PERA HUB by PETNET, a top financial service provider in the Philippines, partnered with Brankas in 2021 to launch a Digital Remittance Platform. Read about it.

In some parts of the world, financial institutions and their customers are transitioning from open banking to open finance. Businesses use this innovation to improve their company’s offerings, while consumers leverage the technology to make sound financial decisions.

Yet despite widespread adoption, some people still don’t have access to open banking or even a bank account. For instance, the number of account holders in the Philippines nearly doubled from 20.9 million in 2019 to 42.9 million in 2021. Unfortunately, many adult groups of the country’s population remain unbanked, including farmers, retirees, and homemakers.

Open banking APIs can resolve this problem in the Philippines and the rest of the world. This article will discuss everything you need to know about open banking and its role in promoting financial inclusion.

Financial inclusion or inclusive finance refers to individuals and businesses having access to affordable and convenient financial products and services, regardless of economic standing.

Financially included people can save, apply for credit and loans, start and expand a business, and invest in their holistic financial health. On the other hand, financially included organizations can manage financial risks, grow their investments, and make long-term data-driven plans.

Over the past decade, financial innovations such as mobile banking, peer-to-peer payments, and online trading platforms have empowered individuals and businesses in various aspects of their financial journeys.

With open banking entering the scene, you may wonder how it fits into the financial inclusion discussion. Open banking and financial inclusion support each other in several ways.

1. Enables personalized products and services

Open banking APIs give financial institutions access to personal and financial customer data such as bank usage and transaction history. As a result, financial institutions can personalize their products with this information to better address customers' financial needs.

For instance, a bank can offer microloans to small business owners to cover damages or losses incurred from a natural calamity like a typhoon. The bank can also help first-time home buyers anticipate real estate rates and payments and build a good credit score based on their savings and transaction history.

The more personalized and “human” banks are, the more their customers will avail of their offerings. After all, 72% of banking customers today already see personalization as “highly important.” Therefore, there’s no better time to adopt open banking than today to create unique and more targeted banking experiences.

2. Promotes improvement of financial offerings

Open banking encourages financial institutions to partner with emerging financial technology companies, diversify their offerings, and take advantage of growth opportunities in the finance sector.

Financial institutions can also shift to a more flexible banking-as-a-platform business model by adopting technologies like chatbots, user-centered apps, and virtual and augmented realities.

Consequently, these technologies can eliminate paperwork, disburse products and services in real-time, and boost customer satisfaction. Not only do these benefits lower costs for financial institutions, but they also help unbanked and underserved customers achieve financial inclusion in no time.

A 2022 study found that 53% of bank account holders trust financial service providers more when they deliver “integrated, consistent, cross-device experiences.” Another 70% said they use online accounts, while 33% transact with online-only banks.

3. Allows for more informed financial decision-making

Without personalized financial products and services, unserved and underserved individuals can’t independently understand their finances or take advantage of wealth management opportunities that can improve their quality of life.

Open banking resolves this problem. When financial institutions share customer data with third parties, those in unserved and underserved communities, including banking novices, can enjoy new financial management tools and make better-informed decisions. Data sharing can also help them build a credit history to qualify for credit and loans and lower interest rates and fees.

Additionally, open banking supports financial apps that give users an overview of their savings, expenses, and overall financial health. For instance, the rise of super-apps in recent years has given users a one-stop shop for many services, such as food delivery, retail shopping, and ride-hailing.

Many banks are now catching up with this trend, consolidating and offering their products and services—such as payments, loan applications, and fund transfers—in one app. With this financial innovation, many more individuals can access their money, understand their financial standing, and even seek professional help without physically visiting their bank.

4. Improves financial literacy

Since open banking enables fintech firms to create and improve personal finance management tools, users can have an accurate view of their financial health and achieve financial literacy.

For instance, some mobile banking apps help users track their spending habits, save for necessary expenses, and set financial goals. Then, based on user data, these apps can provide personalized recommendations on how users can achieve their goals—whether to build their wealth further, invest in lucrative assets, or enhance their overall financial well-being.

5. Supports micro, small, and medium enterprises (MSMEs)

Beyond the individual level, open banking can also contribute to the growth of MSMEs, which account for up to 99.9% of total establishments in Southeast Asia. They also contribute 85% to employment, 44.8% to GDP, and 18% to national exports.

Open banking ensures MSMEs can automate their accounting and cash management tasks. Delegating these business functions to a third party helps MSME owners focus more on enhancing other parts of their operations and looking for more growth opportunities.

Most importantly, open banking provides MSMEs easy access to capital. Traditionally, MSMEs would manually submit requirements to qualify for a loan. With open banking APIs, banks can have a real-time view of an MSME’s financial health and performance and offer customized loans for the latter to expand their offerings or investments and fund their short- and long-term plans.

6. Supports contingent workers

Over the years, freelancers or independent contractors have had difficulty qualifying for more advanced financial products such as credit cards and loans because of their unstable income. This predicament leaves them underbanked and hinders them from improving their quality of life until they have accumulated enough wealth to save and cover their expenses.

Open banking now allows them to access financial offerings, which can help fund their resources, education, and more. For instance, data sharing will enable lenders to pull financial information from a freelancer’s bank account and assess their creditworthiness.

Meanwhile, open banking enables freelancers to upload invoices and receive payments through their preferred payment gateways, streamlining their bookkeeping process.

7. Encourages economic participation

Again, open banking enables and streamlines digital transactions, makes financial products and services more accessible, and helps unbanked and underserved individuals understand their finances.

With the majority benefiting from open banking, this financial innovation can contribute to local and global economies. The more financially literate people are, the more they can enhance their living standards and, ultimately, contribute to the economy.

Financial inclusion goes beyond giving individuals and businesses access to affordable financial products and services. Being financially included means participating in the global economy and improving critical infrastructures that support daily life.

With open banking fast becoming a norm, financial institutions can finally serve the unbanked and underserved while empowering individuals and businesses to achieve their financial goals.

If you want to experience the benefits of this financial innovation, reach out to open banking API providers like Brankas. We’ll help you integrate open banking APIs into your systems to improve your products and services and onboard more unbanked and underserved customers. You can also cross-check customer data across multiple partners to make credit, loans, and other financial services more accessible.

Visit our website to learn more about open banking APIs and how we use them to enable financial inclusion.

PERA HUB by PETNET, a top financial service provider in the Philippines, partnered with Brankas in 2021 to launch a Digital Remittance Platform. Read about it.

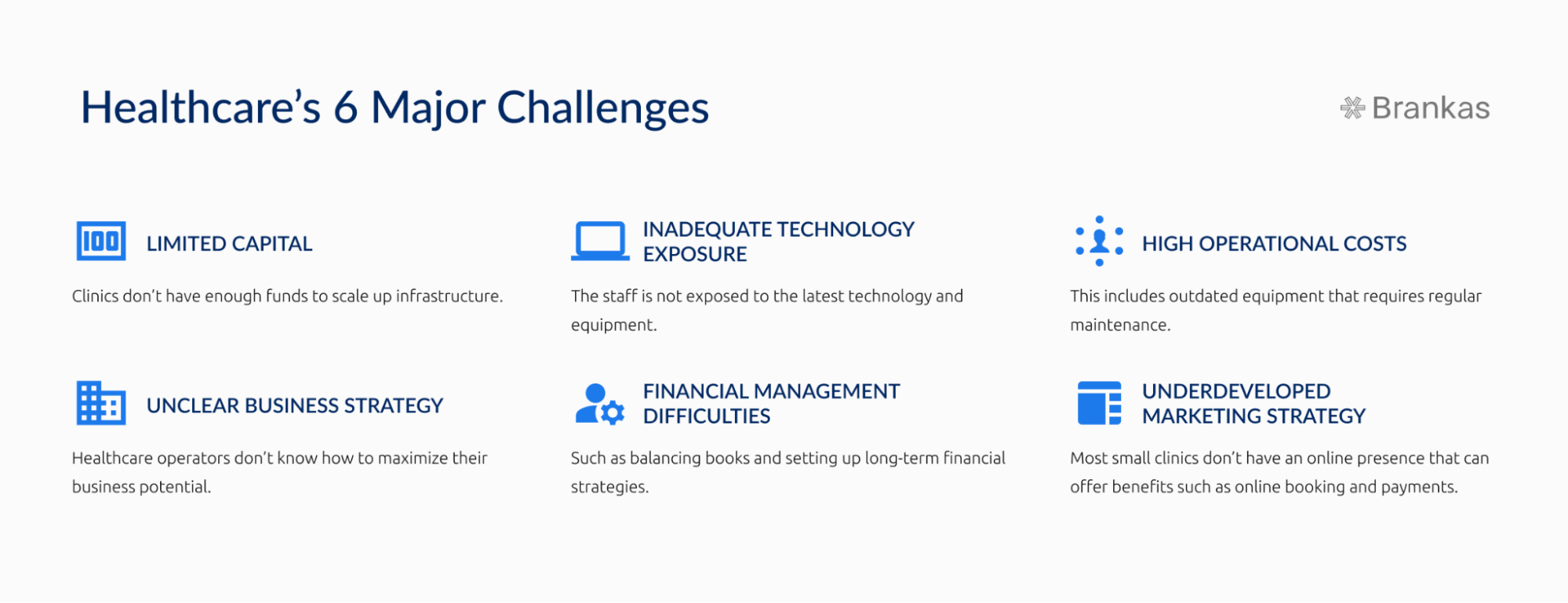

Read how Klinikgo is digitizing health services in Indonesia by partnering with Brankas, a global leader in open finance technology and API solutions.