency, security, and customer experiences. One technology that has become a cornerstone of modern banking is the strategic implementation of APIs (Application Programming Interfaces) and their meticulous management.

Brankas and NetGlobal Solutions Inc. (NGSI) have signed a Memorandum of Agreement (MoA) under which Brankas will support NetGlobal Pay in its QR Ph, pay-by-bank, and pay-by-wallet capabilities in both NetGlobal Pay’s payment and e-wallet platforms.

The report offers valuable insights into the uptime performance of top banks in the Philippines and Indonesia, including RCBC, Bank Mandiri, and UnionBank, informing businesses, partners, and end users on the infrastructure reliability of the banks they trust.

Open banking standards refer to a framework that encourages secure data sharing and collaboration among financial institutions, FinTech innovators, and other third-party providers.

Non-compliance with open banking regulations transcends geographical boundaries and carries legal implications that resonate globally. This article is designed to equip you with the essential steps to ensure compliance and success in open banking compliance.

This guide will inform you how to efficiently handle your SSS contributions online, offering you a hassle-free and secure way to ensure financial security.

Innovation is reshaping how businesses operate, and insurance companies are no exception. As technology revolutionizes various industries, staggered payments have emerged as a game-changer, offering numerous benefits for insurers and policyholders.

SWIFT and bank codes function as digital signatures, uniquely identifying financial institutions. They play a vital role in verifying the origins and destinations of funds, reducing errors, and simplifying the intricate process of cross-border money transfers.

The spotlight on these groundbreaking banking transformations is illuminated by the Top 10 Banking Technology Trends and Adoption in 2023.

Embedded finance is not merely a trend; it is a seismic shift in the business landscape. It is about convenience, personalization, and, most importantly, keeping customers engaged and loyal. Financial transactions are no longer bound by traditional banking, and embedded finance opens new horizons.

This new white paper is a timely resource that sheds light on the evolving and dynamic financial landscape of financial services and addresses the pivotal themes shaping the transformation in the MENA region.

The significance of customer retention cannot be overstated. The pursuit of new customers is undoubtedly vital, but the retention of existing ones is equally, if not more, important. Loyal customers often prove to be the cornerstone of a thriving business, driving revenue, and providing stability.

Open banking presents transformative possibilities for Indonesia’s MSMEs. The successful integration of MSMEs into the open banking framework has a profound impact that extends well beyond their individual growth.

Your credit score is crucial for financial opportunities in the Philippines. Understanding and monitoring it is key to success. It affects loans, credit cards, and interest rates. This guide empowers you to make informed decisions.

GCash revolutionized the financial industry in 2012 with its groundbreaking mobile app, simplifying complex transactions into effortless taps on a smartphone screen. With 5 million merchant partners spanning various industries, you can learn more in this article about how to become a GCash merchant and integrate GCash as a payment method for your business.

Brankas and PesoPay today announced that the payment gateway by AsiaPay is now live with Maya, enhancing the number of payment options available for existing and new PesoPay merchants.

Global leaders in open banking and open finance join forces to provide centralised technology infrastructure and Banking as a Service (BaaS) solutions to fast-track open finance.

Open banking constitutes a transformative shift where customers can seamlessly explore novel financial offerings from authorized third-party providers. This innovation is facilitated by financial institutions crafting Application Programming Interfaces (APIs) that align with the central bank standards of a country.

QR codes (Quick Response codes) are no longer strange to Filipinos. Social distancing and contactless payments during the pandemic paved the way for consumers to pay for goods and services using their mobile devices. Consumers scan the code with their cell phones, and payments are sent in real-time. If you have been shopping recently, you may have noticed some QR codes that have a blue, red, and yellow logo in the middle of the usual black dots and white spaces. This is QRPh.

Indonesia is embarking on an ambitious project to build a new capital city in Kalimantan, Ibu Kota Nusantara (IKN). Jakarta, the current capital, will no longer hold that title by 2024. This bold decision promises a fresh start for the nation, with hopes of a brighter and more sustainable future.

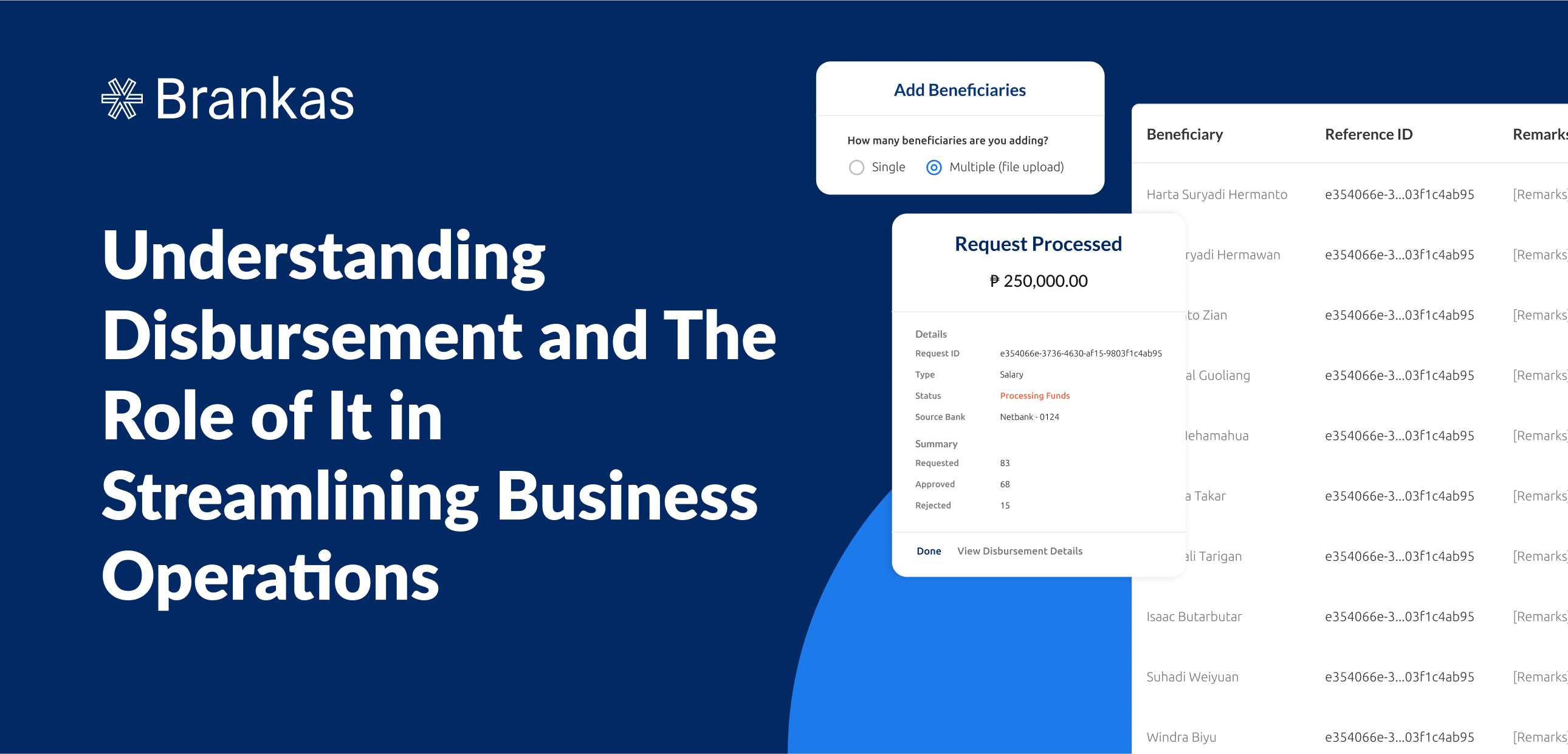

Delves into the “disbursement” concept, its role in releasing funds for specific business purposes and streamlining operations. It also highlights the Brankas Disburse API to enhance task efficiencies like payroll and merchant payments.

The synergy between Musoni’s core banking system and Brankas' integration network marks a transformative leap in financial innovation.

Hosted jointly by Brankas and Asbanda, this event brought together regional development banks from across Indonesia to explore the theme of “Maximizing Growth Through Ecosystems.”

Brankas and Appsynth have announced an exclusive strategic partnership in Thailand to drive technology innovation in the financial services industry.

E-commerce transactions have shown remarkable growth in recent years worldwide. Apart from brick-and-mortar stores, shopping has advanced into an industry that uses multi-channel strategies, such as online stores, mobile apps, and e-commerce platforms. Asia is leading the way in B2C (business-to-consumer) sales. Statista reports almost 60% of worldwide e-commerce transactions came from Asia. By 2024,it will comprise 61% of global revenue.

Event Recap: The inaugural Open Finance Revolution by the Fintech Philippines Association (FPH) took place on July 5, 2023. Here’s a quick recap of what transpired.

Leading digital challenger bank Rizal Commercial Banking Corp. is teaming up with Brankas Digital Technologies Inc. to further amplify its digital payment streams.

The emergence of financial services technology, more commonly known as “fintech,” has made it more convenient to pay for services and products. With just a button tap, a QR code scan, and other similar tools, fintech allows people to complete financial transactions quickly and securely.

Going digital can help banks adapt to modern times. Read here to learn how open-source API can help meet consumer demands and stay competitive.

Keeping up with rapidly evolving fintech, like open-core services, is crucial to business growth. Read on to learn more.

Discover how the Asia-Pacific (APAC) fintech industry defied the odds and remained resilient amidst the global economic uncertainties. Learn about the exciting developments in the APAC fintech landscape.

Are APIs important in banking? Yes! Read our blog on the various benefits, factors, and reasons why APIs are very important in banking.

What is open finance? We answer this and more in our complete guide to open finance and key benefits in Asia-Pacific. Read the full guide.

Open finance leader Brankas announced a new integration that will allow MPT DriveHub app users in the Philippines to reload using their active Philippine bank accounts.

It can be challenging for banks and financial establishments to attract new customers, especially using the traditional account opening process. Many people simply do not have the time or patience to drive to the nearest bank, wait in line to talk to a representative, and fill out a bunch of forms to open a bank account.

Convenience is crucial in today’s fast-paced world. Here, technology has made financial transactions more seamless than they were a few decades ago and nowhere is it more evident than in digital banking. Formerly time-consuming, you can now manage bank accounts in the palm of your hand with little to no delay.

Open finance leader Brankas has announced that it has acquired both the Payment Service Provider (PJP) Category 3 License from Bank Indonesia (BI) and the Operator of Payment Systems (OPS) Registration from the Bangko Sentral ng Pilipinas (BSP). The certifications confirm that Brankas meets all local regulatory and security standards for its Open Finance payment solutions.

In some parts of the world, financial institutions and their customers are transitioning from open banking to open finance. Businesses use this innovation to improve their company’s offerings, while consumers leverage the technology to make sound financial decisions.

Many organizations and individuals face inadequate financial services. This inadequacy can have severe implications as it can hinder financial literacy for individuals and business growth for companies. On the other hand, financial inclusion can result in a more productive economy. But what is financial inclusion?

Here are several benefits of banking-as-a-service for enterprise businesses and MSMEs—grow your business by improving customer experience.

Open finance leader Brankas has announced a new feature enabling instant bank account opening as an “embedded finance” experience on third-party applications.

With so many financial developments today, it’s not easy to keep up with such innovations. Then again, staying on top of digital transformation can help secure your spot in your industry. In addition, the right approach can improve your business’s financial stability. Here, open banking and open finance are driving the financial technology industry.

Singapore’s Brankas will enhance open finance infrastructure with Arab Financial Services (AFS) in the Middle East and Africa. Read about the partnership today.

Hylobiz, a B2B supply chain network fintech, partners with Accurate and Brankas to boost business growth in Indonesia. Read about the partnership today.

Nowadays, many people use an app for online financial transactions, like paying bills or sending money to friends and loved ones. But what if you can use the same app not just for simple transactions but also for more complex ones, like investing in the stock market, adjusting your insurance, or even managing your pension?

Like most sectors, the finance industry is seeing increased demand for digitalization to improve the customer experience. A 2021 study found that banking customers now prefer personalized and digitally-driven services. They value text alerts, opportunities to transact more efficiently, and the ability to track multiple accounts using a single dashboard.

Why is fintech becoming a staple in emerging economies like the Philippines? Read about how financial technologies are performing in countries like the Philippines.

Brankas had an awesome 2022! Read about our key accomplishments, compliance certifications, and how Brankas cemented itself as a global open finance leader.

Brankas and Element Inc. partner to enable enhanced security against fraud in open finance technology. Read about the partnership in this article.

According to McKinsey & Company, Asia-Pacific (APAC), customers will likely demand more financial services, given the growing population joining the consuming class. Breakthroughs in digitalized financial services, including open banking and open finance, are making them increasingly popular worldwide, such that emerging countries in Southeast Asia are finding benefits from them.

PERA HUB by PETNET, a top financial service provider in the Philippines, partnered with Brankas in 2021 to launch a Digital Remittance Platform. Read about it.

Brankas and Kaya Founders launched the 8-week Open PHinance Challenge for PH startups, fostering financial inclusion. Read about what happened.

Brankas unveils the ‘Brankas Open’ software license for Open Finance Suite and Open Core products in Southeast Asia. Read about these products.

Oct 27, 2022 — Brankas, a leading Open Finance technology provider, has today announced that it has gone live with Visa to unveil a new Open Finance solution to increase financial inclusion across Southeast Asia, citing TrustDecision (Tongdun) and IziData as two of the pilot customers already using the joint solutions.

Brankas and CRIF, global leaders in open finance and credit bureau solutions, are partnering to launch APAC’s first open finance credit score product.

In 2021, the BSP issued the Open Finance Framework providing the guidelines for enabling Open Finance in the Philippines and setting the standard across Southeast Asia. The regulatory framework is aligned with the Bangko Sentral ng Pilipinas’s (BSP’s) Digital Payments Transformation Roadmap 2020-2023, which aims to strengthen customer preference for digital payments and promote more innovative and responsive digital financial services.

Technology is advancing faster than ever before that is why banks needs to step up their game on the technology side. Here are the latest trends and what to expect.

According to the World Bank’s 2021 Global Findex Database, 1.4 billion adults globally do not have access to formal financial services (unbanked). The main reasons are lack of money, the distance to the nearest financial institution, and insufficient documentation. These challenges are precisely what open banking is trying to address.

Read how Klinikgo is digitizing health services in Indonesia by partnering with Brankas, a global leader in open finance technology and API solutions.

Introducing Brankas Open Core: Streamlining operations and enabling custom financial products. Know more about Brankas Open Core by visiting our website.

The payments industry has found a dynamic and fast-paced market in Asia in recent years. According to consultancy firm McKinsey, payments revenue growth in the region is forecast to increase 7 percent between 2021 and 2025, driven by rapid developments in digital infrastructure, the surge in B2B activity, and the increasing appetite for digital wallets and real-time payments. Now is the best time to explore how an IPG can support Asia’s increasingly complex demands for payments.

Southeast Asia has emerged as a hub for startups, thriving with opportunities for innovation. Embracing open finance is a crucial way for banks and financial institutions to stay ahead of the curve and serve currently unmet customer needs, opening up avenues to serve the underbanked.

Traditionally, consumer lending has been a long and tedious process. To apply for a credit card, you would have to provide your proof of income, bank statement history, and other documents to verify that you are able to repay your credit, often requiring trips to your bank branch. The underwriting process may also take weeks or months before the approval of a loan. They merit a high amount of effort on the part of both the borrower and the lender.

Brankas is pleased to announce that we have passed the certification audit and now hold the PCI-DSS (Payment Card Industry Data Security Standard) certificate.

In this article, we look at three common misconceptions about open finance security and the real situation behind them (and the truth behind them).

Brankas and Paynamics partner to build open banking avenues for e-commerce companies, primarily in the Philippines, giving users a wider variety of payment options.

Growth of cryptocurrency adoption among emerging economies accelerated at the beginning of the pandemic. Read how Brankas can support cryptocurrency companies.

Brankas had a great 2021 and received the Inclusive Fintech 50 Award! Read about our key accomplishments in 2021 and how open finance reached new heights in SEA.

[5th Jan 2022] - Brankas, Southeast Asia’s leading Open Finance technology company, announced the close of its US$20m Series B investment round led by Insignia Ventures Partners with participation from existing investors Beenext and Integra Partners.

Brankas announced that we were awarded the Monetary Authority of Singapore (MAS) Financial Sector Technology and Innovation (FSTI) Proof-of-Concept (POC) grant!

Decoding technology investment opportunities in the Philippines—A joint webinar between Brankas and DTI’s Board of Investments. Watch the webinar on our website.

For a limited time only, receive USD 10,000 worth of credits or an equivalent of 40,000 statement retrievals when you go live any time before 31st January 2022.

Brankas recently announced the appointment of data privacy law expert Arvin Razon and APAC business expansion specialist Simo Figuigui to its Leadership Team.

Brankas is proud to be selected as part of Inclusive Fintech 50’s 2021, an annual competition to identify 50 top technology startups committed to drive financial inclusion.

What Open Banking means for MSME merchants in Indonesia? Looking at a recent report by the Asian Development Bank on Financial Inclusion, we aim to answer that.

Open finance enables banks to expand access to underserved customers by lowering the cost of customer acquisition and onboarding. Read more on our blog.

User interviews are an effective way to get product feedback. Here are 5 effective steps to prepare for your next user interview, brought to you by the Brankas team.

What is Open Finance? How does it matter to end-users? Convenience is a key value added to users. It also unlocks a new phenomenon known as embedded finance.

We recently published a whitepaper on embedded finance in Southeast Asia, Key concepts and definitions of open finance are discussed in this paper. Download it today.

COVID-19 changed the way that almost everyone operates a business. Here’s our take on how to launch a product during a pandemic. Read our insights today.

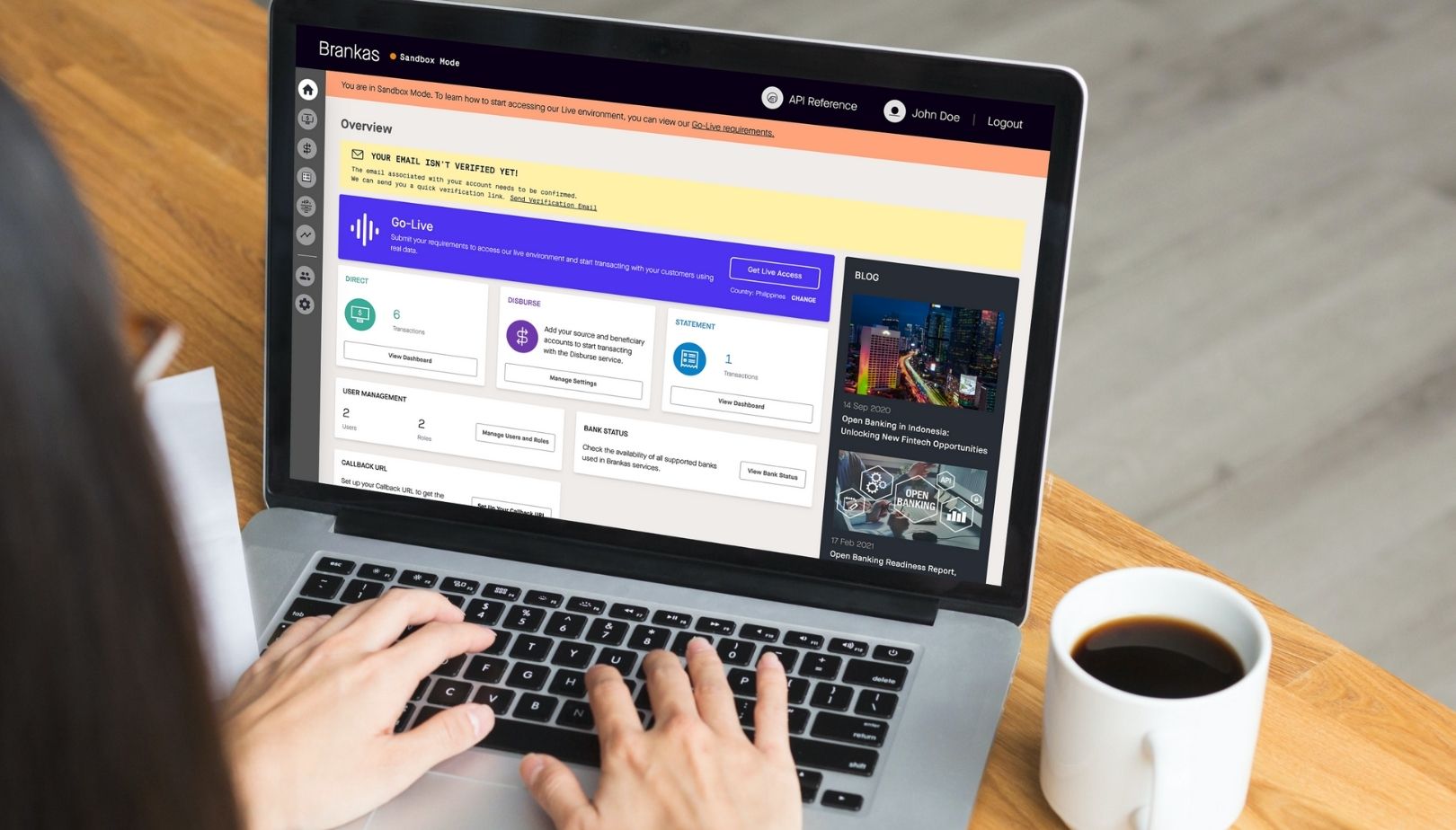

Want to test our open finance APIs? Here’s a guide on getting started with Brankas: Dashboard Sign Up and Staging Site. Check it out today by visiting our website.

Here’s a quick overview on how to complete a transaction on Brankas Direct—our payment product that allows users to make payments without leaving your website or app.

In this blog post we will see how Jaeger tracing can be easily added to a gRPC application in Go inside a distributed microservices architecture. Read it today.

Woohoo! Brankas officialy reached over 10 million monthly API calls across 80 partners. This is a massive achievement for the open finance community!

Brankas enabled easy, fast, and secure loan repayments for Robocash Philippines. This allows users to pay their loan amortization within the Robocash app.

From being a Marine to a high-caliber Systems Engineer, Chad Kunde has come a long way from his humble beginnings on his family’s farm in Iowa. Growing up with 3 sisters, you can only imagine the chaos!

Brankas Direct is a fund transfer service that allows businesses to accept fund transfers from customers instantly and digitally through their web and mobile app.

Originally from Bangladesh, Anik came to Singapore for his undergrad studies at the National University of Singapore. A Biomedical Engineering graduate, passionate about academic research, and has vast experience in areas like 3D printing, cancer cell study; even co-authored papers in peer-reviewed scientific journals! With a career path set in scientific research, how did this young achiever end up at Brankas, his takeaways from working for a fintech startup, and some life lessons for his peers.

The world of User Experience, or “UX” as most people know it, is a growing field that many are taking more notice of, with many UX misconceptions. Read them today.

Through Brankas’ API integration, customers of 2C2P’s merchants will be directly connected to major Indonesian banks including Bank Central Asia (BCA) and Bank Mandiri.

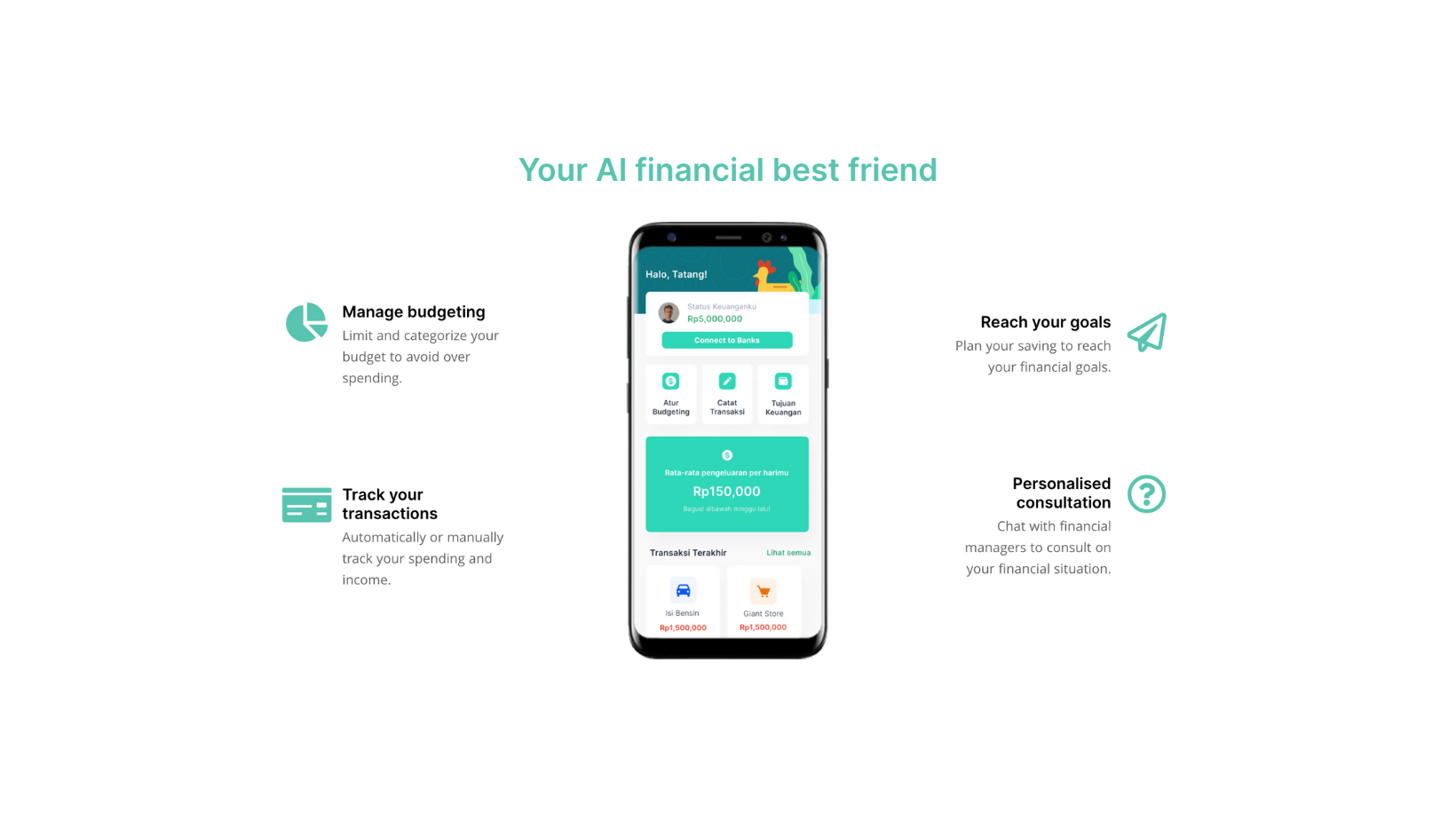

ALIA offers personalised financial advice based on banking Application Programming Interface (API) provided by Brankas to help users manage their money better.

The Brankas community is ecstatic to have Hanny lead our Human Resources team! We had a chance to catch her bubbly and confident personality for this feature. In this month’s HuBs spotlight, we give her a warm Brankas virtual hug and get to know her, her quirks, her insights, and her plans for Brankas a little bit more.

Proxtera is a new global trading network for the connected age: empowering wholesale marketplaces to discover new buyers and sellers around the world, transact securely, and access a range of financial and logistics services to support a successful trade. With support from the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA)’s Business Sans Borders (BSB) initiative, Proxtera is creating a new online economy for global trade.

Brankas has helped banks across Southeast Asia launch new digital solutions for their customers, with a focus on Open Banking technologies. Read the report today.

In this Humans of Brankas Spotlight, we feature Kich who joined our Sales team. Read about her experience, background and what she brings to the Brankas team!

For millions of employees globally, working from home is the new normal. Our biannual Performance Review is one of our tried-and-tested techniques for ensuring that our colleagues are aligned with our vision to make modern financial services available to everyone.

In this Humans of Brankas Spotlight, we feature Ria who joined our Development team Read about her experience and what she brings to the Brankas team!

Recently, we had a webinar on “The State of Open Banking in the Philippines” with Fund Managers Association of the Philippines (FMAP). Watch the full webinar today.

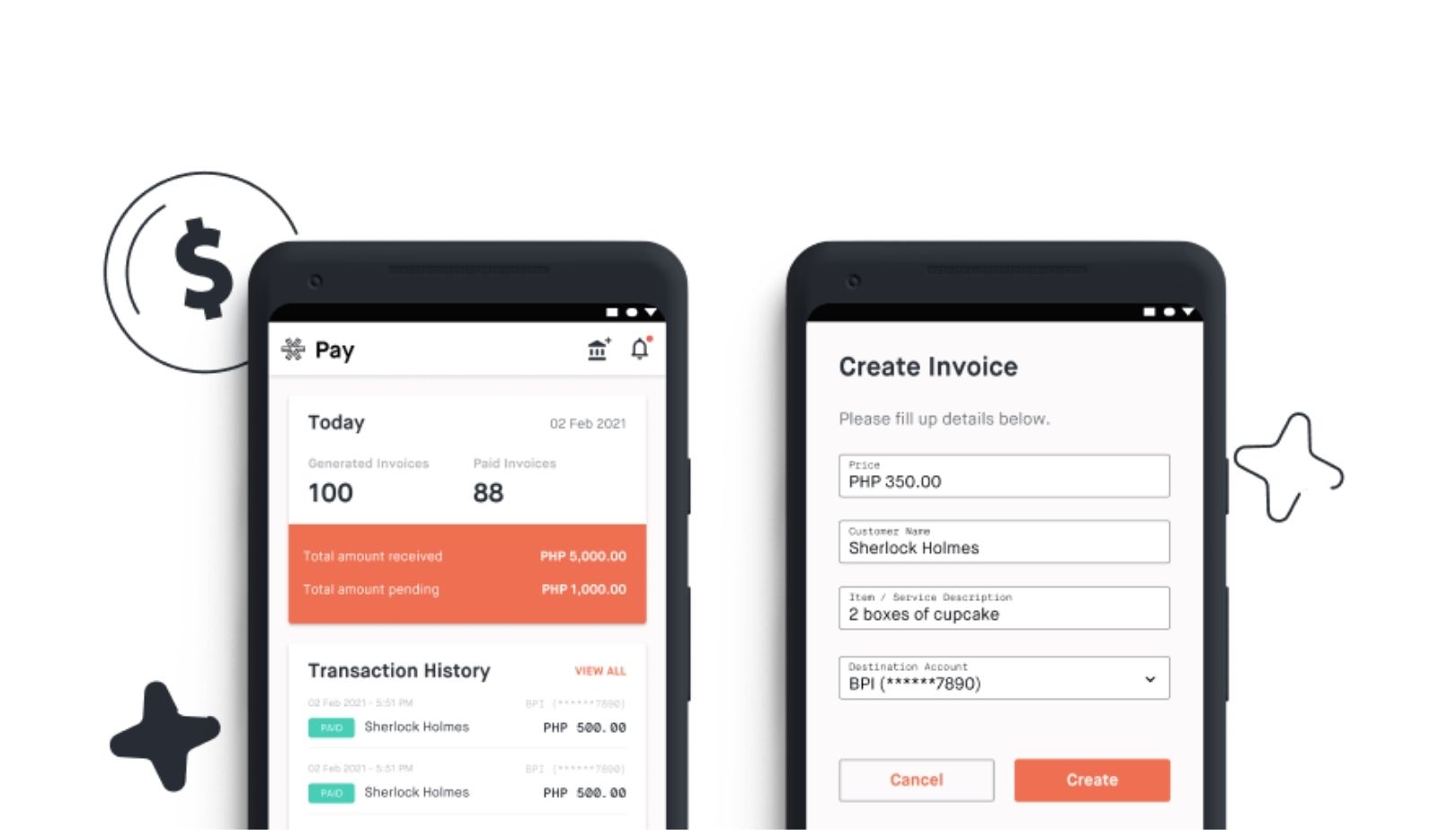

Marco Palinar is proof of how sometimes, life sends you on a path, different from what you set out for yourself. The Brankas spotlight turns on for our resident UI/UX guy, all-around-design-master, Pay Product Manager, rockstar, and sneakerhead- Marco. He gets candid about his beginnings, his career evolution, and his Brankas baby - Pay.

In recent years, there has been a push for tighter Open Banking regulations in Indonesia, and the government has unveiled the Indonesia Payment System Vision 2025 that opens up countless opportunities to weave Open Banking practices into the business model of many companies.There is a need to provide services that are accessible, low cost, and reliable, allowing any business to easily integrate technologically-reliant services into their platforms.

HuB Spotlight: Avani Ajmera Shares How Passion Meets Vocation in Her Role as Finance Director

Open Banking refers to when banks allow third parties to access their customer data. Here’s an overview of Southeast Asia’s Open Banking landscape as of 2020.

Michelle Christine: Next Generation People Operations Associate - She talks about her beginnings, her love for people and culture, and where she’s taking the future of Brankas recruitment.

What are key ways to effectively manage a remote workforce? In this article we talk about “The Three Cs” — Communicate, Collaborate, and Celebrate. Read it now.

Brankas Statement provides a verified, accurate, secure, and instant statement retrieval. Lenders can instantly access customers' financial transaction data, identity data, and real-time account balances. Brankas Statement integrates seamlessly with a lender’s mobile application or website, eliminating the need for paperwork, branch visits, or manual data entry.

Last Monday, June 8th, we held our virtual GoManila meetup for developers interested to learn more about Golang. Here’s a recap of what happened.

Randy Cahyana: Coding Sparks Joy - Randy shares his adventures starting out, the joy of coding, lessons learned, and what’s next at Brankas.

Open banking initiatives are sprouting globally, as more banks recognize the commercial and product innovation opportunity. Banks are thinking differently.

Brankas Direct enables your customers to make instant online payments without leaving your website or app. Read more about Brankas Direct today.

Mike joined Brankas this year and is leading the team full steam ahead. He grew up in Indonesia and Australia and believes his diverse background contributes greatly to how he breaks down and solves problems. Mike has always been passionate about finding solutions that help people. That’s his philosophy and CPO mission.

Due to COVID-19, bank branches are closed. How can banks attract new customers? In this article, we aim to answer that question while focusing on open finance.