Introduction

Today, technology is advancing faster than ever before. There are 1.35 million tech startups innovating across various fields, more than 4,383 million internet users, and 5 billion people that own mobile devices. These advancements affect nearly every aspect of our lives, with banking certainly not excluded. Banking evolves just as fast as technology does, with technological advancement driving the growth and innovation of banking services. Gone are the days when banking was seen as a tedious process; individuals can now access their bank accounts remotely, make transactions instantly, use digital wallets to make payments, and much more.

As new technology emerges, the banking industry continuously adapts to it. Technology has put the world at our fingertips – everything is a tap away and more connected than ever. With innovations coming at the speed of light, it is important for banks and FinTechs to keep up with trends in order to stay competitive. Customer satisfaction is now driven by ease of use and seamless user experience brought about by the latest technology. Thus, the ability to continuously innovate through keeping up with technological trends is ultimately what will dictate success in the financial industry.

Banking Technology Trends: What’s to Expect?

Banking is now being driven by technology, with large financial institutions and FinTechs alike incorporating technology into their business activities. Digitalization is changing how business is being done, with banking technology as the main driver of the future of financial services. With a growing young and tech-savvy population demanding digital banking experiences, the industry is transforming to meet their needs. At the core of these changes is the growing demand for expanded financial services, instant connection, upskilling, and consolidation of services. With these in mind, below are some of the top trends to expect in the banking industry.

- Bank-as-a-Service (Baas)

BaaS is a system in which financial institutions can provide access to their services to non-banking institutions through the use of open APIs, 5G, and other related technologies. This allows for greater integration and services available to consumers, ultimately creating an open ecosystem for the banking industry to continuously share resources and encourage innovation across the board.

- Super-app

Super-apps act as a marketplace that consolidates the services a company offers – such as food delivery, digital wallets, and more – into one app, providing greater accessibility and ease of use to consumers. This trend is becoming prevalent in banking as well, with companies consolidating all their services into one application for their customers to use, ranging from making payments, accessing your account balance, taking out a loan, and many more.

- Cloud Technology

Cloud technology allows companies to store all their information in a virtual space – the “cloud” – allowing for information sharing through the internet without physical space limitations. This provides better storage, scalability, and collaboration and is being used in banking through Customer Relationship Management (CRM) to deliver more efficient customer data consolidation and interaction.

- Artificial Intelligent and Machine Learning

AI & Machine Learning, some of the most exciting technological trends, provide a hyper-personalized customer experience that can drive high customer satisfaction and retention in the increasingly competitive banking industry. AI can also help reduce operational costs, automating and expediting manual processes within companies.

- Smart Contracts

Smart contracts are programs stored in a system that automatically runs when certain conditions are met. These can help ensure that claim processing, KYC processing, transparent audits, and more are rolled out more quickly and can allow these to be done simultaneously.

- Digital Currencies

Digital currencies are starting to be taken seriously by central banks, with some already in the process of launching digital currencies of their own. This opens up large opportunities for the banking industry to provide faster, more secure payment options and to widen its customer base.

- New Talents and Upskilling

With banks heightening their technological capabilities, it demands skills in new avenues such as programming and software engineering. New talent and upskilling are critical, with current employees needing to be trained in digital competencies and new talent being focused on finding those who have the necessary digital skills to continuously provide innovative services.

Conclusion

Technological advancements will continue to change the way we live, and banking services are no exception. It will continue to evolve as technology advances, and it is critical that these trends are adopted by companies to stay ahead of the tight competition within the industry. At the end of the day, customer satisfaction is at the heart of success; and with customers increasingly demanding digitalization, the banking industry must be able to keep up with trends and incorporate these into business activities moving forward.

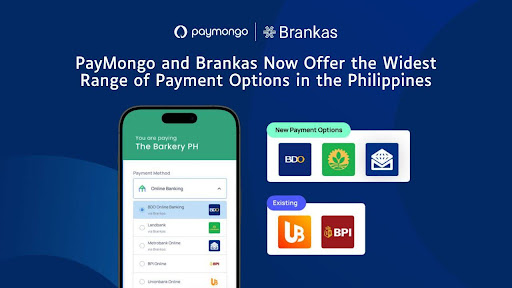

For companies who are looking to stay ahead of the curve, Brankas is here to provide technological solutions to suit your needs. Brankas provides open banking services, enabling financial access through our ready-made and customizable API solutions.

Want to learn more about how we’re building open banking in Southeast Asia or Interested in partnering with us or trying out our products? Sign up or Contact us to learn more about what we can offer.