Singapore’s Brankas will enhance open finance infrastructure with Arab Financial Services (AFS) in the Middle East and Africa. Read about the partnership today.

The payments industry has found a dynamic and fast-paced market in Asia in recent years. According to consultancy firm McKinsey, payments revenue growth in the region is forecast to increase 7 percent between 2021 and 2025, driven by rapid developments in digital infrastructure, the surge in B2B activity, and the increasing appetite for digital wallets and real-time payments. Now is the best time to explore how an IPG can support Asia’s increasingly complex demands for payments.

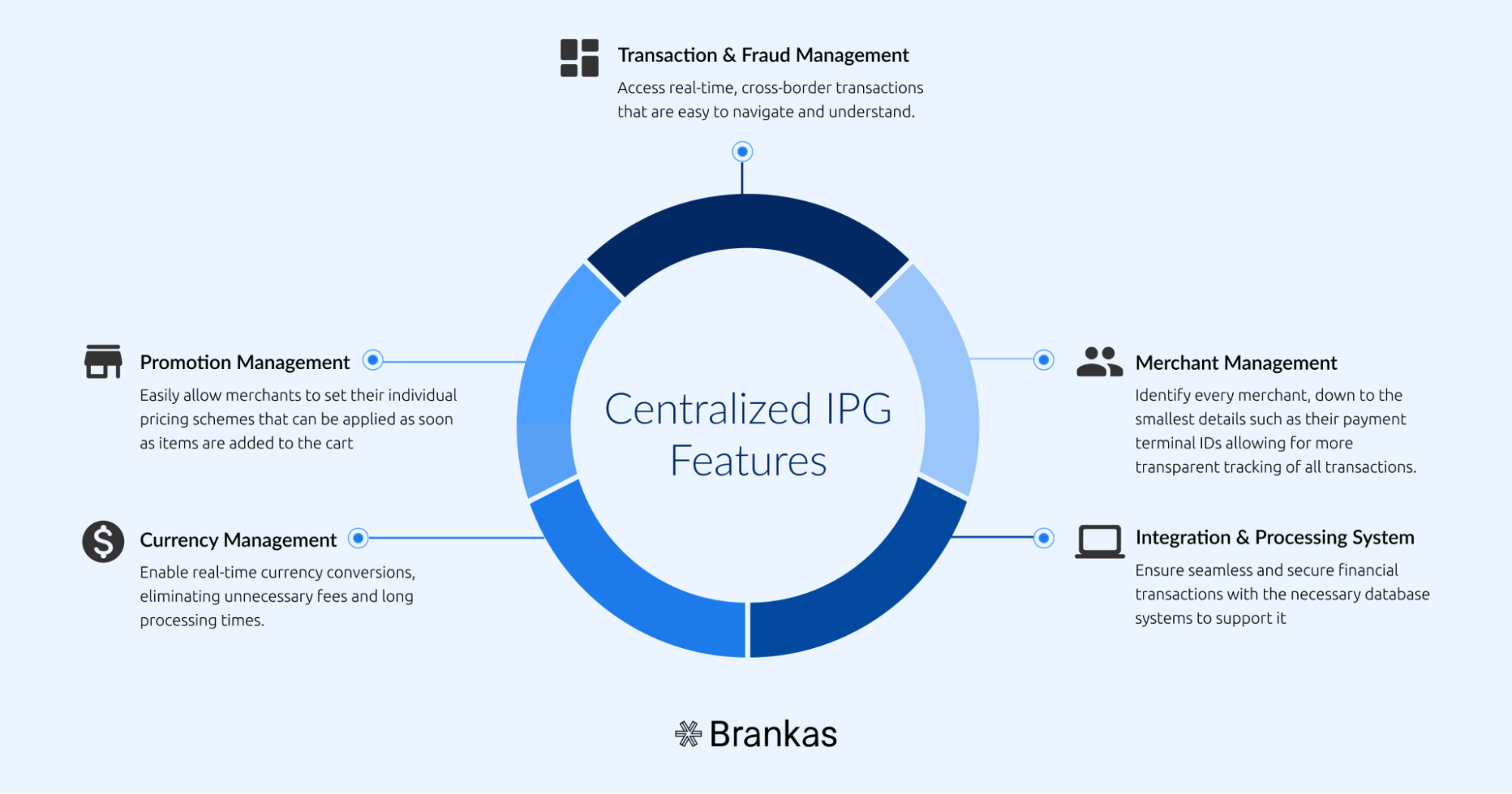

An IPG system serves as a reliable and secure bridge between financial institutions/merchants and their clients. Through our open APIs, we can build an in-house payment hub that allows financial institutions to process payments directly instead of relying on third-party providers. Brankas offers a holistic IPG system that can manage all kinds of payments and integrate other crucial features such as promotions and fraud detection.

For example, we can help an e-commerce platform handle multiple transactions and promotional schemes for their vendors. The merchant will also be able to track every transaction and configure the types of payments allowed, all within one centralized dashboard.

Flexible. Unlike most providers that can only integrate specific payments platforms, we can accommodate all kinds of payment options. This allows us to incorporate any platform in the market that has partnerships with merchants.

Secure and certified. Like all our products and services, we prioritize cybersecurity and compliance in our IPG. We are ISO 27001-certified and PCI DSS (Payment Card Industry Data Security Standard) Level 1- certified. In particular, the PCI-DSS is crucial as it is an information security standard mandated by the PCI Security Standard Council (composed of major credit card brands) for all organizations that accept, process, store, or transmit credit card information. We can also add all kinds of security authentication for APIs, such as mobile keys, one-time pins, and 3D secure.

Centralized. Our one-stop payments management dashboard is able to handle multiple tasks.

Interested in an IPG API for your business?

Brankas has the expertise, technology, and teams that can help jumpstart your payment gateway systems. Our portfolio of API partnerships with major financial institutions in Southeast Asia has given us the knowledge and experience to implement solutions that work.

If you want to know more about our IPG and open banking solutions, please reach out to sales@brank.as.

Singapore’s Brankas will enhance open finance infrastructure with Arab Financial Services (AFS) in the Middle East and Africa. Read about the partnership today.

Woohoo! Brankas officialy reached over 10 million monthly API calls across 80 partners. This is a massive achievement for the open finance community!