COVID-19 changed the way that almost everyone operates a business. Here’s our take on how to launch a product during a pandemic. Read our insights today.

Application programming interfaces (APIs) have become more prevalent in the banking industry in recent years.

For instance, regulations promoting open API in banking have led to a 499% growth in banking platforms globally. Southeast Asia is gaining notable progress as well with open banking API. The Philippines is an excellent example of this, meeting its objective of reducing average financial exclusion from 44% to 30%.

API banking can break banking barriers through digitization. Whether speeding up and automating repetitive tasks or adding more functions, there’s untapped potential with what API banking can deliver to banks and other financial institutions in the years to come.

This article will cover API banking’s significance to banks, businesses, and the fintech industry.

Before understanding how APIs work in the banking industry, let’s tackle first what an API is. An API, or application programming interface, is a set of protocols enabling various applications to communicate with each other. It’s comparable to a common “language” that different software can use to share data among themselves efficiently and securely.

Similarly, the way of structuring data differs from bank to bank. This factor makes it difficult to provide integrated banking services to consumers amid the demand for digital payments.

This is where API banking comes in, allowing banks and financial institutions to communicate and interact with each other and with third parties.

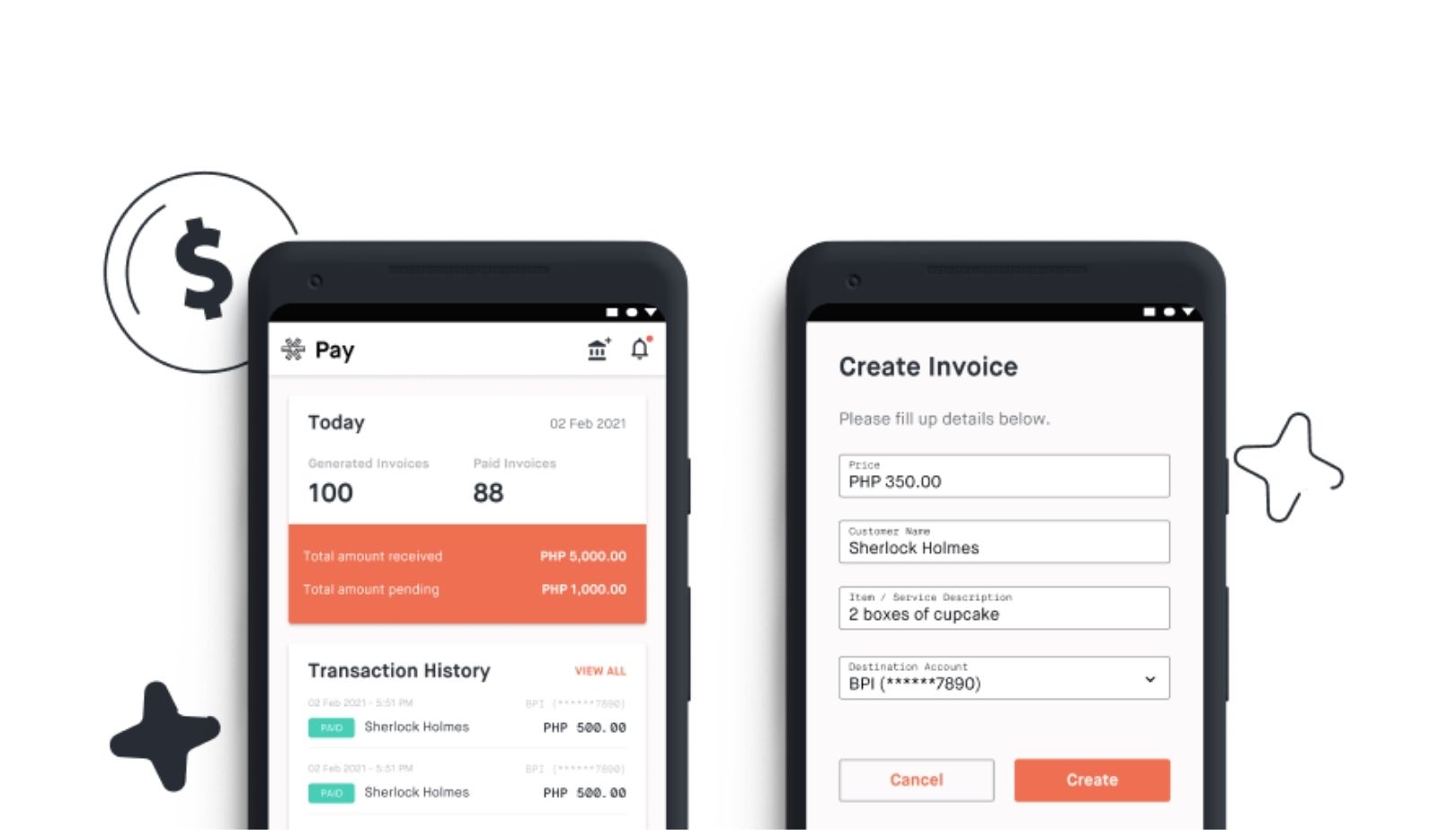

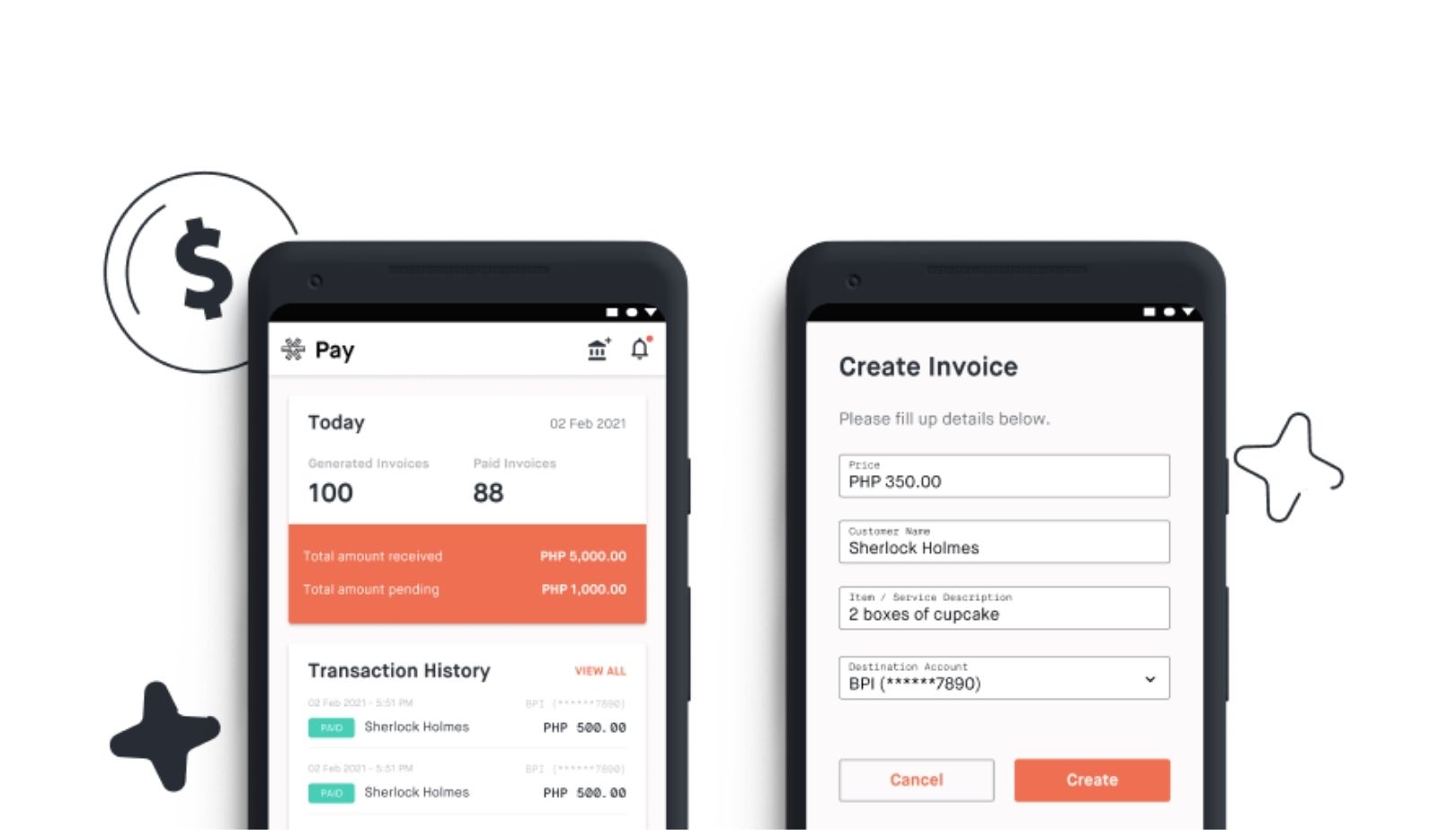

Aside from consumer benefits, API banking also offers major benefits to banking operations, including resolving transaction errors, managing internal tasks, tracking successful or canceled payments, etc.

At its core, API banking provides customers with better services and a seamless digital banking experience. Here’s how.

Customer engagement is crucial in the banking industry because communicating with your customers, addressing their concerns, and meeting their demands can lead to brand trust and loyalty.

People expect convenient services when they go online to access their bank accounts, credit cards, etc. Here, APIs can improve customer engagement by providing customers reliable 24/7 access to their bank accounts and personal data.

For example, implementing Brankas' Statement API offers a reliable and secure way for bank customers to track their finances digitally from any device without worrying about the security of their transactions.

The finance industry is fast-paced. With cutthroat environments and demanding workloads, employees bear tremendous pressure to accomplish tasks and satisfy customers. Changes in work protocols and customer policies can also lead to a decline in performance. With APIs, increasing staff efficiency is possible, as they help make bulky data integration projects more manageable.

Data silos pose challenges among traditional banks when upgrading their legacy systems for the digital age. As competition in the fintech industry shows no signs of slowing down, banks must prioritize breaking down these silos to drive innovation and quality in their products and services.

APIs' data accessibility and interoperability provide tremendous value to businesses. For example, Brankas aggregates APIs from various financial institutions into a single API that banks can use to build tailored services for their customers.

Banks have an extensive selection of financial services to offer to customers. But without new revenue channels, bank operations might not be sustainable.

How can APIs help banks in this department? Instead of developing a new product from scratch, banks can use APIs from third-party providers to expand their product features or use cases, reach international markets, etc. This way, banks can save time and continue making money.

Handling sensitive financial information demands the utmost security. Bank accounts, credit cards, and other digital assets are common targets of cybercriminals, which is why banks must implement robust security systems to prevent online theft, fraud, and hacking.

APIs protect sensitive data via multiple layers of authorization, keeping cybercrimes under control. For its part, Brankas uses the highest security standards, such as HTTPS connections and AES-256 encryption, to maintain data security.

APIs are game changers for the banking industry. They empower banks to upscale their internal processes and maximize the potential that digital technologies have to offer.

In the case of Southeast Asia’s emerging markets, open banking APIs help the financial sector serve unbanked populations by making financial services more accessible. The push for API banking in these markets helps improve financial inclusion and address the needs of less privileged individuals and communities.

Here are successful use cases of API banking in Southeast Asia in recent years:

Southeast Asia has gained a reputation as the “wallet first” region, with API-powered mobile apps and e-wallets as the primary method of digital payments for online transactions.

Telecommunications and utility companies are using banking APIs to offer multiple payment options to their customers.

Like e-wallets, cryptocurrency apps are popular alternatives to traditional banking in Southeast Asia. These apps use banking APIs to allow crypto holders to link their bank to their crypto wallets for making fund transfers, deposits, withdrawals, investments, etc.

Unlike the US, which uses a standardized system for creditworthiness via FICO scores, many Southeast Asian countries rely on data that traditional banks collect. Unfortunately, this approach puts unbanked groups at a disadvantage.

The good news is that banking APIs are changing this by aggregating customer data from various sources to assess a person’s creditworthiness. As a result, vulnerable sectors, like those with no bank accounts or credit history or informal workers, can also avail of lending services.

Insurance companies collaborate with banks through an arrangement called bancassurance, which allows insurance companies to provide their services more seamlessly through banking APIs.

API banking has a lot in store for the banking industry. For banks that have yet to transition to complete digitalization, API banking is helpful in remodeling and restructuring digital operations for high-impact financial services.

A reliable financial service provider like Brankas can guide you in navigating the future of business. Brankas offers a comprehensive array of financial services for everyone in Southeast Asia in partnership with major banks and financial institutions.

Ready to boost your financial services? Contact us to learn more!

COVID-19 changed the way that almost everyone operates a business. Here’s our take on how to launch a product during a pandemic. Read our insights today.

In this blog post we will see how Jaeger tracing can be easily added to a gRPC application in Go inside a distributed microservices architecture. Read it today.