PERA HUB by PETNET, a top financial service provider in the Philippines, partnered with Brankas in 2021 to launch a Digital Remittance Platform. Read about it.

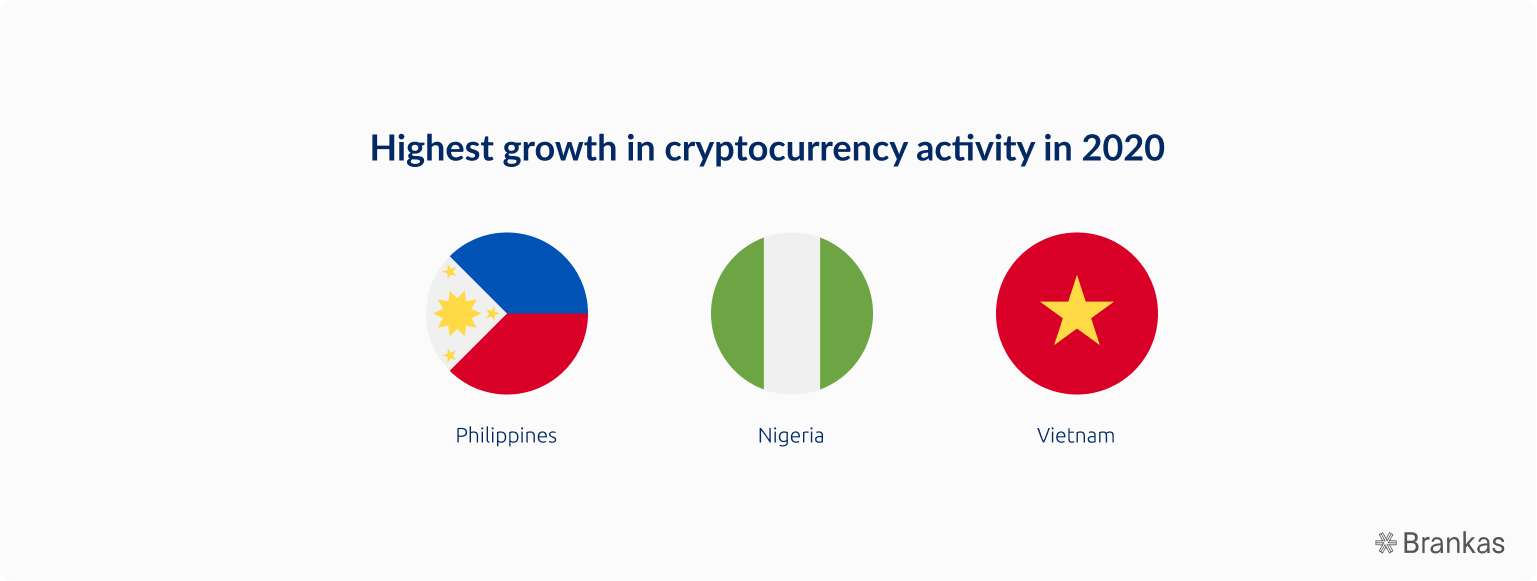

There’s no doubt that cryptocurrency’s relevance in the financial industry will remain significant over the coming years. Growth of cryptocurrency adoption among emerging economies accelerated at the beginning of the pandemic. According to research firm Oxford Business Group, the top-three developing countries that had the highest growth in cryptocurrency activity in 2020 were Nigeria, Vietnam, and the Philippines, driven by remittance payments.

Financial institutions in the Asia-Pacific region are expected to ramp up their cryptocurrency initiatives in 2022, according to US-based credit rating firm Fitch Ratings. A recent example is Jakarta-based venture capital firm BRI Ventures partnering with crypto exchange platform Tokocrypto to launch Indonesia’s first blockchain-focused accelerator program in January 2022. The program will focus on funding startups within the decentralized finance space, including play-to-earn systems and non-fungible tokens (NFTs).

To support the growing market for cryptocurrency products and services in the region, Brankas is offering our open API system to partners who want to create a customized interface that can seamlessly process cryptocurrency transactions.

Currently, the process of converting cryptocurrency tokens to fiat (currency-based money) is complicated and requires different third parties with varying fees. With all the various providers and tokens available, the whole process of token conversion can be overwhelming.

Through our technology and experience in decentralized finance, we have the expertise to eliminate these pain points and create open APIs that are:

We plan to offer more interconnected cryptocurrency products and services in the future, such as one-stop apps for the entire cycle of cryptocurrency management. This includes:

Brankas has the expertise, technology, and teams that can help jumpstart your cryptocurrency digital services. Our portfolio of API partnerships with major financial institutions in Southeast Asia has given us the knowledge and experience to implement solutions that work.

If you want to know more about our cryptocurrency and open banking solutions, please reach out to sales@brank.as.

PERA HUB by PETNET, a top financial service provider in the Philippines, partnered with Brankas in 2021 to launch a Digital Remittance Platform. Read about it.

Like most sectors, the finance industry is seeing increased demand for digitalization to improve the customer experience. A 2021 study found that banking customers now prefer personalized and digitally-driven services. They value text alerts, opportunities to transact more efficiently, and the ability to track multiple accounts using a single dashboard.