Adopting instant payment solutions is not just a technological upgrade in the UAE; it’s a shift that is changing how businesses operate, boost their competitiveness, and drive growth.

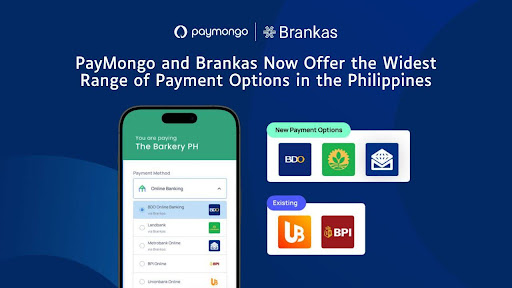

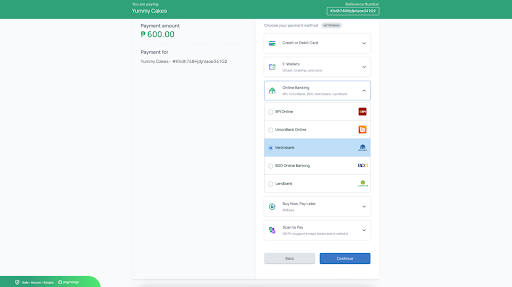

PayMongo, has partnered with Brankas to add new payment options to the PayMongo platform, making it the payment gateway with the widest range of payment options for Filipino businesses. PayMongo payment options include credit cards, e-wallets, BNPL, QRPh, and online banking. PayMongo merchants can now accept direct online banking payments from three additional Philippine banks — BDO, Metrobank, and Landbank — offering greater convenience and flexibility for both merchants and customers.

eCommerce stores, food delivery websites, ride-hailing apps, and gaming platforms that are PayMongo merchants can accept more forms of payments by integrating Brankas Direct API. This pay-by-bank channel is another trusted payment method that makes transactions faster and enhances the overall payment experience for users.

“Brankas and PayMongo share the same commitment to deliver fast and secure payment experience for users. Offering more payment options is a win-win for both customers and merchants as we offer greater payment flexibility and customer reach at the same time.” said Todd Schweitzer, Brankas CEO and Co-founder.

To start accepting direct online banking payments, existing PayMongo merchants simply need to contact PayMongo Customer Support to request the activation of BDO, Metrobank, and Landbank payment options. The feature is available for Shopify plug-in users, PayMongo’s Custom & Checkout API, PayMongo Pages, and PayMongo Links. Users of the custom API require minimal updates, and the PayMongo developer website provides the full details.

Ready to enhance your payment offerings and provide a better customer experience? Enable Brankas Direct through PayMongo now. Visit Brankas Direct or PayMongo to learn more.

PayMongo is a leading financial infrastructure platform in the Philippines, designed to simplify how businesses manage their finances. From payment processing to embedding financial services, PayMongo provides solutions that enable businesses to accept payments both online and in-person, streamline financial operations, and drive profitability. By offering a wide range of payment options and seamless integration, PayMongo empowers businesses to grow their revenue and succeed in the digital economy.

Brankas is a leading global open finance technology provider. We provide API-based solutions, data and payments solutions for financial service providers (like banks, lenders and e-wallets) and online businesses. Brankas partners with banks to build and manage their open finance infrastructure, producing APIs for real-time payments, identity and data, new account opening, remittances, and more. With Brankas’ secure open banking technology, online businesses, fintech companies and digital banks can use Brankas APIs to create new digital experiences for their users.

Adopting instant payment solutions is not just a technological upgrade in the UAE; it’s a shift that is changing how businesses operate, boost their competitiveness, and drive growth.

Online loan applications made through digital channels, or digital lending, are expanding quickly. It is easy to use, quick, and available to anyone. The global market value exceeded $12 million in 2022. It is forecasted to hit $71 million by 2032 (Allied Market Research). Technology breakthroughs and consumer need for convenience have substantially increased its appeal.