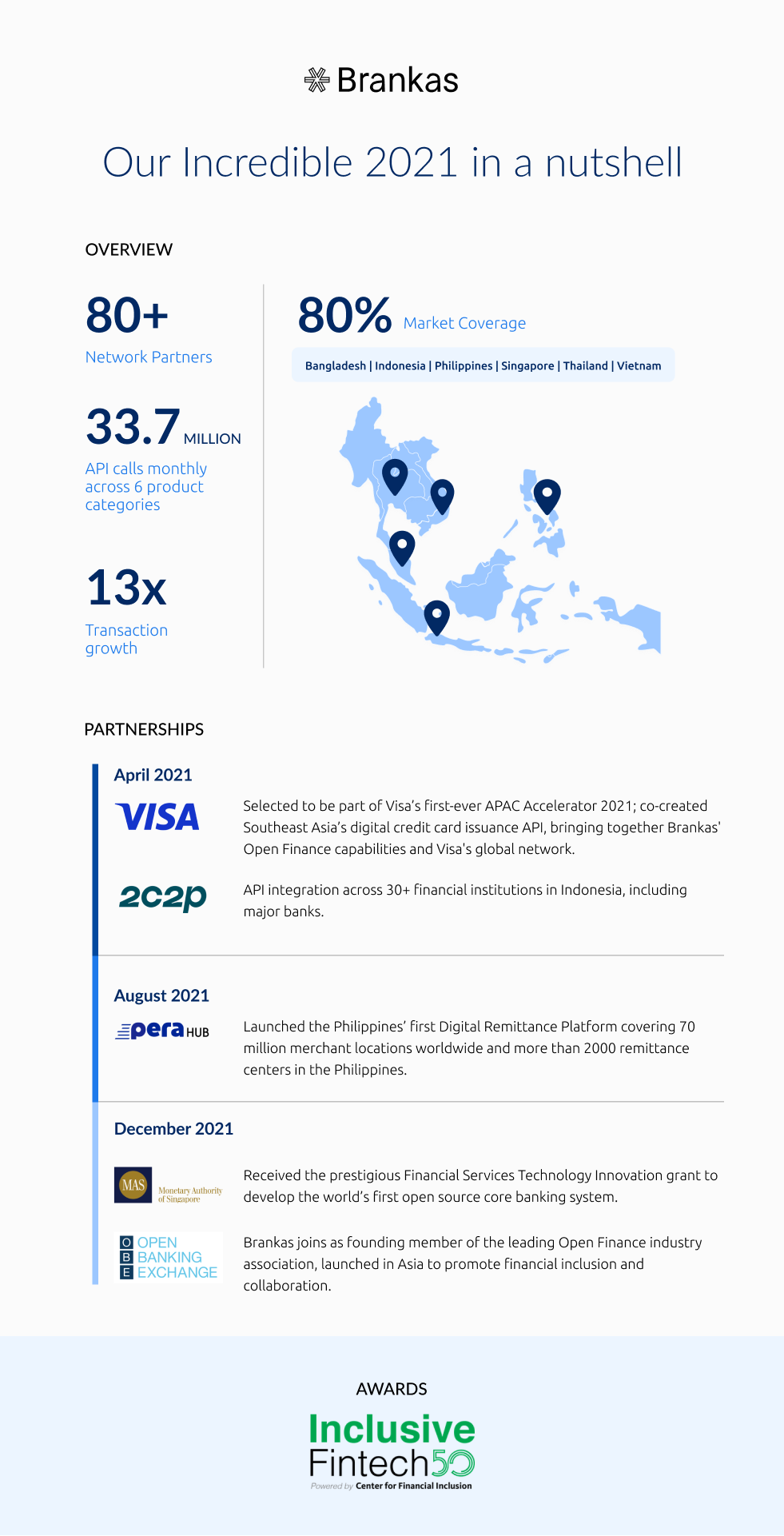

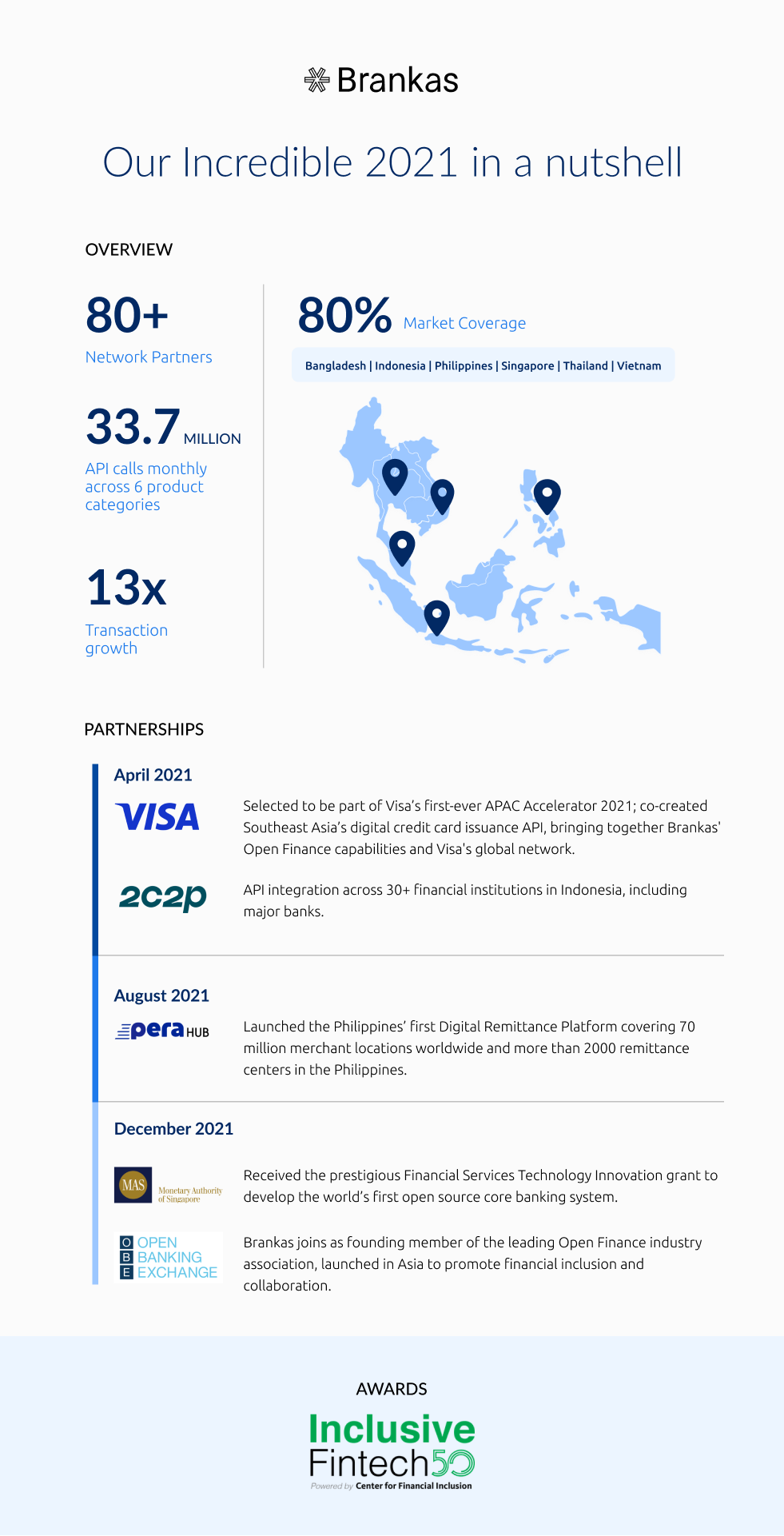

Our incredible 2021 in a nutshell

Overview:

- 80+ network partners

- Over 33.7 million monthly API calls across 6 product categories

- 13x transaction growth

- 80% market coverage

- 6 countries (Indonesia, Singapore, Thailand, Philippines, Vietnam, Bangladesh)

- 120+ team members across 17 nationalities

- Inclusive Fintech 50 Award

- Founding member, Open Banking Exchange Asia

Partnerships:

- VISA (April 2021) – selected to be part of Visa’s first-ever APAC Accelerator 2021; co-created Southeast Asia’s digital credit card issuance API, bringing together Brankas' Open Finance capabilities and Visa’s global network.

- 2C2P (April 2021) – API integration across 30+ financial institutions in Indonesia, including major banks.

- PERAHUB / Western Union (August 2021) – launched the Philippines’ first Digital Remittance Platform covering 70 million merchant locations worldwide and more than 2000 remittance centers in the Philippines.

- Monetary Authority of Singapore (December 2021) – received the prestigious Financial Services Technology Innovation grant to develop the world’s first open source core banking system.

- Open Banking Exchange (December 2021) – Brankas joins as founding member of the leading Open Finance industry association, launched in Asia to promote financial inclusion and collaboration.

Funding:

US$20 million Series B investments (led by Insignia Ventures Partners and VISA, with participation of existing investors Beenext and Integra Partners).

2021 Brankas Highlights

Customer trust

In the first half of 2021, we hit more than 10 million monthly API calls. By the end of the year, we reached 33.7M API calls per month, showcasing how much our close collaboration with our partners has paid off.

We expanded our network to over 80 partners by the end of 2021. Our track record has led us to be selected for the VISA Accelerator Program for Asia-Pacific and a Grant from the Monetary Authority of Singapore. In November, we were also awarded as part of the 2021 Inclusive Fintech 50, which recognizes companies that support MSMEs and low-income individuals to recover and thrive during the pandemic.

Strategic partnerships

Our success was driven by our partners, who worked with us to develop API solutions to all financial transactions, removing pain points commonly associated with these activities – from remittances to payments to transfers.

Some of the pivotal partnerships we had across 2021:

- VISA Accelerator Program (March). We were selected as part of VISA’s first round of startups included in their Accelerator Program for Asia-Pacific. Our task was to create a prototype of a streamlined, digital payments solution that’s user-friendly and scalable, which we presented during Demo Day in September.

- Komo’s instant app deposit (May). We worked with EastWest bank’s digital service, Komo, to add the top-up feature within the app. Now, users can receive and deposit money through all major Philippine banks within one interface.

- Aiah’s expanded payment channels (July). We collaborated with Aiah, a process automation company in the Philippines, to add debit bank transfers to its payment channels. Aiah’s MSME and enterprise clients can now link their Brankas Pay app account to receive direct debit as payment.

Together with traditional banks, governments, fintech companies, and e-commerce platforms, we made it our goal to make financial products and services accessible to all, regardless of location and scale.

One-of-a-kind products

Where there was an opportunity or needs gap, we thought of ways to close the gap and make open banking even more user-friendly. Aside from releasing new products, we continued to review, improve, and add features to our existing offerings.

- Pay app mobile version (March). We launched the mobile version of our Pay app, which allows for seamless bank transfers for merchants.

- Balance (June). Our new product, Balance, went live, enabling users to check their balance data and better understand their financial health.

- Income (October). We launched Income to give financial institutions insights into their users’ financial standing, which is helpful for credit scoring and income verification.

Data privacy & security milestones

Data privacy and cybersecurity are central to our operations. We uphold Privacy By Design and use the latest technologies and industry-best practices for authentication and data handling, including SSL/TLS and AES-256 encryption methodologies, HMAC and OAuth 2.0 standards, and OWasp practices. We are ISO 27001-certified and PCI DSS-compliant - one of the first Open Finance providers in Southeast Asia - reflecting our commitment to keeping our information security management systems safe and reliable. As an industry leader and first mover, we are working closely with regulators and our partners in building data privacy and security standards that will accelerate the implementation of Open Finance throughout the region, in a safe and secure manner.

World-class talent

In November, we welcomed senior industry talents to our global team in our efforts to ramp up our growth and regulatory compliance.

- Arvin Razon as Director for Legal, Compliance, and Regulatory Affairs. Formerly the Legal Counsel and Data Protection Officer for ING Philippines, Arvin’s solid experience in data privacy will help Brankas create policies and procedures for data protection strategies and controls, such as handling consumers’ consented data.

- Simo Figuigui as Head of Business Development and Growth. Brankas is committed to expanding our support across Asia, and Simo, through his extensive experience in sales and fintech market strategy, will help us transform open banking in the region.

- Piyush Sinha as Director of UX, who will be helping take the Brankas user experience to the next level. He is a very experienced UX practitioner having built and scaled the UX practice for startups (SimpleRelevance (TechStars ‘13, Acquired) , Xendit (YCombinator ‘15, B2B Unicorn)) as well as Fortune 100 (Agoda.com (Booking Holdings Group)). He brings extensive experience from having built UX practices, managed teams, conducting user research in more than 14 countries across North America, Middle East and Asia, and introducing and scaling human centered design practice across product teams.

What’s new in 2022?

We plan to build on our current momentum and expand our products, capabilities, and teams. We are looking forward to breaking new grounds and promoting open finance across the region.

- New Markets: We have started groundwork in Vietnam to build up an office and team to support local banks and fintech companies by replicating our success in Indonesia and the Philippines. We are also targeting Bangladesh to be set up and operational by the end of the year. We also plan to double our current workforce of 100.

- New Products: We have in total 8 products across data and an exciting product roadmap as we look to expand and grow our customer base through 2025.

- Open Finance Enablers: We will continue to engage with various sectors and industries to create educational series across Southeast Asia to showcase how our customers can benefit from more collaborative use cases.

We look forward to partnering with governments, enterprises, and non-profits as we continue to build the path toward a more financially inclusive Southeast Asia.

Reach us to know more on how Open Finance and Open Banking works through support@brank.as