The Middle East is quickly progressing as a leading region for Open Banking. In the past years, governments across the GCC (Gulf Cooperation Council) have actively created regulatory frameworks around open banking to support fintech growth.

In Saudi Arabia, the UAE, and Bahrain, open banking frameworks are already live. Following the neighboring countries, Oman has now taken a regulatory-driven approach to open banking, which is regulated and supervised by the Central Bank of Oman (CBO).

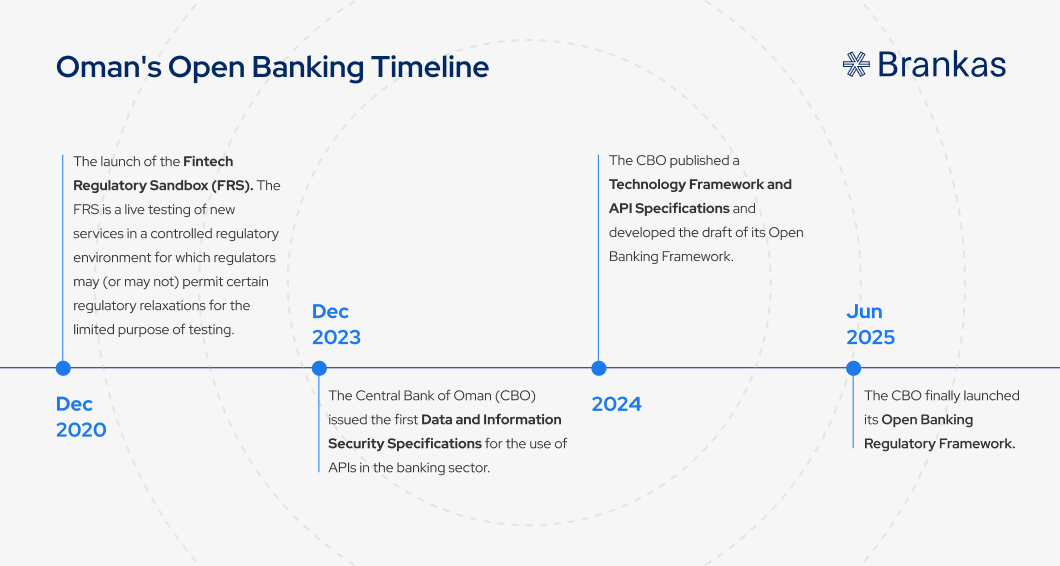

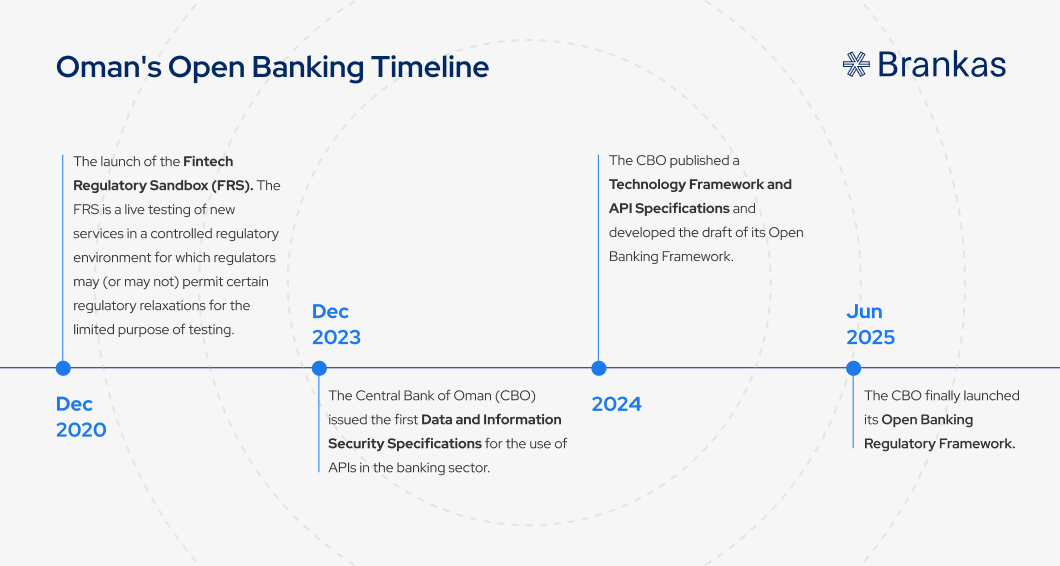

Oman Open Banking Roadmap:

Oman’s journey toward open banking has been gradual and structured. The country’s open banking development initially began with a call from local banks (Oman Banks Association).

This phased approach reflects Oman’s focus on stability, security, and industry readiness.

Inside The Open Banking Framework

The Open Banking Framework is a comprehensive set of regulatory guidelines, technical requirements, and operational standards. It is designed to enable secure collaboration between banks, fintechs, and third-party providers (TPPs).

The framework aligns with Oman Vision 2040 and the new Banking Law of 2025. Together, they support a more transparent, digital, and data-driven financial ecosystem. The OBF does not mandate a specific standard to be used. Instead, it allows the market to determine implementation approaches.

At the same time, the CBO places strong emphasis on security. The framework requires strict technical adherence and mandates API interoperability through recognized specifications, including OpenAPI (OAS 3.1.0).

What It means for the Industry:

- Consumer empowerment & financial inclusion: Customers gain more control over their financial data, enabling more personalized and accessible financial services.

- Increased competitive pressure on banks: Incumbent banks must innovate, partner, or adapt as new digital players enter the market.

- Fair and secure access for fintechs & TPPs: Standardized APIs create a level playing field, encouraging innovation and safer integrations.

- New monetization opportunities: Banks can unlock new revenue streams through API-driven and data-driven services.

- Global alignment: Oman accelerates toward global Open Banking leaders such as the UK, EU, Australia, and SG.

Beyond Compliance: The Opportunity for Banks

For incumbent banks, open banking in Oman presents more than a regulatory obligation. It’s an opportunity to reinvent customer relationships and expand their role in the digital economy.

By embracing partnerships and new business models, banks can prepare for the broader shift toward open finance and, eventually, the open economy. Those that act early will be better positioned to compete and scale.

Brankas’ Role: Powering Secure Open Finance Infrastructure

As Oman’s Open Banking ecosystem and pilot programs scale, trusted orchestration becomes even more critical. Brankas’ proprietary solution, the Brankas Open Finance Suite (OFS) enables banks to comply with Open Banking regulatory requirements. Our technology ensures all participants can interact securely, efficiently, and in full regulatory compliance to unlock open banking potential.

The solution comes complete with features, including but not limited to, developer portal for TPPs to manage their API usage, an admin portal for bank operations team to manage their Open Banking programme and end user interfaces for consent management.