Brankas today released a new report analyzing the state of open banking readiness in Southeast Asia, focusing on Thailand, the Philippines, and Indonesia.

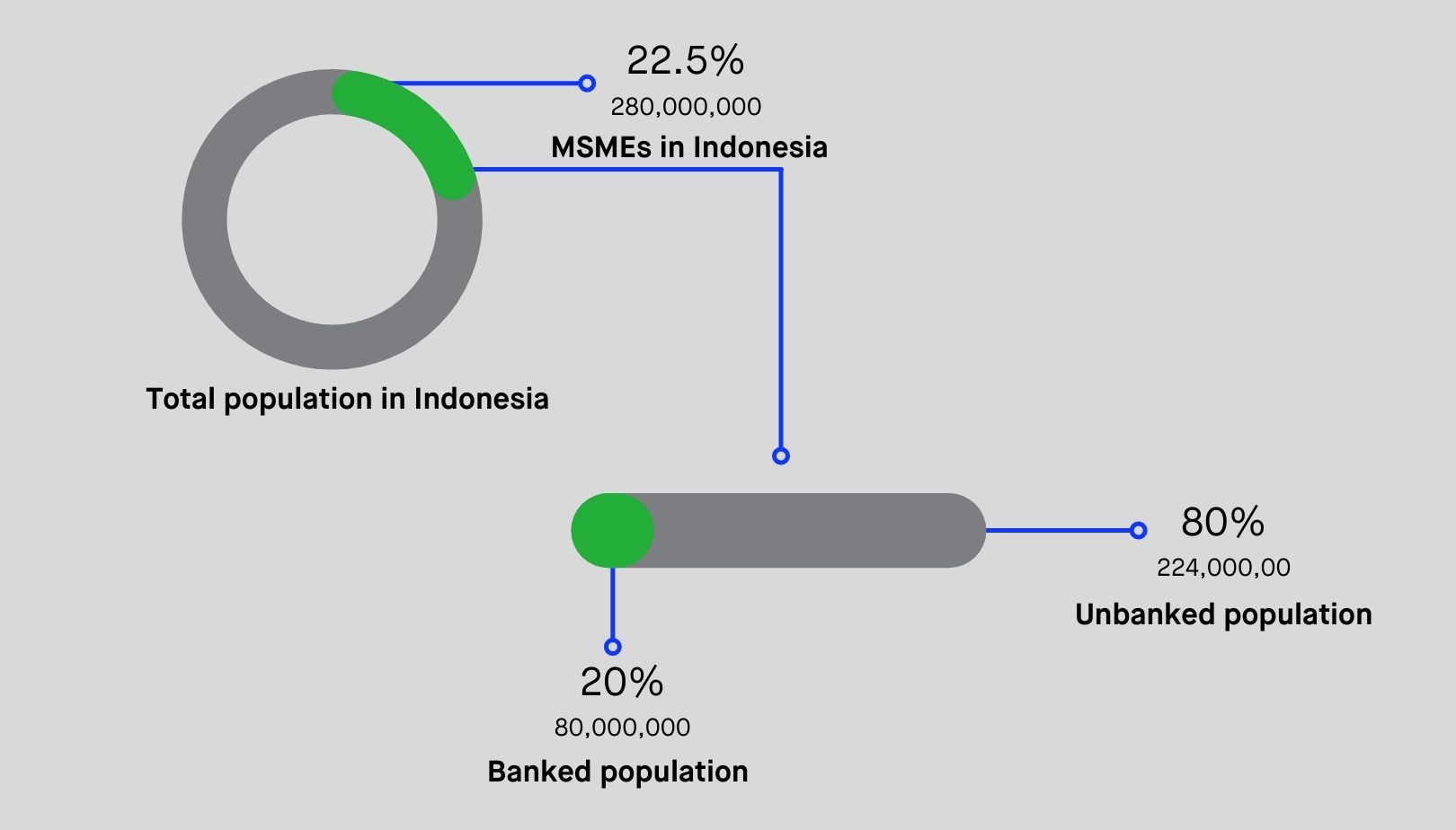

According to a recent report by the Asian Development Bank on Financial Inclusion, close to 80%, or 200 million of citizens are considered ‘unbanked’: inidviduals who do not have access to banking or financial services such as loans and savings accounts. Typically, these are citizens who have lower levels of education (i.e. illiterate or primary school graduates) or live and/or work in regions or sectors with limited access to such services.

Out of the 63 million MSMEs, only 20% are considered to have access to banking and other financial services, while the remaining do not and/or are not financially literate.

It is a well known fact that, for all the growth of Indonesia’s tech sector (Indonesia has the region’s highest number of tech unicorns), the country is still mostly an offline and cash-powered society, its population spread across almost 15 thousand islands. Banks and financial institutions face an almost insurmountable challenge to cover the regions that are populated, particularly those in the most remote areas where even mobile reception is almost non-existent.

So how does an Open Banking ecosystem help to spread financial inclusion and literacy across such a challenging realm? One word: Collaboration.

Imagine a scenario where anyone can walk up to any road-side stall (warung as they are locally termed) and open a bank account at any bank, make a financial transaction, or apply for a productive or microloan from a peer-to-peer lending platform.

The warung owner would be able to offer these financial services as if they were a bank branch or agent through a mobile app, and get financially rewarded by the providers of the services, and thus incentivized to, quite literally, spread financial inclusivity to their fellow citizens.

This will all be made possible with an Open API ecosystem and Brankas is working towards this vision by aggregating the financial service providers’ products and services, thereby making it possible to distribute them to Resellers via API, which in our above example, includes our warung owners.

Resellers can include networks or associations of these offline warungs or retail outlets, and also online platforms such as directories, blogs and marketplaces. Think of something like Amazon’s affiliate network… but for banking and financial services - these Resellers are empowered and incentivized to sell financial products through their own marketing channels, whether they’re online or offline.

Lookout for our next blog posts as we dive deeper and learn the tools required to turn warungs into bank agents.

Brankas today released a new report analyzing the state of open banking readiness in Southeast Asia, focusing on Thailand, the Philippines, and Indonesia.

GCash revolutionized the financial industry in 2012 with its groundbreaking mobile app, simplifying complex transactions into effortless taps on a smartphone screen. With 5 million merchant partners spanning various industries, you can learn more in this article about how to become a GCash merchant and integrate GCash as a payment method for your business.