A Comprehensive Guide for Merchants: Chargeback vs. Refund

Understanding the intricacies of chargebacks and refunds is paramount for merchants. Chargebacks and refunds play crucial roles in customer satisfaction and maintaining a positive business image. Merchants need a comprehensive understanding of these processes to navigate potential challenges, reduce disputes, and foster a healthy relationship with their customer base.

Chargebacks Explained

A chargeback occurs when a customer disputes a transaction and requests a refund directly from their bank. These disputes can arise due to various reasons:

· Unauthorized transactions- Customers may claim they did not authorize a purchase.

· Product/service issues- Dissatisfaction with the received product or service.

· Billing discrepancies- Confusion or errors in billing statements.

· Fraudulent activity- Cases where the cardholder did not make the transaction due to fraud.

Chargebacks can have significant consequences for merchants. Beyond the immediate loss of revenue, merchants may face additional fees, damaged reputation, and increased scrutiny from payment processors. A high number of chargebacks can even lead to the termination of merchant accounts. Understanding and effectively managing chargebacks are crucial for merchants to protect their business and customer relationships.

Navigating the Chargeback Process

These are the steps in a chargeback procedure:

- The customer identifies a transaction issue and contacts their bank.

- The bank investigates the claim, considering evidence from both parties.

- If the dispute is valid, the customer receives a provisional credit.

- Merchants can respond to the chargeback with evidence.

- The bank makes a final decision, either upholding or overturning the chargeback.

Refunds Unveiled

Refunds are transactions initiated by merchants in response to customer requests for reimbursement. The most common reasons why buyers request refunds are:

- The purchased product is defective, malfunctioning, or fails to perform as advertised.

- The product does not meet their expectations, even if there is no defect.

- Delays or non-delivery of products beyond the promised timeframe.

- Customers may change their minds or cancel orders shortly after making a purchase.

- Customers might notice discrepancies in billing, such as double charges or overbilling.

- Dissatisfied customers may seek refunds due to poor service experiences.

- Customers may realize they do not need or want a product after purchase.

Understanding Refund Dynamics

Initiating a refund follows these steps:

- A customer contacts the merchant to request a refund via customer support, email, or an online platform.

- Merchants verify the customer’s purchase by cross-referencing the details provided with their records.

- Merchants confirm whether the customer’s request aligns with the terms and conditions outlined in their refund policy.

- The merchant decides whether to approve or deny the refund request, based on the verification and policy review.

- If approved, the actual refund processing begins. Merchants initiate the transaction to return the funds to the customer.

- The merchant should promptly notify the customer once the refund is processed.

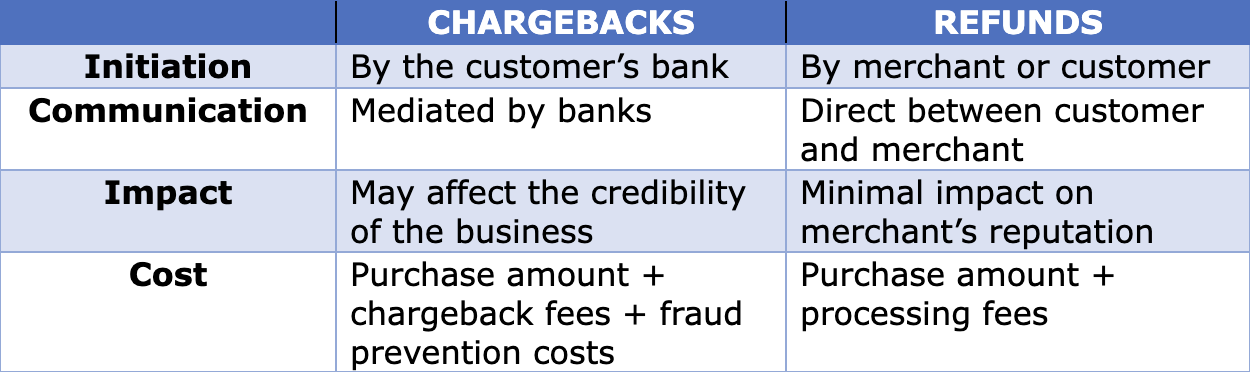

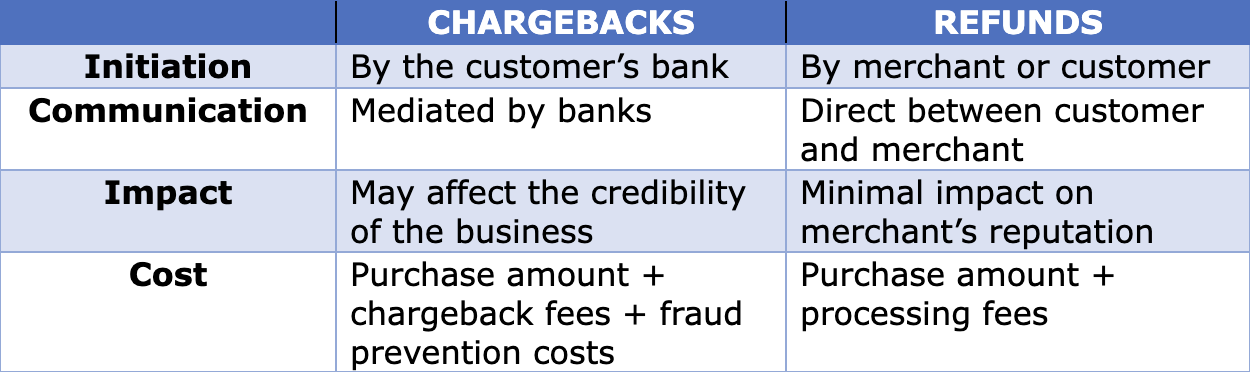

How Chargebacks Differ from Refunds

Chargebacks occur when customers dispute a charge directly with their issuing bank, bypassing the merchant. They are typically initiated for reasons such as unauthorized transactions, fraud, or dissatisfaction with the merchant’s response to a refund request.

Refunds involve the return of funds from the merchant to the customer. They are often initiated by customer requests due to reasons such as product defects, unmet expectations, or other customer-centric issues. Merchants usually have control over refund policies and determining conditions under which they offer reimbursements. Costs to merchants include the value of the product or service refunded, along with potential processing fees associated with payment gateways or financial institutions.

Chargebacks involve higher costs for merchants compared to refunds. Merchants may incur chargeback fees imposed by banks and payment processors in addition to refunding the purchase amount. Excessive chargebacks can have severe consequences, including increased processing fees, restrictions on merchant accounts, and even the termination of the account. Merchants may also incur costs associated with implementing fraud prevention measures to reduce the risk of chargebacks.

Chargebacks involve the intervention of financial institutions to resolve disputes, while refunds involve a cooperative process between the customer and the merchant. Each process has its own set of rules, timelines, and implications for merchants and customers.

Are Refunds Better than Chargebacks for Merchants?

Refunds are considered a more favorable option for merchants. A customer initiating a refund indicates a voluntary return of funds due to dissatisfaction or a change of mind. Merchants typically have more control over the refund process, which allows them to manage customer relations and potentially salvage the customer-business relationship.

Chargebacks are initiated by customers through their credit card issuer, often without direct involvement or consent from the merchant. Chargebacks are typically associated with higher costs for merchants, including chargeback fees imposed by banks and payment processors. Frequent chargebacks can lead to reputational damage, increased processing fees, and, in severe cases, the termination of the merchant account.

Refunds offer a more transparent and predictable process for merchants. Merchants can handle refunds more proactively with a well-defined refund policy and efficient processing mechanisms, contributing to customer satisfaction and loyalty.

Chargebacks introduce a level of uncertainty and financial risk that can be challenging for merchants to manage effectively. Merchants prefer to handle customer concerns through a refund process rather than dealing with the complexities and potential drawbacks of chargebacks.

Why Some Customers Prefer Chargebacks to Refunds

Some customers may prefer chargebacks over refunds due to several factors:

- Chargebacks typically offer a faster resolution process compared to refunds. Customers might opt for chargebacks when they seek a swift resolution to their dispute, especially if the traditional refund process is perceived as time-consuming.

- Some customers may believe that chargebacks provide an extra layer of protection. They see the chargeback process as a way to involve their issuing bank in the dispute, assuming it offers a higher chance of success or a more favorable outcome compared to dealing directly with the merchant.

- Customers might choose chargebacks to bypass the merchant’s refund policies or restrictions. Chargebacks are often seen as a more direct means of dispute resolution, allowing customers to contest a transaction without adhering to the merchant’s terms.

- Customers may not be fully aware of the distinction between chargebacks and refunds. In cases where consumers are unfamiliar with the nuances of the two processes, they might opt for chargebacks simply because it seems like the more straightforward path.

- Some customers might view a chargeback as a more impactful way to express dissatisfaction. They may perceive it as a stronger signal to the merchant that the service or product did not meet expectations, potentially prompting a quicker response from the merchant.

Understanding these factors can help merchants tailor their dispute resolution strategies and communication to address customer concerns effectively. It also emphasizes the importance of clear communication and transparent refund policies to minimize the likelihood of customers resorting to chargebacks.

Encourage Customers to Request Refunds

Encouraging customers to request refunds rather than initiating chargebacks is crucial for maintaining a positive relationship and avoiding unnecessary complications.

Merchants should streamline the refund process, making it easily accessible and straightforward. Communicate the refund policy clearly to ensure customers are aware of the procedures and timelines for requesting refunds. Providing excellent customer service is essential; promptly address customer inquiries, concerns, and dissatisfaction.

Merchants should consider implementing a satisfaction guarantee or a hassle-free refund policy to instill confidence in customers. Offering incentives for choosing refunds, such as discounts on future purchases, can further motivate customers to opt for this resolution. Seeking feedback regularly and addressing customer grievances actively can enhance the overall customer experience and reduce the likelihood of chargebacks.

Educating customers on the potential drawbacks of chargebacks, such as longer resolution times and potential fees, can also be effective. Merchants can encourage customers to choose refunds over chargebacks by fostering a customer-centric approach and emphasizing the convenience and fairness of the refund process, contributing to a more positive and collaborative relationship.

Double Refund Chargebacks

Double refund chargebacks occur when a customer receives a refund from a merchant for a particular transaction and subsequently files a chargeback with their issuing bank. The customer is seeking a refund twice for the same transaction.

This scenario is a concerning challenge for merchants as it represents a potential avenue for exploitation by unscrupulous customers. It can arise due to various reasons, including genuine confusion on the part of the customer, technical glitches, or intentional attempts to exploit the chargeback system for financial gain.

Double refund chargebacks underscore the complexities and challenges that merchants face in managing transaction disputes. Merchants need to implement robust systems for tracking and documenting refunds, ensuring that they can provide clear evidence to refute unjustified chargeback claims.

Mitigating the risk of double refund chargebacks involves not only streamlining internal refund processes but also fostering transparent communication with customers. Clear and easily accessible records of transactions and refund procedures can help in resolving disputes promptly and prevent instances of customers erroneously or fraudulently seeking double refunds through chargebacks.

The Merchant’s Role in Preventing Chargebacks and Refunds

Merchants face the challenge of minimizing chargebacks and refund requests. Adopting a proactive approach to prevent these issues is beneficial for the merchant and contributes to a positive customer experience. Here are key strategies to help prevent chargebacks and refunds:

- Communicate product descriptions, terms of service, and refund policies clearly on your website. Provide detailed information about products, including images, specifications, and any potential limitations.

- Implement robust security measures to protect customer data, reducing the likelihood of unauthorized transactions and fraud. Utilize secure payment gateways and employ encryption technologies to safeguard sensitive information.

- Ensure that billing descriptors on customers' statements reflect the business name and purpose of the transaction. Avoid vague or confusing descriptors that may lead to chargebacks due to unrecognized transactions.

- Offer responsive and accessible customer support channels to address queries and concerns promptly. Resolve customer issues proactively to prevent disputes from escalating to chargebacks or refund requests.

- Provide high-quality products and services to meet or exceed customer expectations. Update product information regularly to reflect any changes or improvements.

- Optimize your website’s user interface to enhance the shopping experience. Simplify the checkout process and ensure that customers can easily navigate your site.

- Display product prices, shipping costs, and any additional fees clearly during the checkout process. Avoid hidden charges that may lead to customer dissatisfaction and refund requests.

- Issue detailed invoices and receipts for each transaction, including information on the purchased items, prices, and shipping details. Provide a reliable and easily accessible record of transactions for customers.

Implementing these preventive measures can significantly reduce the occurrence of chargebacks and refund requests, fostering a more secure and trustworthy relationship between merchants and customers.

Best Practices for Processing Chargebacks and Refunds Efficiently

Merchants will face the challenges of chargebacks and refunds. Here are key best practices for merchants when chargebacks or refunds are initiated:

- Establish open lines of communication when dealing with chargebacks or refunds. Respond promptly to customer inquiries and be proactive in addressing concerns.

Benefits: Enhances customer satisfaction, demonstrates responsiveness, and fosters goodwill.

- Communicate your refund policies clearly on your website. Ensure that customers are aware of the conditions under which refunds are granted to help manage expectations.

Benefits: Avoids misunderstandings, provides clarity, and minimizes disputes.

- Maintain detailed transaction records, including invoices and receipts. Having a comprehensive record of each transaction can be crucial when responding to chargebacks or refund requests.

Benefits: Simplifies financial management, facilitates reporting, and ensures compliance.

- Streamline the dispute resolution process. Provide customers with clear instructions on how to initiate disputes or request refunds through user-friendly channels.

Benefits: Enhances customer satisfaction, demonstrates responsiveness, and fosters goodwill.

- Investigate each claim thoroughly before responding. Verify the legitimacy of the customer’s concerns, examining transaction details and supporting documentation.

Benefits: Maintains transparency and provides merchants with accurate information for a fair and informed resolution.

- Implement automated systems for processing refunds to reduce manual workload and minimize errors.

Benefits: Enhances efficiency, speeds up the refund process, and reduces operational costs.

- Use feedback from chargebacks and refunds to improve your products, services, and overall customer experience. Continuous improvement is a valuable outcome of these situations.

Benefits: Builds brand loyalty, encourages repeat business, and attracts new customers.

- Ensure that your payment processing system is secure and compliant with industry standards. A secure payment gateway reduces the risk of fraud-related chargebacks.

Benefits: Mitigates fraud risks, maintains customer trust, and safeguards financial information.

- Compile a comprehensive set of documents when responding to chargebacks. This may include order confirmations, shipping details, and any relevant correspondence with the customer.

Benefits: Shows merchant’s commitment to transparency and compliance.

- Use chargeback and refund instances as learning opportunities. Adapt your business practices based on insights gained from these experiences to prevent future occurrences.

Benefits: Enhances operational efficiency, adapts to changing customer needs, and minimizes errors.

By adopting these best practices, merchants can efficiently process chargebacks and refunds, maintain a balance between customer satisfaction and financial stability, and build a reputation for reliability and professionalism.

Legal and Regulatory Considerations

Navigating legal and regulatory considerations is imperative for merchants when dealing with chargebacks and refunds. Understanding the overarching regulations governing these processes is crucial for compliance. Various jurisdictions may have specific rules regarding the conditions under which chargebacks or refunds can be initiated. Merchants need to stay informed about these regulations and tailor their policies accordingly.

Compliance requirements for merchants often include transparent communication of refund policies, timely processing of refunds, and providing necessary documentation during chargeback disputes. Failure to adhere to these requirements can lead to legal consequences, including financial penalties and potential damage to the merchant’s reputation.

Non-compliance may result in legal actions taken by both customers and regulatory bodies, emphasizing the need for merchants to prioritize adherence to applicable laws and regulations. By staying vigilant and ensuring alignment with legal standards, merchants can mitigate risks and maintain a trustworthy and lawful business environment.

Leveraging advanced tools and technologies is essential for effective management of chargebacks and refunds. Merchants can benefit significantly from utilizing robust payment gateways and fraud detection tools. These tools play a crucial role in identifying and preventing fraudulent activities, helping merchants to minimize chargeback instances.

Integration of technology to streamline refund processes is equally important. Automated systems can enhance efficiency, reducing the time and effort involved in processing refunds. Implementing user-friendly interfaces and secure payment gateways not only improves the customer experience but also contributes to effective chargeback and refund management.

Staying abreast of industry innovations is a proactive approach that merchants should adopt. Continuous technological advancements introduce new tools and strategies to combat fraud and streamline financial transactions. By embracing these innovations, merchants can enhance their operational efficiency, strengthen security measures, and adapt to the evolving landscape of chargebacks and refunds effectively.

Understanding the intricacies of chargebacks and refunds is paramount for merchants navigating the complex world of e-commerce. This comprehensive guide has shed light on the definitions, processes, and implications of chargebacks and refunds. Merchants are encouraged to view these processes not as challenges but as opportunities to strengthen their business operations.

Merchants can safeguard their financial stability and ensure customer satisfaction by managing chargebacks and refunds proactively. Implementing preventive measures, such as fraud detection tools and efficient refund processes, can significantly reduce the occurrence of chargebacks. Maintaining transparent communication with customers and setting realistic expectations can contribute to a positive customer experience.

Staying informed about legal considerations and leveraging cutting-edge technologies are imperative. Merchants who navigate these waters with diligence and adaptability are better positioned to thrive in the competitive e-commerce ecosystem. The synergy between financial stability and customer satisfaction forms the bedrock of a successful and resilient business.

Work with Us

Do you need to refund customers or settle payments with vendors? Brankas can help you create automated workflows that transfer funds directly to their bank accounts.