In 2021, Indonesia’s population was estimated to have reached 275 million, according to the US International Trade Administration. This makes the archipelago nation the fourth most populous in the world. However, Indonesia’s healthcare system is having trouble keeping up with its population and economic growth. In particular, small clinics and independent healthcare facilities are facing a tough battle when it comes to accessibility and modernization.

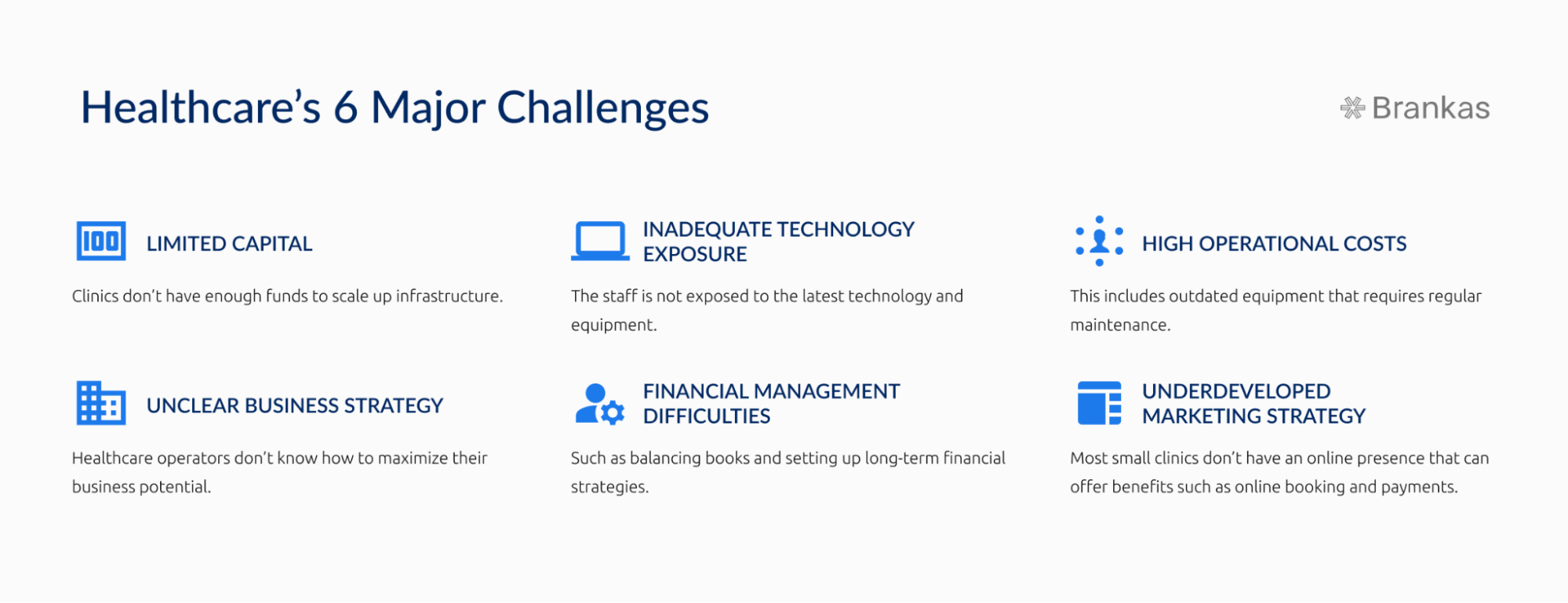

There are six major challenges:

- Limited capital. Clinics don’t have enough funds to scale up infrastructure.

- Inadequate technology exposure. The staff is not exposed to the latest technology and equipment.

- High operational costs. This includes outdated equipment that requires regular maintenance.

- Unclear business strategy. Healthcare operators don’t know how to maximize their business potential.

- Financial management difficulties, such as balancing books and setting up long-term financial strategies.

- Underdeveloped marketing strategy. Most small clinics don’t have an online presence that can offer benefits such as online booking and payments.

KlinikGo is addressing all these challenges by providing a one-stop online platform for healthcare services. The company created an app that consolidates a network of independent clinics where users can book appointments and pay online. The result is a democratized and convenient way of accessing healthcare across major Indonesian cities.

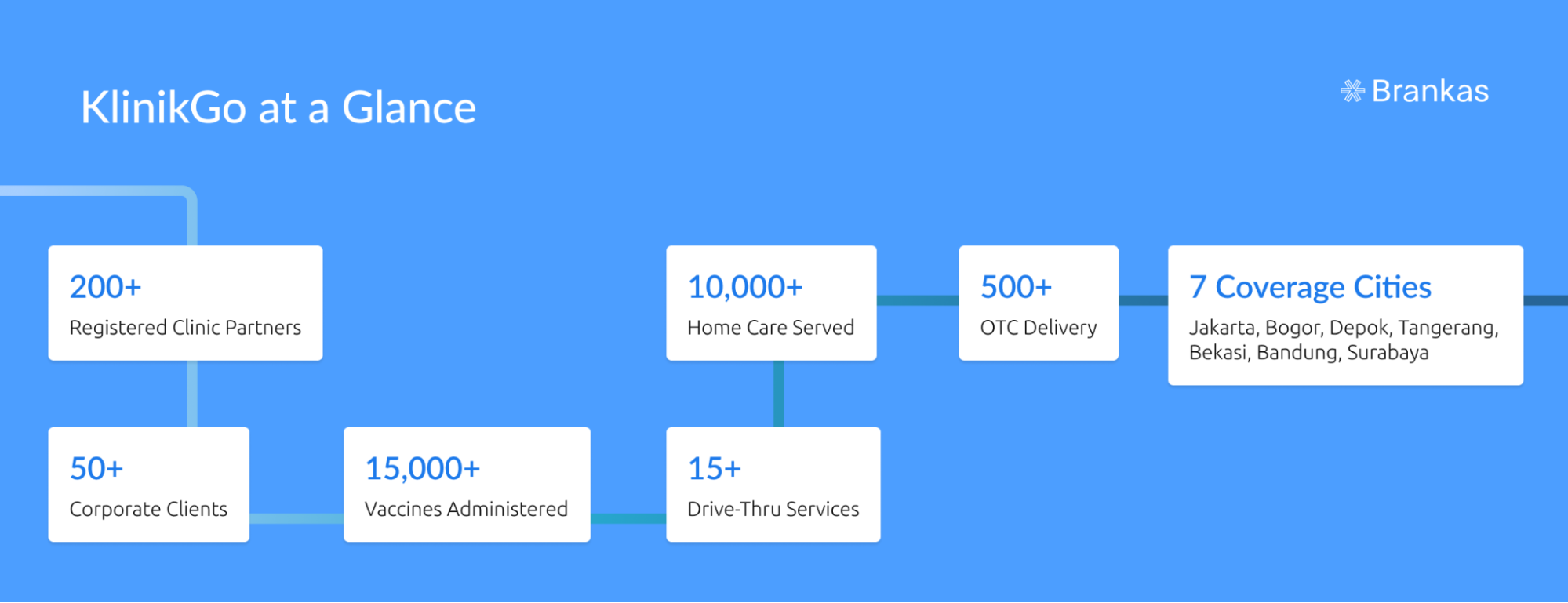

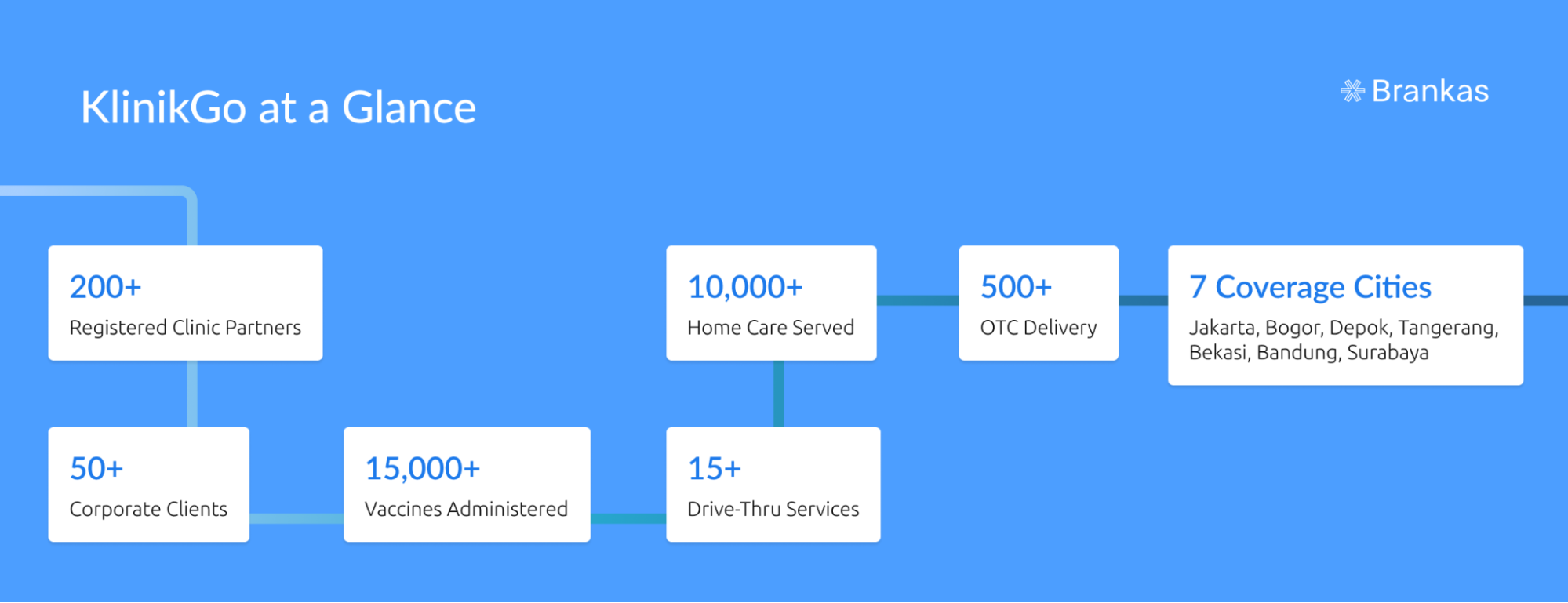

KlinikGo at a glance:

- 200+ registered clinic partners

- 500,000+ registered users

- 50+ corporate clients

- 15+ drive-thru services

- 500+ OTC delivery

- 10,000+ home care served

- 15,000+ vaccines administered

- 7 coverage cities: Jakarta, Bogor, Depok, Tangerang, Bekasi, Bandung, Surabaya

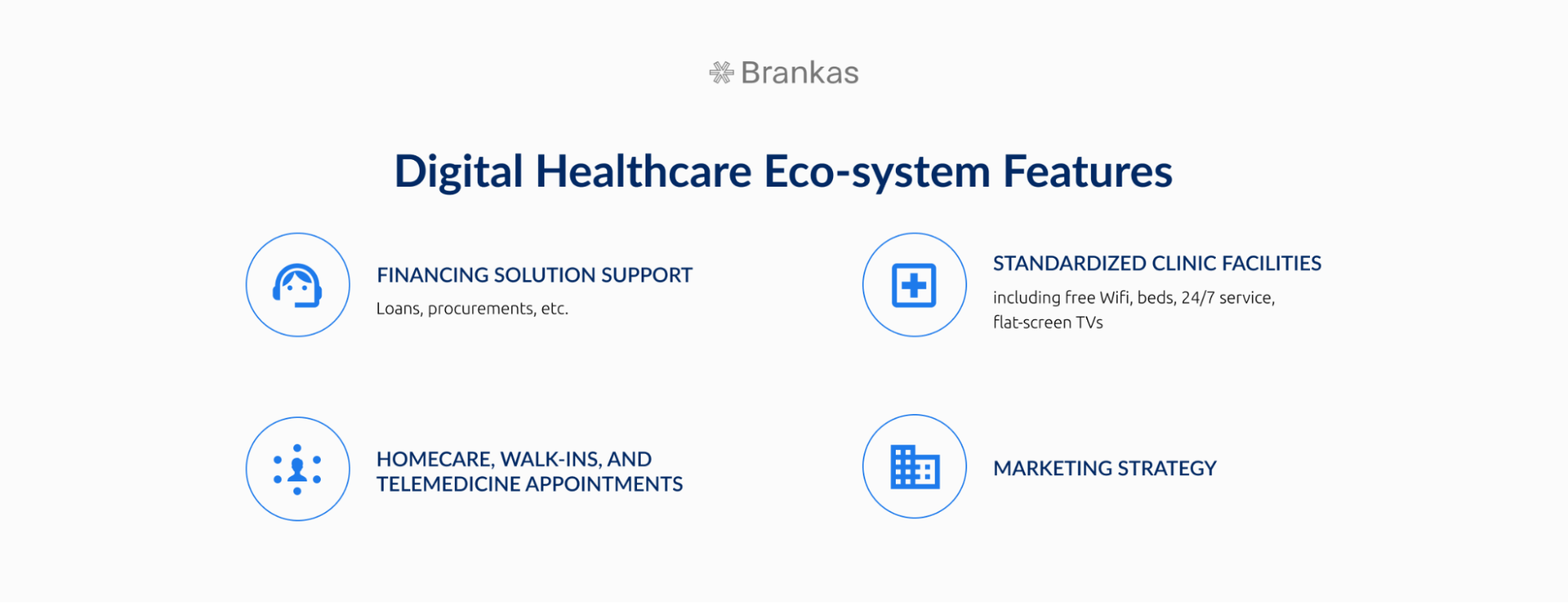

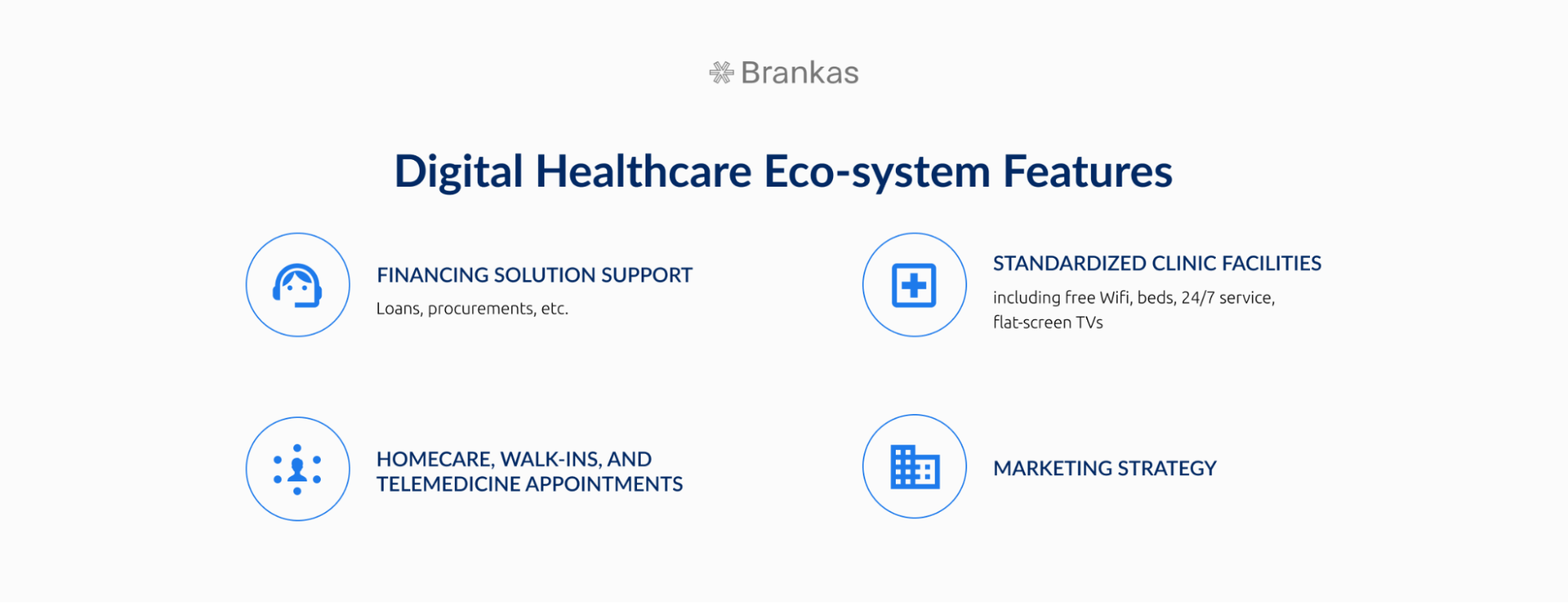

Digital healthcare ecosystem features:

- Homecare, walk-ins, and telemedicine appointments

- Standardized clinic facilities (including free Wifi, beds, 24/7 service, flat-screen TVs)

- Financing solution support (loans, procurements, etc.)

- Marketing strategy

How Brankas helped solve KlinikGo’s challenges

KlinikGo needed a versatile and holistic API system to provide a seamless online service that could handle payments and disbursements. They needed a user-friendly app that could manage the entire process and give real-time information and updates. In particular, the company is using the following Brankas services:

Brankas Products:

- Statement. This service allows users to conveniently retrieve and share up to six months’ worth of transactional data. Additionally, Brankas doesn’t store end-user credentials to protect data privacy. For KlinikGo, Statement is essential for clinics applying for loans to improve their equipment and boost capital. This feature allows them to improve their credit scores and reduces paperwork that makes loan applications inaccessible.

- Disburse. This feature allows automated payments from a corporate account to multiple third-party bank accounts through one API request. The service also integrates well with any payroll system. KlinikGo uses Disburse to pay the salaries of doctors, nurses, and other clinic staff. Disbursements are also made for home care services.

- Pay. This service is a payment gateway that allows merchants to send invoices to customers, receive payments, and track transactions. KlinikGo uses this feature to accept payments from registered users via the convenient Brankas Tap, connecting customers’ banks to the Pay app. This also allows payments through the Quick Response Code Indonesian Standard (QRIS) national QR code. By having a centralized payment system, this service eliminates multiple transaction fees.

By bringing different clinics on one online system, KlinikGo has transformed how healthcare services are managed, operated, and standardized. The company has established strong partnerships with community healthcare facilities, enabled competitive pricing for its network, provided financial support (assisting loan applications and facilitating affordable payment schemes), and empowered clinics by providing reliable and quality services.

Through KlinikGo’s partnership with Brankas, clinics in Indonesia will finally step into a digital future that can make healthcare more convenient and accessible than ever.

Interested in learning more about Brankas’ products? Check out www.brankas.com or email us at sales@brankas.com.