Brankas is the first company to secure the PJP Category 2 License for Account Information (AInS) from Bank Indonesia, marking an open banking data milestone for Indonesia and giving businesses added visibility on payment transactions.

Also read: Investing in Open Banking Solutions for Growth in Indonesia and Beyond (Part 1)

Open banking constitutes a transformative shift where customers can seamlessly explore novel financial offerings from authorized third-party providers. This innovation is facilitated by financial institutions crafting Application Programming Interfaces (APIs) that align with the central bank standards of a country. Third-party entities acquire licenses to interface with these APIs, fostering a collaborative financial environment.

Open finance is an extension of open banking. It unbinds the ensemble of financial data and services, allowing individuals and businesses to access a comprehensive overview of their financial activities, including investments, loans, credit cards, and more. This holistic view empowers users to make informed decisions and fosters innovation within the industry.

This transition towards open finance carries profound significance for the financial sector. Individuals gain a comprehensive understanding of their financial health, promoting better financial management and literacy. Businesses, especially fintech startups, can leverage this data to create personalized financial products and services, enhancing the customer experience and accessibility. Open finance breaks down data silos, enabling collaboration, transparency, and innovation across the financial ecosystem, paving the way for a more interconnected and inclusive financial landscape.

Indonesia encompasses a staggering 17,000 islands. Boasting a population exceeding 273.5 million, dominated by Generations Y and Z, and characterized by their desire for swift and mobile services. This demographic inclination is intertwined with a resounding shift toward digital engagement. While the country enjoys a 56% internet penetration rate, about 92 million individuals remain unbanked, and approximately 46 million people are underbanked. Open banking is an opportunity to enhance financial inclusion and promote financial literacy across the nation.

In 2019, Indonesia’s central bank, Bank Indonesia (BI), introduced the Indonesia Payment Systems Blueprint 2025 (IPS 2025) to address the growing digital needs of its population. This regulatory framework emphasizes strategies for thriving in the digital era, fostering regulated connections between traditional financial institutions and FinTechs to balance innovation’s risks and opportunities. BI’s blueprint consists of five initiatives: open banking, retail payment systems, financial market infrastructure, data, and regulatory, licensing, and supervision.

The first initiative was realized through the National Open API Payment Standard (SNAP), launched in October 2021. The BI-SNAP initiative sets a standard for open API implementation, reducing fragmentation among financial institutions and enhancing interoperability. By fostering integration among API operators, BI aims to drive payment system efficiency, contributing to financial inclusion. The BI-SNAP API standards encompass statement retrievals, account openings, payment channels, information security, and more. Sixteen financial institutions plan to adopt the open API system by June 2022, with full adoption anticipated by 2025. Since SNAP’s launch, various financial institutions and FinTechs have been developing open APIs aligned with BI’s guidelines.

Bank Indonesia introduced its Fast Payment System (BI-FAST) in December 2021 as part of IPS 2025’s second initiative, Strengthening the Configuration of Retail Payment Systems. BI-FAST facilitates real-time retail payments, enhancing the national retail payment system’s resilience by providing an alternative infrastructure. Key to BI-FAST’s adoption is the reduced interbank transfer fee, from IDR 6,500 to IDR 2,500 per transaction. Moving forward, this system will serve as the backbone of Indonesia’s retail payment system, extending to encompass bulk credit, direct debit, and requests for payment services.

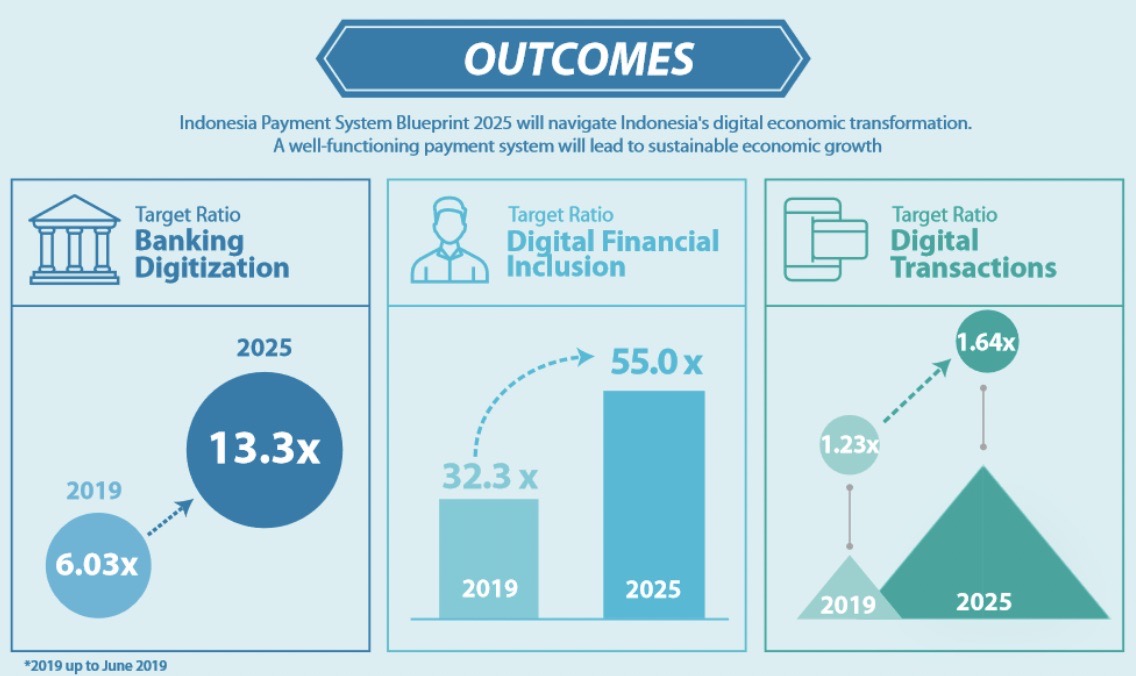

The IPS Blueprint 2025’s implementation culminates in three key milestones that serve as Bank Indonesia’s flagship programs. These milestones comprise the Open Banking consultative paper, the conceptual design of BI-FAST, and the new regulatory structure. These pivotal markers will guide the process and serve as stepping stones for further achievements within the framework of IPS 2025. The blueprint is poised to steer Indonesia’s digital economic transformation, facilitating well-functioning payment, monetary, and financial systems that contribute to sustainable economic growth, prosperity, and financial system stability. IPS 2025 will effectively connect structural reforms with digital transformation, weaving the participation of all economic stakeholders into an inclusive digital ecosystem. In this context, the deployment of IPS Blueprint 2025 is expected to yield two primary outcomes.

First and foremost, IPS 2025 aims to promote more effective collaboration between banks and fintech businesses, as seen in an increase in the Banking Digitalization Ratio. Secondly, a significant boost in the adult participation rate within the financial sector is targeted.

Through IPS Blueprint 2025, Bank Indonesia is taking substantial steps to establish a robust digital ecosystem while fulfilling its role as a central bank. This framework aims to ensure that the ongoing digitalization in Indonesia benefits society by delivering improved economic and financial inclusion on a wider scale.

Open banking offers a range of significant advantages for Indonesian consumers, revolutionizing how they manage their finances and engage with financial services. Here are some key benefits:

In the dynamic landscape of Indonesia’s open finance sector, Brankas emerges as a prominent figure. Established in 2016, this company stands as a powerhouse, providing a suite of banking-as-a-service embedded APIs that encompass a wide range of services, including account opening, credit scoring, identity verification, and online payments. In March 2023, Brankas proudly declared its acquisition of the Payment Service Provider (PJP) Category 3 License from Bank Indonesia (BI). This prestigious certification is a testament to Brankas' unwavering commitment to adhering to the highest local regulatory and security standards for its cutting-edge open finance payment solutions. It also forged a partnership with Element Inc. to further enhance consumer data protection and confidentiality, consistent with the country’s Personal Data Protection Law. Brankas proudly serves over 40 banks, as well as more than 100 enterprise customers and channel partners who trust and depend on its innovative offerings.

The adoption of open banking solutions represents a pivotal stride towards modernization and financial inclusivity in Indonesia. This strategic convergence of traditional financial institutions and cutting-edge FinTech companies is orchestrating a profound transformation, providing Indonesian consumers with amplified access, convenience, and security. The benefits are palpable, spanning from streamlined financial management and personalized services to expeditious transactions and favorable rates. Beyond these immediate gains, the broader impact of open banking has the potential to galvanize financial inclusion and ignite competitive dynamics that will reshape the country’s economic landscape.

As Indonesia propels itself into the digital age, the implementation of the Indonesia Payment Systems Blueprint 2025 and the advent of open banking synergize to redefine the contours of financial services. By leveraging the potency of open APIs, Indonesia is poised to amplify consumer-centric offerings, bolster financial inclusion, and catalyze a virtuous cycle of innovation. This confluence of open banking and a forward-looking regulatory framework beckons a future where financial services are more accessible, responsive, and aligned with the dynamic needs of Indonesia’s diverse population. In embracing this trajectory, Indonesia is not just adopting technology but also crafting a narrative of financial empowerment, transparency, and sustainable economic growth for the nation.

References:

https://www.bi.go.id/en/publikasi/kajian/Documents/Indonesia-Payment-Systems-Blueprint-2025.pdf

https://openfuture.world/open-finance-global-progress-ebook-indonesia/

https://finance.yahoo.com/news/brankas-introduces-advanced-fraud-detection-020000735.html

https://blog.brankas.com/brankas-secures-payments-licenses-in-indonesia-and-the-philippines

Brankas is the first company to secure the PJP Category 2 License for Account Information (AInS) from Bank Indonesia, marking an open banking data milestone for Indonesia and giving businesses added visibility on payment transactions.

Indonesia is embarking on an ambitious project to build a new capital city in Kalimantan, Ibu Kota Nusantara (IKN). Jakarta, the current capital, will no longer hold that title by 2024. This bold decision promises a fresh start for the nation, with hopes of a brighter and more sustainable future.