E-commerce transactions have shown remarkable growth in recent years worldwide. Apart from brick-and-mortar stores, shopping has advanced into an industry that uses multi-channel strategies, such as online stores, mobile apps, and e-commerce platforms. Asia is leading the way in B2C (business-to-consumer) sales. Statista reports almost 60% of worldwide e-commerce transactions came from Asia. By 2024, it will comprise 61% of global revenue.

The invention of the World Wide Web in 1990 and the development of an encrypted security protocol called SSL (Secure Sockets Layer) in 1994 laid the groundwork for online shopping as we know it today. The first online marketplaces were Amazon and eBay. There were not any reliable online payment systems at the time, but PayPal successfully filled this need in 1998.

Things did not move as quickly in Asia. Although Jack Ma founded Alibaba in 1999, this Chinese multinational primarily serves B2B (business-to-business). As internet connectivity improved and more people understood the power of the internet, online activity increased. Social media sites and instant messaging became very popular. When the COVID-19 pandemic hit and governments encouraged people to stay home, the region saw rapid adoption of e-commerce. Many shopped online for groceries, medicine, and food delivery. China is currently the biggest e-commerce market in the world, nudging the US to second place after reigning for over ten years. Japan is fourth on Max Freedman’s list. South Korea follows closely, while India is ranked eighth in the world.

Why Asia is experiencing an e-commerce boom

Asia’s dynamic growth did not “just happen.” There are cultural and economic bases that support its rising progression.

The middle-class is growing. In a Brookings Institute paper, Homi Kharas stated the Asian middle-class population has overtaken those of Europe and North America since 2015. From 2.02 billion in 2020, there will be 3.49 billion middle-class Asians in 2030, and will account for 57% of consumption in this demographic worldwide.

Asian consumers are quick to embrace new technologies. 50.3% of worldwide internet users come from the region, which means they are more comfortable and open to using new technologies. They quickly adapt to digital marketplaces, purchasing products from social media sites, and using digital payment systems.

Amazon set the bar for delivery logistics, but Asia is getting there. The World Bank’s logistics performance index shows that 17 countries from Asia are among the world’s top performers, with Japan and Singapore within the top 10. The United Arab Emirates, Hong Kong, South Korea, and China are not far behind.

As consumer behavior shifted, businesses innovated their sales and marketing strategies. The rapid growth of e-commerce comes from marketplaces that innovate and find unique ways to be better than their competitors. Video commerce, live video shopping, and social media are some trends that successful retailers are using.

COVID-19 also brought about the quick adoption of digital payments. Governments across the region encouraged consumers to pay digitally to decrease the risk of infection. In Singapore, the use of cash decreased from 74% to 56%, while mobile wallet usage rose from 31% to 41%.

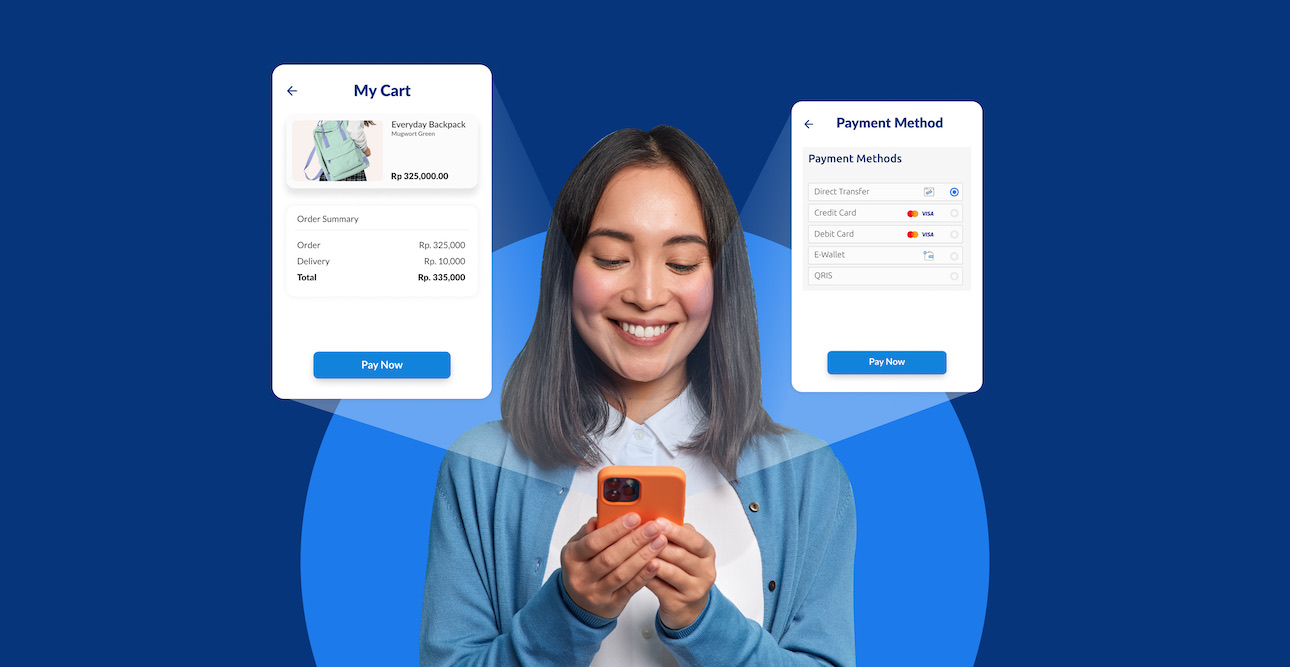

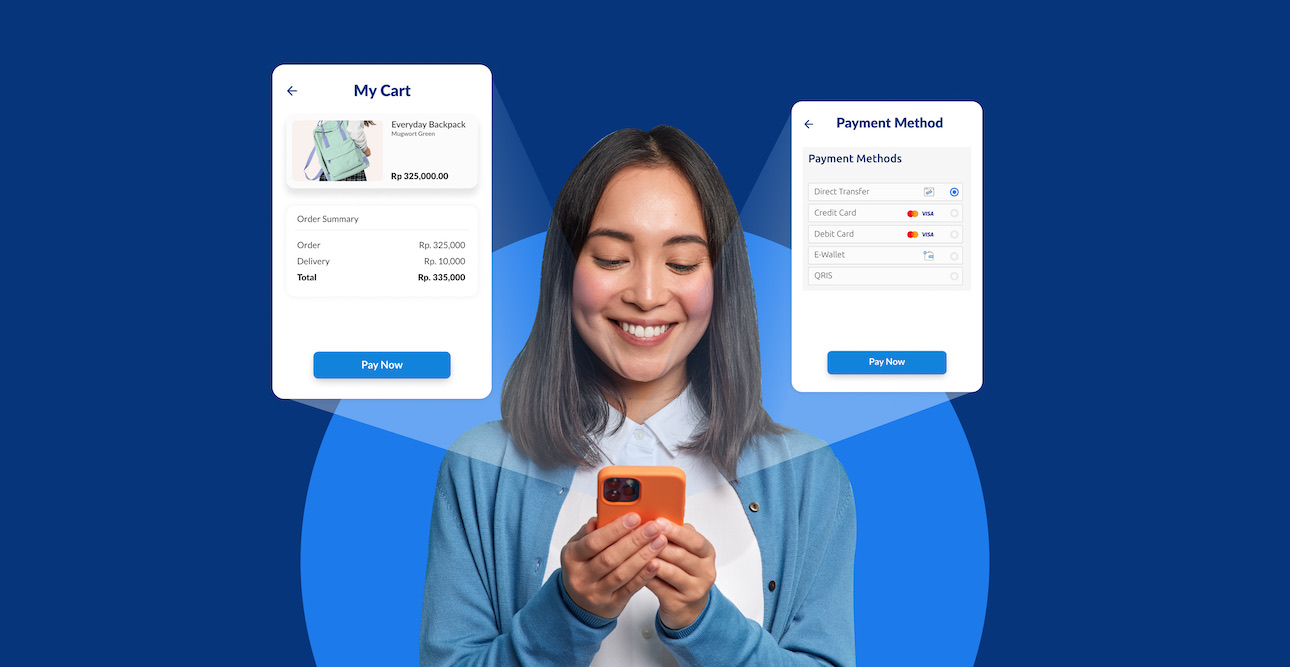

E-commerce is a prime enabler of digital payment methods

Asia’s booming e-commerce is unsurprising, given that the area has the greatest number of internet users and a fast-growing usage of smartphones and other mobile devices. Easy access to mobile devices makes this a primary tool in empowering digital payments, even for the unbanked and cardless population. An iPrice Group study reported a spending increase of 57% for online services, and the use of shopping apps went up to 53% in the Philippines. Digital payments accounted for 30.7% of the e-commerce value, up from 21% in 2017, according to a 2021 GlobalData survey.

As more companies, merchants, and entrepreneurs transform digitally, there is a proportionate demand for quicker, transparent, and flexible payment solutions. “Payments modernization is crucial to your business growth. As technology, competition, regulators, and customers continue to raise the benchmark, your ability to respond at speed and scale becomes critical.” (2022 World Payment Report) Businesses need to strengthen their competitive position throughout customer segments while boosting revenue by offering the latest payment solutions.

E-payments will boost the expansion of the e-commerce landscape

“Digital payments are no longer a nice-to-have but a must-have, and a key part of every company’s business strategy. The ability of businesses to optimize their payment capabilities and operations according to geographical reach will also determine how they stay competitive, agile, and successful across the region.”

-Aung Kyaw Moe, founder, and CEO of 2C2P

Customers prefer dealing with companies that offer a wide range of payment methods, especially digital options. Merchants who cannot identify the intended market’s preferred mode of payment will miss the opportunity to gain a wider customer base. For instance, consumers in Indonesia, Thailand, and Vietnam favor mobile wallets. Including an e-wallet payment option will serve businesses in these countries well.

E-payments have changed the way people purchase goods and services and are a crucial component of any e-commerce venture. Besides existing digital payment systems, businesses will have a better advantage over competitors by implementing these next-generation payment technologies.

Regulations may affect BNPL progress

BNPL (Buy Now Pay Later) is a short-term financing method that enables consumers to buy now and pay for them later in installments. A newcomer to the Asian market, it has strong potential to grow. The Asia Pacific Buy Now Pay Later (BNPL) Markets Report in 2022 expects the BNPL Merchandise Value to rise from $139 billion in 2021 to $782.9 billion by 2028. BNPL enables customers to buy products they may not afford upfront and offers flexible terms. For business owners, BNPL helps increase revenue by offering their customers an easy payment scheme with no need for credit cards.

One reason BNPL is taking off in Asia is that regulations are infrequent on the product. Guidelines in Singapore serve as suggestions rather than rules. Malaysia, however, is setting policies in place and may signal other countries to do the same. Expect to see industry guidelines on credit assessment, payment authentication, and marketing practices.

Almost everyone is aware of contactless payments via scanning an establishment’s QR code and using an e-wallet or bank app on mobile devices to pay for purchases. There are up-and-coming innovations that will redefine friction-free payments. One is “tap-to-pay.” Consumers with credit/debit cards simply tap their cards on a terminal that uses RFID (radio frequency identification) or NFC (near-field communication) instead of handing their cards to a cashier. RFID and NFC technologies have inspired new ways to pay. Visa will launch a “tap-to-phone” function for Android smartphones, enabling merchants to make their phones into contactless POS terminals. At the cusp of AI (artificial intelligence) and IoT (Internet of Things), some tech companies are developing apps for smartwatches and key fobs to “tap-to-pay,” as well. Another Visa project in collaboration with Honda is integrating voice assistants in their vehicles for in-car payments.

The major challenges in using QR codes, RFID, or NFC is ensuring that apps and payment channels connect seamlessly and there are robust security solutions in place. Intuitive POS terminals, merchant training, and end-user education are also additional things to consider as businesses plan to implement payment systems that use these technologies.

CBDC may give credibility to crypto

Cryptocurrency is a digital currency with no central issuing or regulating authority. Governments distrust crypto because they cannot regulate it and it enables users to sidestep capital controls. People bought crypto to use as digital payment and as an investment tool. Crypto might grow to be a staple rather than a trend, and countries are slowly accepting it to take advantage of its benefits — accessibility, transparency, secure and efficient cross-border payment system, reduced transaction costs, and faster transaction speed. CBDCs (Central Bank Digital Currencies) are cryptocurrencies backed by governments or central banks. As of June 2020, Asia comprised 43% of worldwide crypto transactions, according to Cointelegraph. Unsurprisingly, many countries in the region are developing CBDCs. China launched its CBDC in 2019. India and Thailand are in the late stages of their CBDC development, while Korea, Malaysia, and Singapore have proof-of-concept. Twelve other Asian countries are in research and development (R&D). Authorities are skeptical about crypto, but CBDCs may just give cryptocurrency the legitimacy it sorely needs. Integrating crypto with e-wallets, payment apps, and in-app platforms will increase financial inclusion and contribute further to the development of e-commerce.

Asian central banks, though, need to address the risk of centralization, cybersecurity, and the stability of virtual and physical currency as they develop CBDCs.

Open banking as a solution to financial inclusion

Open banking uses APIs (Application Programming Interfaces) to connect customer data between banks and third parties. Just like on an e-commerce platform, open banking connects financial institutions, FinTech companies, and non-financial enterprises. Any bank or company can use APIs to embed its products into the non-financial entity’s sales platform.

Seven out of ten adults in Asia are under-banked or unbanked, according to a Bain research. There are also many SMEs (Small and Mid-sized Enterprises) that have funding difficulties. Open banking makes these traditional financial services accessible by implementing open-source digital solutions, such as hybrid cloud secure architectures, systems, and software.

As with everything digital, data security and the cultivation of trust may slow the widespread adoption of open banking. Some legacy banks will have difficulties in catching up with FinTech companies and the digitalization taking place, preventing their clients from benefiting from open banking.

What lies ahead for e-commerce as it converges with payment technologies

Statista’s forecast that Asia will account for 61.4% of global e-commerce revenue by 2024 will hinge on the pivotal role that e-payments will play. Merchants will need to plan their modes of payments strategically and prioritize the methods that will have the most relevance and acceptance in their markets. As e-commerce expands, so should the type of payment interfaces.

Enterprises that do not offer digital or e-payment methods must seriously consider adopting them. They enable seamless transactions, especially on online sites where it will be extremely difficult to use cash. Cash used to be king, but e-payment is more efficient and convenient, especially when shopping online. A positive user experience has a tremendous impact on customer loyalty and must be one of the top priorities of companies.

Payment security

While retailers need to adapt quickly to fresh forms of digital payments, maintaining security is paramount to protect not only the financial components, but private data and information as well. Digital payments must be regulated, requiring basic levels of authentication (eg. Multi-Factor Authentication) from payers, and basic security standards for vendors and payment processors (eg. PCI DSS, SSL certificates).

Analyze the risks and benefits of a game-changing digital payment method and analyze its benefits and risks before implementation. It is crucial to understand the implications of the changes or additions. Businesses need to know if this is relevant to their target audience, if it complies with regulations and industry standards, and if it is secure. Without understanding the full implications of the changes, companies may not make the necessary adjustments to take full advantage of the new system.

Digital payment providers also have an opportunity to educate consumers and merchants by communicating the benefits and financial leverage they gain by availing their services. A PayPal study revealed that a significant number of Asian consumers are aware of digital payments, but the adoption rates are much lower than awareness rates.

The Asian e-commerce market is undoubtedly a massive growth opportunity for companies that will adapt and innovate. Its impressive growth in digitalization, ownership of mobile devices, and internet usage are crucial accelerators to make financial services more accessible to everyone, enabling them to leverage digital products. Customer behavior and preferences change quickly. E-commerce platforms and businesses must adapt just as fast and take advantage of current and emerging e-payment systems. It will not only be beneficial to consumers and businesses. It will also impact their countries’ economies. Digital solutions in a digital world will pave the road to success.