What is open finance? We answer this and more in our complete guide to open finance and key benefits in Asia-Pacific. Read the full guide.

Last year, Brankas was awarded the Monetary Authority of Singapore (MAS) Financial Sector Technology and Innovation (FSTI) Proof-of-Concept (POC) grant to back the development of an innovative open-source core banking system (CBS), designed to help traditional and digital banks, fintechs, cooperatives, and non-bank financial institutions (NBFI) provide reliable financial services in the emerging markets.

Since receiving the award, we are now more than excited to introduce Brankas Open Core: an integrated, cloud-based CBS designed to streamline your operations, allowing you to build a suite of financial products for your customers’ needs.

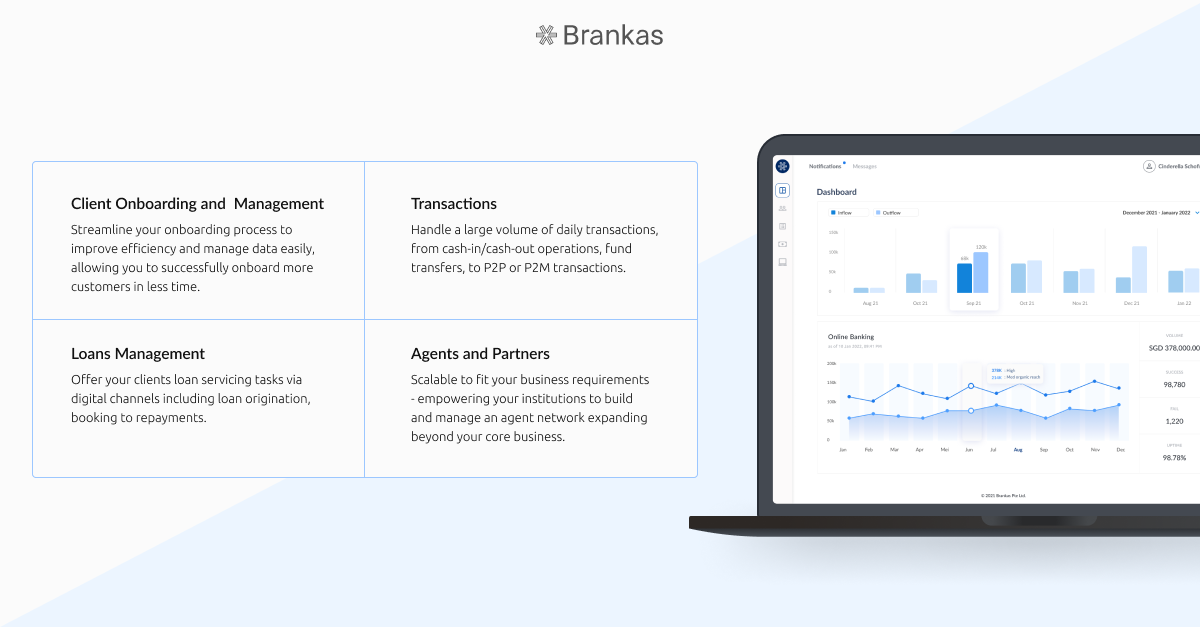

Brankas Open Core is a core platform that gives you all the functionalities to build an all-in-one digital financial service experience. Our extensive set of components offers flexibility to implement financial functionalities custom-suited to your businesses. From onboarding new accounts, servicing loans, to generating reports for your CRM, Brankas Open Core is made for you to deploy quickly and securely.

Brankas Open Core is designed to disrupt the banking status quo and make financial management more affordable. Currently, for many financial institutions and fintech companies in emerging markets, a core banking system remains a costly and challenging aspect where the cost of licensing often exceeds the potential value of the business.

Our cloud-based CBS is built in an open-source environment without licensing costs, allowing your business to grow with us. We offer an affordable and flexible pricing structure, catering to financial institutions of all sizes.

“We are currently offering heavily discounted fees for financial institutions who would like to join the pioneer round of Open Core adopters. Reach out to sales@brankas.com to learn more.”

Brankas Open Core gives you the flexibility to tap into Brankas’ growing network of partners. With over 90% coverage in Indonesia, the Philippines, and Thailand, we provide access to a self-service API portal and sandbox for developers in the region.

Our team of Open Finance pioneers - seasoned engineers, product managers, and business development managers - is available to help you manage everything from migration to implementation and maintenance, allowing you to deliver digital financial services and further drive financial inclusion in the region.

Want to get started with Brankas Open Core? Learn more about how our technology could achieve your financial service digitalization goals here.

What is open finance? We answer this and more in our complete guide to open finance and key benefits in Asia-Pacific. Read the full guide.

Brankas Direct is a fund transfer service that allows businesses to accept fund transfers from customers instantly and digitally through their web and mobile app.