Here’s a quick overview on how to complete a transaction on Brankas Direct—our payment product that allows users to make payments without leaving your website or app.

From business process management and payment solutions to cloud computing and automated enhancements, the Financial Technology scene in the Philippines is definitely making noise.

One of the companies in this industry is Brankas—Southeast Asia’s leading open finance technology provider. Brankas offers payment solutions, data management, and other financial-related processes to streamline the financial services of different countries and companies.

But why is FinTech becoming more of a staple in emerging economies like the Philippines?

Driven by the rising digitalization of economies, traditional financial institutions have more reasons to streamline their services. However, much of the Southeast Asian region remains largely unserved or underserved when it comes to banking and financing. Although financial technology solutions in the Philippines are on the rise, consumers and businesses can significantly benefit from further developments.

For one, no Philippine banks offer complete external data application programming interfaces (APIs), which are crucial for businesses, particularly those working with third-party developers. There’s also only one Philippine bank that has a fully functional payment API. These factors can severely limit people’s finance management options, leading to lengthy bank transactions with multiple steps and costly transaction fees.

Filipino consumers and small and medium enterprises (SMEs) may benefit from interim or temporary solutions. But, even if banks already have APIs, they can still fail and require fallback solutions. Fortunately, although the Philippines is years away from an open finance regulatory requirement, Brankas is one step ahead.

Brankas utilizes robotic process automation—or RPA—which modernizes businesses by making processes easier, faster, and more reliable. All industries and open finance jurisdictions employ RPA for many reasons: it streamlines labor-intensive financial processes, boosts productivity, and saves time and money.

As one of Southeast Asia’s leading financial services providers, Brankas, has made tremendous efforts to support and promote open finance for businesses and financial institutions. It’s an essential step because RPA technology can enable Open Finance in the Philippines.

Through RPA, the fintech sector can collectively provide Filipinos access to alternative and better financial products and services with superb quality and reasonable cost. Since secure bots are behind RPA, it doesn’t sacrifice consumers' financial and data privacy rights.

In 2022, Brankas and the investment firm Kaya Founder launched an 8-week open finance accelerator program—the Open PHinance Challenge— to encourage financial inclusion and accessibility. Early-stage startups in the Philippines benefited from this campaign as experts dove into informative discussions, mentorship, and product development.

Brankas also introduced “Brankas Open” after realizing that open finance technology requires a modernized open-source framework. Brankas Open is an open-source license promoting digital banking and fintech innovation. It helps neobanks, startups, and traditional financial institutions lower cost barriers.

For Brankas, this structure is ideal for securing community contributions, providing open access, and satisfying financial institutions' data protection and security standards.

In addition, Brankas strongly supports the efforts of the Bangko Sentral ng Pilipinas (BSP) as it continues to establish open financial frameworks in the country. It aligns with Brankas’s initiative to lead Filipino consumers toward holistic fintech and financial inclusion.

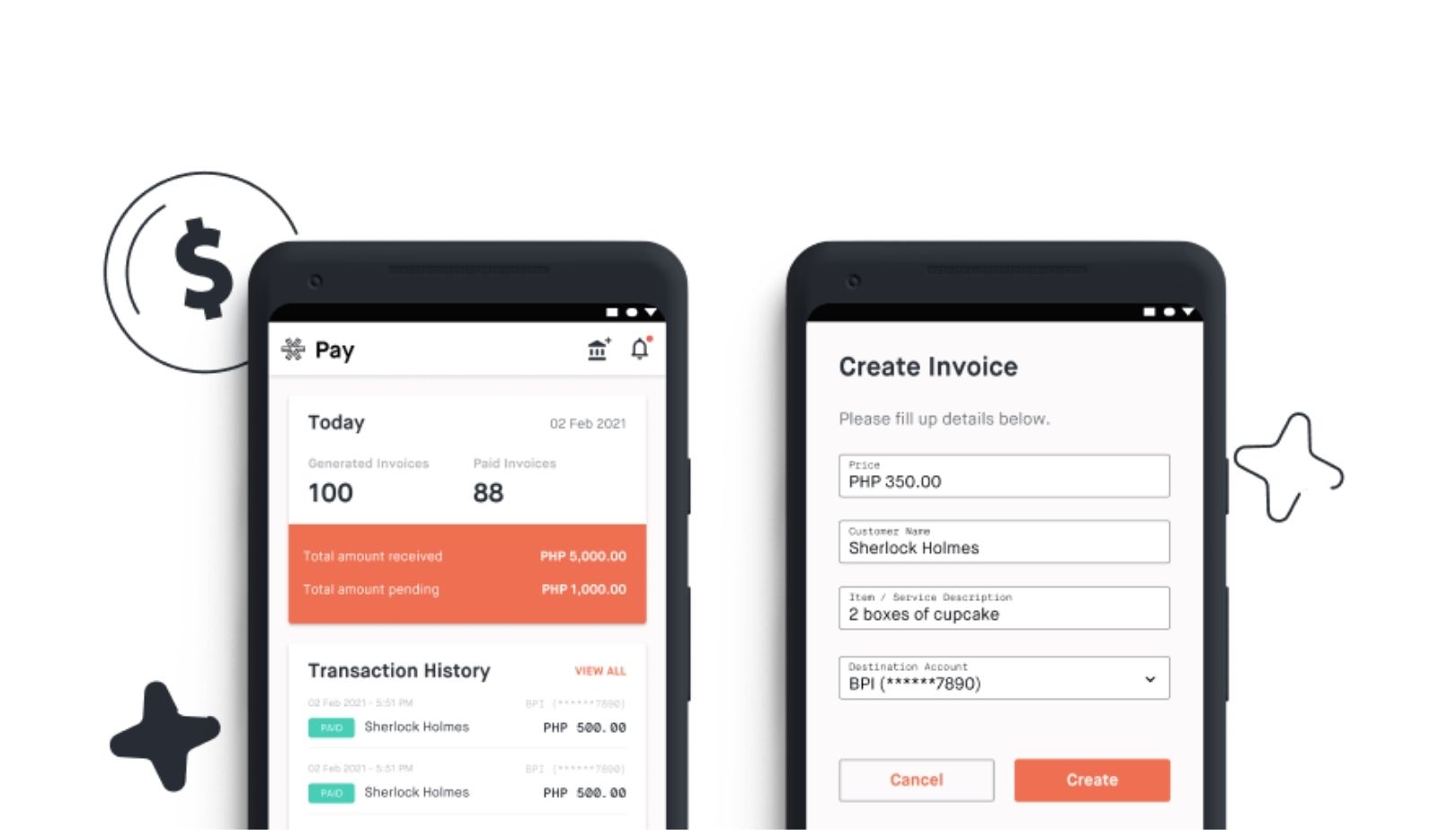

Brankas provides personalized financial services and product options to cater to specific demands. Brankas users can retrieve and access financial data in real-time, securely transfer funds across accounts, and fast-track transactions through these services. A good example is the fast and seamless disbursement of funds to multiple recipients at any bank.

Brankas also enables consumers to access authorized third-party systems, giving them control over their funds and the option to choose how they wish to interact with them. As for businesses, Brankas provides access to consumer data, such as spending habits, so that they can tailor their products accordingly.

With Brankas' streamlined processes and easy payment options, customers can avoid long transactions that can be a dealbreaker to some. These improvements help companies better understand their customers and boost their experience and satisfaction.

Banks also benefit from the concept of open finance. It lowers the cost of client acquisition and onboarding, allowing banks to increase access to underserved customers. In addition, open finance brings more opportunities to partner with third parties and develop more financial service solutions that can improve customer experience and rev up profits.

The fintech sector in the country has made much progress. But there’s still a vast opportunity for development, and one of those is exploring APIs, RPAs, and open finance. These technologies can do wonders for customer experience and business efficiency. Ultimately, the fintech industry can expand further and accomplish more things.

Whether you’re running an organization or an individual consumer, Brankas offers numerous financial solutions you’ll surely appreciate.

As a financial services provider, Brankas is all out in supporting the BSP and financial institutions with the same vision of achieving greater heights and bringing the country closer to fintech and financial inclusion.

Here’s a quick overview on how to complete a transaction on Brankas Direct—our payment product that allows users to make payments without leaving your website or app.

COVID-19 changed the way that almost everyone operates a business. Here’s our take on how to launch a product during a pandemic. Read our insights today.