Open banking standards refer to a framework that encourages secure data sharing and collaboration among financial institutions, FinTech innovators, and other third-party providers.

Open Banking has emerged as a transformative force for innovation, competition and inclusion in financial services. By enabling banks to share customer data with trusted third parties through open APIs, this system empowers individuals and businesses to access more personalized financial services. Open Banking also provides the core infrastructure for embedded finance and banking-as-a-service products like embedded lending, card issuing, and account opening.

Over the last few years, countries in the GCC (Gulf Cooperation Council), including Kuwait, have been developing their own open banking frameworks to promote innovation, expand access to financial services, and strengthen competition.

In early June, Central Bank of Kuwait (CBK) released a draft of its Open Banking Regulatory Framework. The announcement underscores the country’s commitment to develop the sector and enhance its services to help promote the national economy and support digitization, aligned with Kuwait 2030 vision.

CBK has implemented several key initiatives, policies, and regulations with the purpose of fostering growth of fintech in Kuwait. In this blog, we will dive deep into Kuwait’s Open Banking Journey and what’s inside their Open Banking Regulatory Framework.

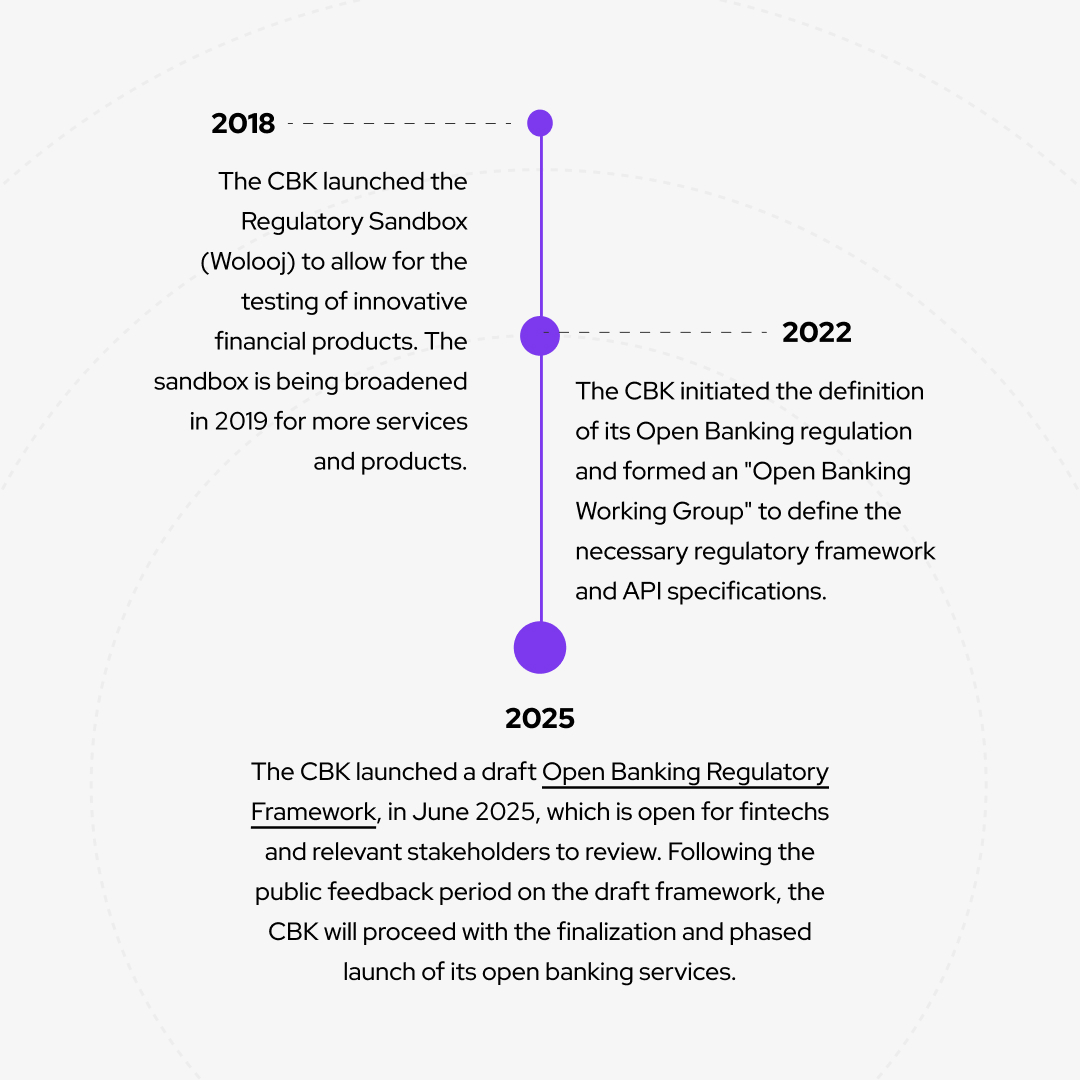

Kuwait’s progress toward open banking did not emerge overnight. CBK has been laying the groundwork over several years:

Kuwait’s approach is measured and forward-looking. CBK has structured its Open Banking Regulatory Framework around four core principles: utility, security, transparency, and adoption. They are designed to ensure the initiative delivers real value while maintaining strong safeguards.

Beyond these pillars, the framework is supported by a series of supporting documents, which outline technical specifications, operational, and regulatory instructions. These materials define API specifications, compliance obligations, security standards, and governance requirements, to give banks and fintechs a consistent and standardized foundation on delivering secure and consent-driven open banking solutions.

Together, these elements reflect Kuwait’s larger ambition: building a competitive, digitally enabled financial ecosystem aligned with its national transformation goals.

Kuwait’s fintech landscape is expanding rapidly. The fintech sector is valued at approximately USD 3.6 billion in 2025 and is projected to reach USD 9.8 billion by 2033, driven by demand for digital banking, faster payments, and personalized financial services (Datacube Research, 2024). In 2024, Ken Research also reported that the Kuwait Digital Banking Market is valued at USD 1.5 billion, driven by increasing adoption of digital banking solutions, enhanced internet penetration, and a growing interest for online financial services among consumers. This growth presents opportunities for banks to collaborate with fintech firms, enhancing service offerings and improving operational efficiency.

Kuwait’s move toward open banking marks a significant stride in its digital financial evolution. With a growing fintech ecosystem, a supportive regulatory direction, and increasing consumer demand for digital services, the country is set to unlock new waves of innovation.

For banks and fintechs, now is the ideal moment to prepare for the future of financial connectivity in Kuwait. As the nation moves closer to an open banking era, Brankas is ready to support the market’s next phase of growth. Backed by our deep experience in regulated Open Finance ecosystems across APAC and MENA, we provide modular, plug-and-play infrastructure that helps banks and fintechs go live faster and help you become compliant with Kuwait’s Open Banking regulation.

Founded in 2016, headquartered in Singapore, Brankas is a leading Open Finance technology provider that empowers banks, financial institutions, and online businesses with API-driven solutions for payments, data, and financial services. Brankas helps banks and financial institutions launch and monetize Open API banking platforms while enabling businesses to connect seamlessly with banks through secure API aggregation.

Brankas partners with regulatory bodies, financial institutions, and global networks to drive Open Finance adoption while ensuring compliance with local regulations. Brankas enterprise solutions help API providers scale, while our embedded financial services enable businesses to create seamless and secure digital experiences for their users.

Brankas has successfully integrated with more than 80 financial institutions across 8 countries, processing more than 10 million API calls per month and achieving 80% market coverage in key regions. Brankas' mission is to provide modern, open and secure technology to empower partners to create world-class financial solutions.

Open banking standards refer to a framework that encourages secure data sharing and collaboration among financial institutions, FinTech innovators, and other third-party providers.

Brankas is the first company to secure the PJP Category 2 License for Account Information (AInS) from Bank Indonesia, marking an open banking data milestone for Indonesia and giving businesses added visibility on payment transactions.