What is open finance? We answer this and more in our complete guide to open finance and key benefits in Asia-Pacific. Read the full guide.

Nowadays, many people use an app for online financial transactions, like paying bills or sending money to friends and loved ones. But what if you can use the same app not just for simple transactions but also for more complex ones, like investing in the stock market, adjusting your insurance, or even managing your pension?

With open finance, these use cases are possible. Let’s look into open finance and how it can pave the way for an open economy.

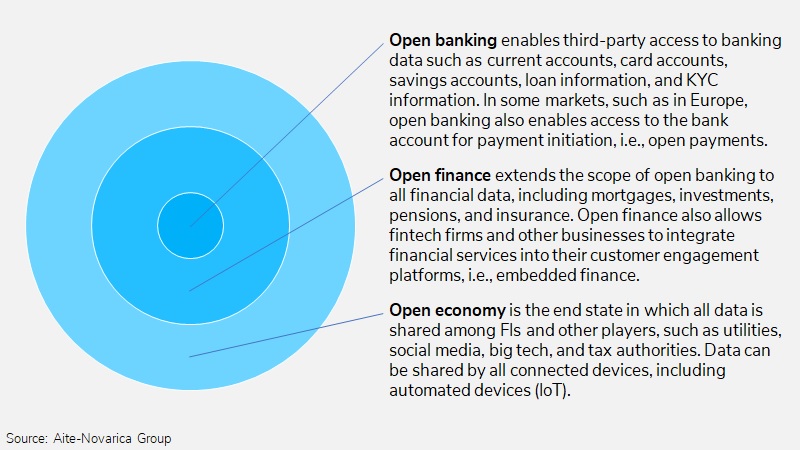

As discussed in a previous article, open banking refers to connecting banks and third-party providers (TPPs) via application programming interfaces (APIs) to make financial services more accessible and convenient for consumers. This model typically covers bank-related transactions, like fund transfers and deposits.

On the other hand, open finance builds on open banking to include more than just bank-related transactions. As such, in the context of open banking vs. open finance, their difference lies in the scope of data involved. While open banking focuses on banking data, open finance extends the coverage beyond banking to include other financial data, such as investments, mortgages, insurance, pensions, etc.

The end goal of open finance is to provide consumers access to their entire financial footprint for more control over which financial services they can use.

Currently, various ways are in place to shape and improve the economy. With open finance at the core, banks and financial institutions can bridge the gap between customers and next-level banking.

Leveled playing field

Banks with physical branches that mainly offer deposit and lending services enjoy a high degree of control over their consumers’ personal information. Moreover, they also have access to other transactions based on their customer interactions.

With open finance coming into the picture, the ownership of financial data shifts from banks and financial institutions to consumers. This framework levels the information playing field, empowering consumers to take control of their data while incentivizing competition among financial services providers.

Interconnected financial products and services

A common frustration among consumers is the limited services that a financial institution provides. For example, banks may focus on getting more customers rather than developing new services for their existing ones because it is more profitable for their bottom line.

This is where open banking comes in, allowing banks to open their financial data to TPPs who can develop new features and services for their customers. As a result, banks can still focus on their core function, while customers now have access to better financial services. It’s a win-win for everyone.

Open finance aims to extend this interconnectivity beyond banking. Innovations in open finance can encourage more partnerships between financial institutions and businesses, fostering a more collaborative financial ecosystem and better and interconnected financial products and services.

A more resilient financial system

Traditional banking puts control of consumers’ financial data on banks. Unfortunately, this model makes switching to different banks a pain and often causes lock-in effects where consumers have no choice but to keep using a particular product or service because there isn’t a better option.

With open finance, consumers have more options so that they don’t have to stay locked into a particular vendor. In addition, better data access and portability means customers can simply “plug in” their financial data to a third-party service their bank doesn’t offer.

Moreover, open finance can reduce structural reliance on large banks, leading to a more diverse financial ecosystem that can sustain severe shocks amid government regulations. Should financial institutions fail, along with tons of private information, open finance will make it easier to share such data with prospective new lenders. It can also reduce the costs of institutional failure.

Better competition among financial institutions

Unequal information between financial institutions results in tremendous barriers to the entry of new, more innovative, and possibly better competitors. With open finance leveling the information playing field and improving the entire transactional footprint of customers through data portability and interoperability, it can ensure a large, diverse, and competitive universe of players.

Since stiffer competition among financial institutions inspires them to deliver higher quality, cost-effective, and more personalized products and services, consumers can benefit from a more dynamic and efficient financial services industry that offers them better choices.

Unlock Banking-as-a-Service for your organization

Banking-as-a-Service (BaaS) supplies banking products and services via non-bank businesses. Examples of BaaS include setting up transfers between banks, depositing checks via smartphones, and online shopping with debit or credit cards.

BaaS aims to win customers away from traditional banks. Meanwhile, open finance allows access to one’s financial records and sharing them through APIs. The result is better services for consumers. Once you unlock BaaS with open banking technology, you can lead the market with an all-in-one channel for remittance, payments, loans, and more.

Monetize your existing APIs

APIs enable two software components to exchange data using various protocols. In banking and other financial transactions, APIs help process payments, facilitate conversion between currencies, and more.

Monetizing APIs means charging fees for its endpoints. First, businesses sell API access directly to software developers. Then, they use it to access data or perform other actions.

Meanwhile, the open finance suite allows secure third-party access to services like Buy Now Pay Later (BNPL), virtual credit card issuance, remittance, and insurance and authorizes more monetization opportunities.

Automated account opening, payments, disbursements, cards, and credit checking

As consumers consent to make their financial information available, it’s easier to have automated account opening, payments, disbursements, cards, and credit checking. These processes provide customers with seamless and smooth financial transactions whenever and wherever. Plus, automation lets bank professionals focus on quicker and more high-profile tasks.

As open finance becomes the predominant trend in the financial ecosystem, so do we get closer to a future of an open economy, where all data is shared among financial institutions and non-financial industries. This vision provides consumers with limitless possibilities for integrating their financial data, thus allowing them to do everything digitally.

We’re not quite there yet, but more and more organizations are creating solutions that push for the growth of the open finance ecosystem. For instance, Brankas offers Open Finance Suite, which has already helped financial institutions in Southeast Asia take advantage of open banking technology.

In the Philippines, PERA HUB built its Digital Remittance Platform on top of Brankas’ Open Finance Suite. This helped them manage their API endpoints in real-time, connect with more partner services, and achieve their mission of becoming the one-stop platform for cash and payment-related transactions in the Philippines.

Open Finance makes financial transactions seamless. In today’s generation of consumers who rely heavily on technology, it’s time for companies to include such software in their systems that will adjust to their business processes and customer needs.

To improve financial technology in your businesses, reach out to Brankas and make way for new revenue streams. We have the expertise, technology, and teams to design solutions tailored to your business needs. So say hello to new customers, unlock BaaS for your organization, and bridge access to financial services today!

What is open finance? We answer this and more in our complete guide to open finance and key benefits in Asia-Pacific. Read the full guide.

Discover how the Asia-Pacific (APAC) fintech industry defied the odds and remained resilient amidst the global economic uncertainties. Learn about the exciting developments in the APAC fintech landscape.