According to the World Bank’s 2021 Global Findex Database, 1.4 billion adults globally do not have access to formal financial services (unbanked). The main reasons are lack of money, the distance to the nearest financial institution, and insufficient documentation. These challenges are precisely what open banking is trying to address. Financial inclusion is a crucial pillar in the open banking industry, and it is an ongoing global initiative that can reduce poverty and give equal opportunities to everyone. This principle is one of the key components of the United Nation’s Sustainable Development Goals (SDGs) and the World Bank’s Universal Financial Access 2020 Initiative.

How does open banking or decentralized finance enable financial inclusion?

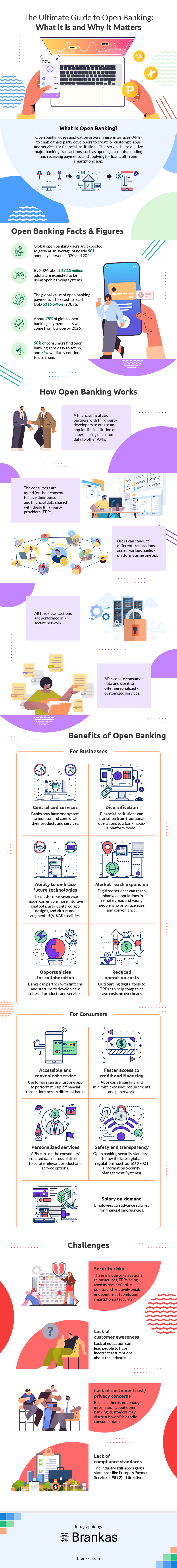

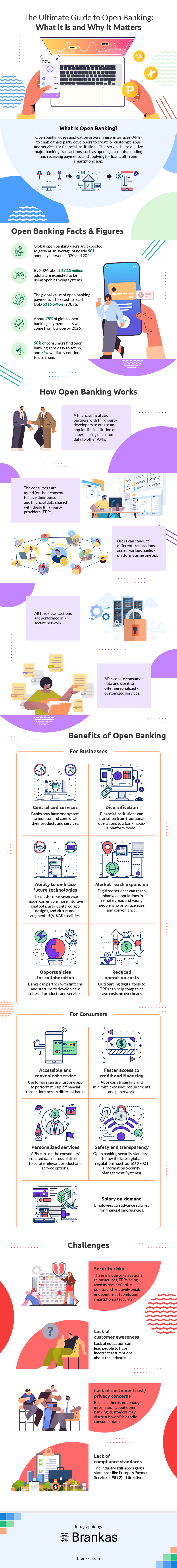

It is by democratizing access to financial services through application programming interfaces (APIs). Through smartphone applications and partnerships with major financial institutions, open banking providers are bringing the bank to the people. The industry is revolutionizing access to global banking services. According to research firm Statista, the number of global open banking users is forecast to grow at an annual rate of about 50 percent between 2020 and 2024, reaching 132 million by 2024. In addition, the value of global open banking payments is expected to hit USD $116 billion in 2026.

What is Open Banking? And How Does It Work?

Open banking uses APIs to enable third-party developers to create or customize applications and services (e.g., payment gateways and e-wallets) for financial institutions. In the traditional banking model, individual banks own their customers’ data because transactions can only be made through specific apps and branches. With decentralized finance, transactions like opening accounts, sending and receiving payments, and applying for loans, are democratized and centralized in smartphone apps, allowing non-banks to compete. The potential of open banking is massive, considering that there are currently 6.6 billion smartphone users globally, according to Statista. That number is expected to grow to nearly 7.7 billion by 2027.

In an open banking system, a financial institution allows access to customer data and financial information to third-party providers (TPPs), which consumers must consent to before using the apps. The APIs aggregate customer data across different platforms/transactions to suggest personalized products and services that suit the users’ needs. All these transactions and data analytics are done within secure networks using various encryption security protocols like SSL (secure sockets layer).

Benefits of Open Banking

For businesses:

The main advantage of open banking for financial institutions is that they can use one system to monitor and control all their existing products and services. In addition, by centralizing data and services, institutions can have a holistic view of their customers’ needs, behavior, and preferences. Another benefit of open banking is that it allows banks to diversify their services, transitioning from traditional operations to the more flexible banking-as-a-platform model. The platform-based model also allows banks to embrace future technologies, including more intuitive chatbots, user-centered app designs, and virtual and augmented (VR/AR) realities.

With financial institutions shifting to better ways to reach their customers, they can expand their market reach, particularly to young people who prioritize convenience and accessibility. Using open banking, financial institutions can also encourage more people to avail of services by eliminating paperwork and providing a more streamlined online experience. In addition, the more banks collaborate and partner with fintechs and startups, the more they can create new services or enhanced offerings. As financial institutions understand their strengths and weaknesses, they can outsource some of their services to other providers, reducing long-term operation costs.

For customers:

What draws customers to open banking is how it makes everything accessible and convenient. Users no longer have to go to the nearest physical bank that might be too far from their locations. Instead, they can conduct multiple financial transactions through just one app or digital ecosystem. The next advantage for clients is that requirements to access products and services have been streamlined or minimized. This feature doesn’t mean that transactions have become unsafe or random; it means that excessive paperwork has been eliminated, and users can monitor or track their transactions in real-time. As a result, clients have faster access to credit and financing.

Another strength of open banking is the ability to use the consumers’ collated data across platforms to curate relevant product and service options. Data analytics can detect how customers utilize the apps and suggest further improvements in the user interface and experience (UI and UX). In addition, the decentralized finance industry has been proven to be as safe as traditional financial institutions in handling consumer data. Open banking security standards follow the latest global regulations, such as ISO 27001 (Information Security Management Systems) and PCI DSS (Payment Card Industry Data Security Standard).

Finally, open banking has enabled on-demand payroll, where employees can get paid whenever they want without waiting for paydays. For example, in many countries (like the UK, US, and Spain), the Flexible Earned Wage Access (FEWA) on-demand pay solution allows employers to coordinate with banks to release checks for employees with financial needs. Workers who have financial emergencies can now request advances on their salary.

Challenges in open banking

Cybersecurity

Perhaps the main concern people have over open banking is the security risks. Because APIs force banks to re-organize themselves, the organizational structures may also change, including who has the final say on cybersecurity measures. This confusion can lead to conflicting internal interests, which might open IT infrastructures to weaknesses. Another security concern is that hackers and cybercriminals may use TPPs as their entry points into financial databases. These API developers tend to be relatively new fintechs and startups, so they might not be as prepared for cyberattacks as established companies. Finally, security for endpoint devices such as tablets and smartphones is still relatively weak and will take time to mature.

Lack of customer awareness

Another challenge facing the industry is the lack of customer awareness. Most people are still used to traditional institutions when it comes to financial transactions and may be wary of new technologies that seem “too good to be true.” In particular, the older generation is not used to conducting all transactions online and may distrust apps in general. For example, consultancy firm Accenture’s research showed that most consumers in the UK are unwilling to share their personal information with TPPs. Because there’s a lack of education about open banking, consumers may not form a solid foundation on what the industry is about and think of it as another “unsafe” technology that will take advantage of consumer data.

Lack of compliance standards

Finally, there is still a lack of global compliance standards to govern the industry. So far, Europe has the most fleshed out policy like the Payment Services (PSD 2) - Directive and the UK government’s Open Banking Initiative. In emerging economies where decentralized finance is just being established, it might be difficult to gather stakeholders together and agree on open banking policies for the region. Global standards are necessary because they dictate how applications should be built, including mandatory cybersecurity measures.

Conclusion

Even with these challenges, open banking still has a great potential to promote and advance financial inclusion, particularly in developing nations. According to a 2020 report by consultancy firm McKinsey, Asia has been a breeding ground of digital banking innovations for the past five years. Examples are China’s WeBank, South Korea’s Kakao Bank, and Japanese e-commerce platform Rakuten. These technologies have made financial transactions accessible for millions of people in the region, and these innovations will only continue to accelerate.

How can Brankas assist you in your journey?

Brankas has the expertise, technology, and teams to customize solutions to your business needs. Our Open Finance Suite can build the right infrastructure to integrate into your existing systems, enable third parties to deploy new products through APIs, and quickly deploy these systems using the cloud. We also have solutions for payments, account management, and disbursements.

If you want to know more about our open banking solutions, reach out to us!