Brankas Direct enables your customers to make instant online payments without leaving your website or app. Read more about Brankas Direct today.

Brankas Direct is a fund transfer service that allows businesses to accept fund transfers from customers instantly and digitally through their web and mobile applications. It provides businesses with a single point of integration through which they can execute fund transfers via various banks with whom Brankas is integrated.

The transaction is processed directly from the source bank account to the beneficiary bank account. No middlemen involved. No extra transaction fees are charged*. Brankas Direct strives to provide a means to transfer funds with the least hassle, human error, and barriers. Empowering anyone and everyone in society.

If you are considering introducing Brankas Direct as a payment option to your customers, let’s shine a light on the limitations of the methods you could currently be using.

Card transactions have obvious pros and cons: it’s convenient for customers to pay during checkout. They just need to enter their card details once, and the transaction would be processed in real-time. But you as a merchant would be charged a Merchant Discount Rate (MDR) ranging around 2-3.5%. Depending on the agreement with card acquirers that you have.

Virtual accounts could work well as you get to receive payments with a lower fee. But think about the settlement time: since the funds hit intermediary first, you will only get the money settled to your account at least T+1. Not to mention the fact that this fund is settled to you as one aggregated total settlement. Making it a hassle to do reconciliation for the purchases made by your customers. From the customers' end, the virtual account is prone to error while they are inputting the virtual account number. Increasing the chance of transaction errors, delayed and abandoned payment.

You may think eWallets fill this gap. Perhaps you are currently relying on them to receive a faster settlement of payment. But you may also think that registering as a merchant to each wallet account is a tedious process and requires some admin time. A time better spent to manage your business. On top of that, eWallets also charge your business an MDR transaction fee for processing the payment.

With Brankas Direct, as the funds are processed directly from customers to your business bank account instantly, this would have an impact on a healthier cash flow for your business.

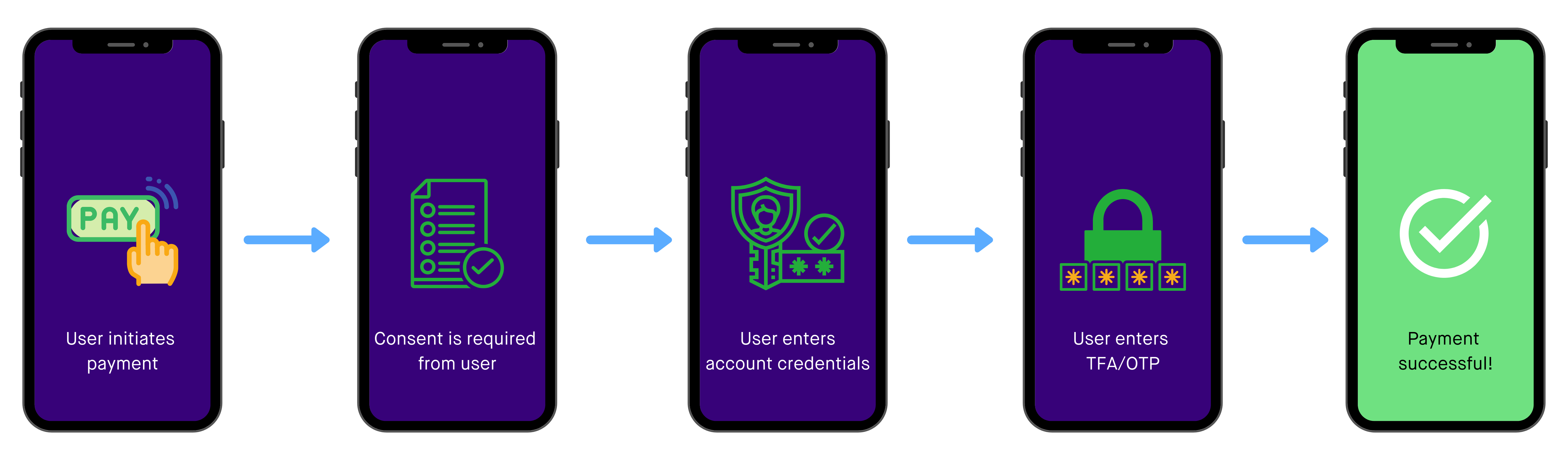

Your customers completes their transactions without leaving your application, Brankas Direct provides a more seamless checkout experience. End to end journey that includes authentication of account to entering TFA/OTP happens in one cohesive payment flow.

Customers will also be receiving immediate notifications from their banks. The status of each transactions are updated and shared to merchants too. Brankas Direct eliminates the hassle of chasing customers for payments.

Introducing Brankas Direct to collect payment from your customers is much more straightforward than you might think. And it’s all thanks to the secured and easy flow, thinking of customers first when we are building it.

In the spirit of transparency, Brankas Direct offers a consent page before the payment is transacted. This is a one-time consent for our system to facilitate the payment on behalf of customers. Brankas Direct does not store the customer’s banking credentials and OTP/TFA codes. Brankas Direct passes the details to the selected bank to process the payment.

In addition, the efficiency and security of Brankas Direct are monitored and protected by your bank and the payment rails behind it.

Integrating with Brankas Direct is as easy as 1, 2, 3.

If your business is using a wordpress website or other ecommerce website enabler, it’s even easier to use Brankas Direct. All you need to do is just connect with one of our plugins. No programming required.

Receive payments via partnered banks. Refer to our bank coverage here.

View transaction history and generate reports for reconciliation purposes on the Brankas Dashboard. You can add a memo in the body of the checkout request to Brankas Direct. It would appear in your bank statement as an additional note.

Remember Me feature allows customers to be automatically logged on for subsequent transactions facilitated by Brankas, delivering a more seamless experience.

Are you interested in a career in fintech? Join the Brankas team!

Brankas is bringing Open Banking to Southeast Asia. Our vision is to make modern financial services available to everyone.

Brankas Direct enables your customers to make instant online payments without leaving your website or app. Read more about Brankas Direct today.

Many organizations and individuals face inadequate financial services. This inadequacy can have severe implications as it can hinder financial literacy for individuals and business growth for companies. On the other hand, financial inclusion can result in a more productive economy. But what is financial inclusion?