In this blog post we will see how Jaeger tracing can be easily added to a gRPC application in Go inside a distributed microservices architecture. Read it today.

In finance, certain standard terms are used to describe specific activities. One of these terms is “disbursement,” commonly used in financial institutions such as banks. Still, it is also widely used in business, particularly in accounting. This article will explain what disbursement means and how it can benefit users.

In a business context, disbursement refers to the release of funds by a company for specific purposes sourced from business accounts or other financial accounts owned. Companies use disbursements for various activities, such as distributing payroll funds, paying vendor invoices, settling rental fees, and more.

We can use various digital application products to make the disbursement process easier. Nowadays, there are even Application Programming Interfaces (API) based platforms explicitly designed for the disbursement process, which can be integrated into a company’s system, making it more agile.

During disbursement transactions, various terms are commonly used, including:

To ensure efficient cash flow management, it is essential to understand key terms in the disbursement transaction process, such as Cash Disbursement, Cash Disbursement Journal, and Cash Receipt Journal. These three activities are interconnected and involve recording transaction processes.

Cash Disbursement refers to the process of making cash payments by a company, which is crucial for meeting the company’s needs and avoiding errors in cash flow management. Companies can use a Cash Disbursement Journal, a ledger, or a cashbook, to record each cash disbursement transaction. This journal includes details such as the transaction date, payee name, amount of cash disbursed, and the purpose of the expenditure.

In addition to the Cash Disbursement Journal, companies can use a Cash Receipt Journal, another ledger that records every cash receipt transaction the company receives. By recording every transaction in these journals, companies can effectively monitor incoming and outgoing cash flow, leading to better and more accurate financial decision-making.

In business, effective disbursement management is crucial for optimizing fund usage and ensuring sustainability. As a result, business owners need to give proper attention to disbursement management in their operations, ensuring that each expenditure is accurate and targets the right objectives.

The benefits of good disbursement management are numerous, including preventing errors in spending. An organized and structured disbursement system allows businesses to ensure that each money expenditure is made correctly, in line with business needs, which helps prevent errors that could negatively impact business finances.

In addition, a well-structured disbursement system can also ease expenditure tracking. By recording each business expenditure, business owners can easily track each expense and ensure that it is necessary for business continuity. This helps optimize fund usage by prioritizing necessary expenses, enabling businesses to avoid waste and ensure sustainable operations.

Finally, a well-organized disbursement system can simplify tax management by recording each business expenditure. This makes it easy for businesses to calculate and manage taxes owed. This ease of compliance with tax regulations helps avoid penalties from tax authorities.

The disbursement process can be simple and involve only a few transactions for a small business scale. However, additional tools are necessary for large quantities and nominal transactions that require detailed record-keeping.

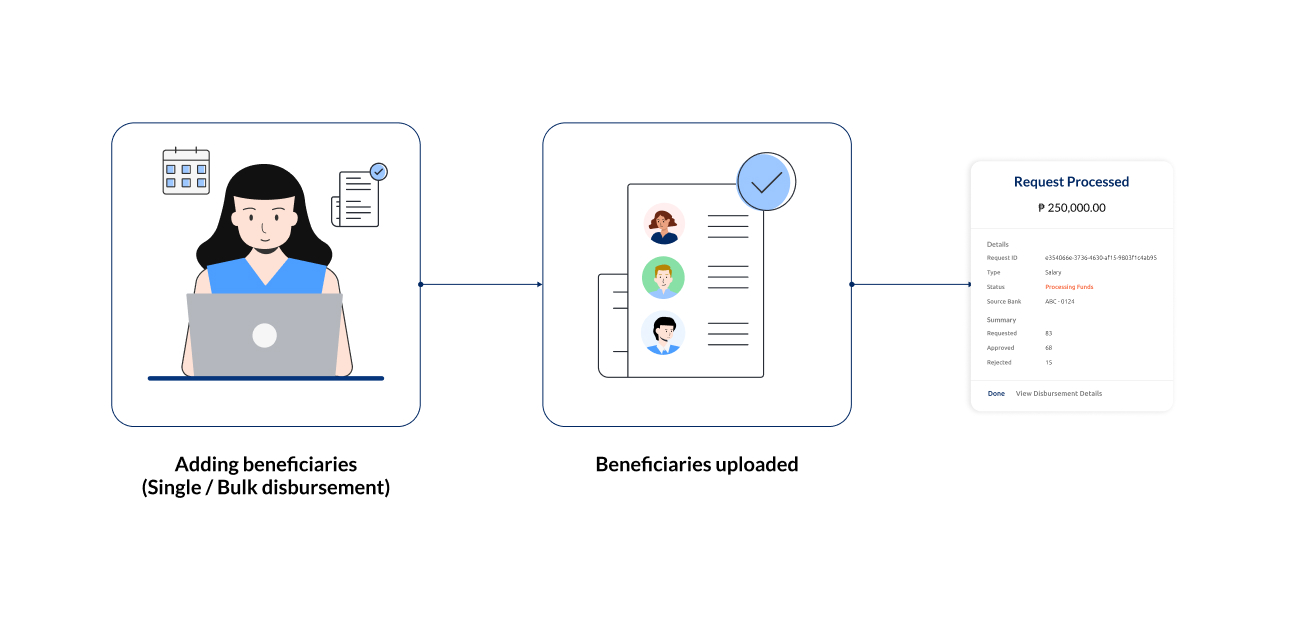

Businesses can use various digital platforms to facilitate the disbursement process. One such platform is the API Disburse mechanism, which simultaneously simplifies sending funds to different banks and multiple accounts.

Brankas is a licensed service provider in Indonesia that offers many benefits. Firstly, it provides a flexible mechanism. With Brankas' disbursement services, businesses can disburse funds to bank accounts through an API connected to the company’s application or an easy-to-use dashboard.

Secondly, Brankas provides a real-time recording and status update system for fund disbursement transactions with guaranteed security for every transaction.

Brankas' Disburse API has affordable fees with free integration fees and a reliable system guarantee. With Brankas' API, businesses can simplify and automate their disbursement process, only needing to analyze transaction summaries. This automation also enables various payments, such as payroll or insurance, to be scheduled for a more streamlined process.

In this blog post we will see how Jaeger tracing can be easily added to a gRPC application in Go inside a distributed microservices architecture. Read it today.

Here are several benefits of banking-as-a-service for enterprise businesses and MSMEs—grow your business by improving customer experience.