Expand access to underserved customers

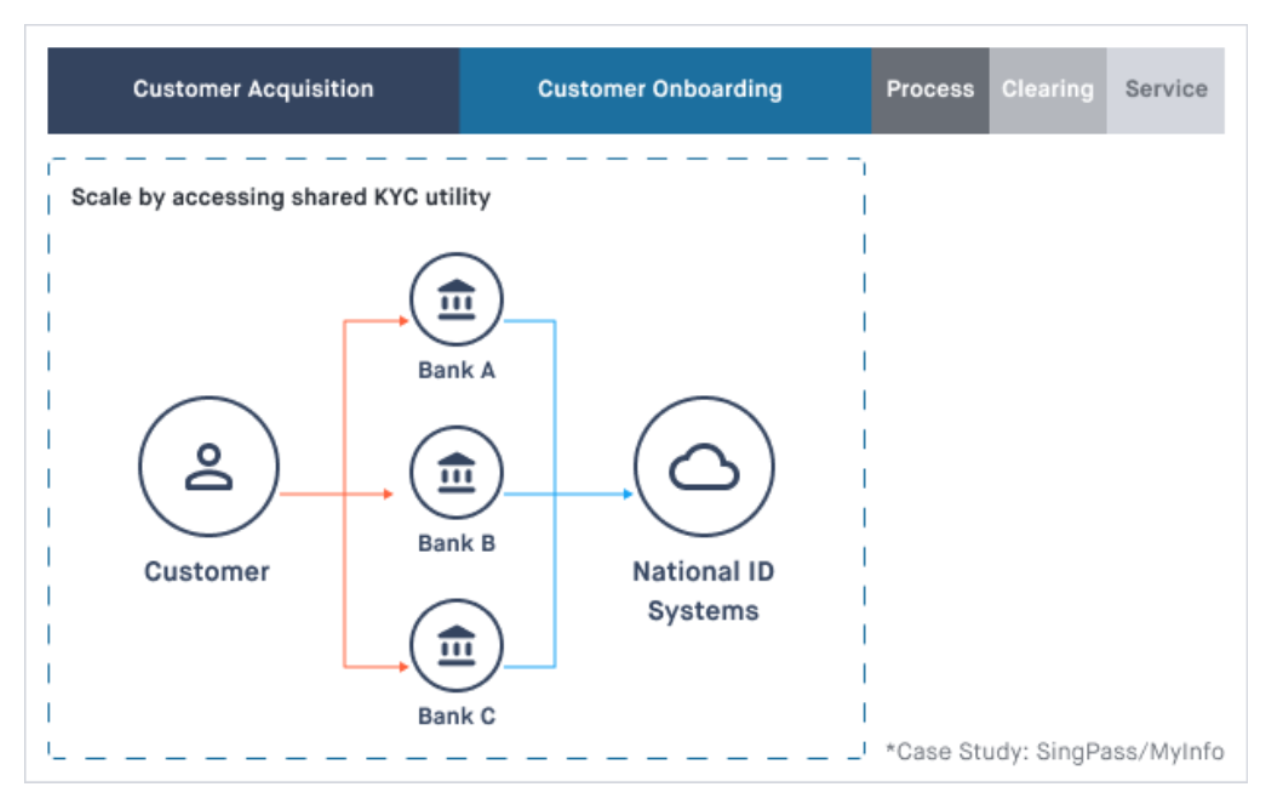

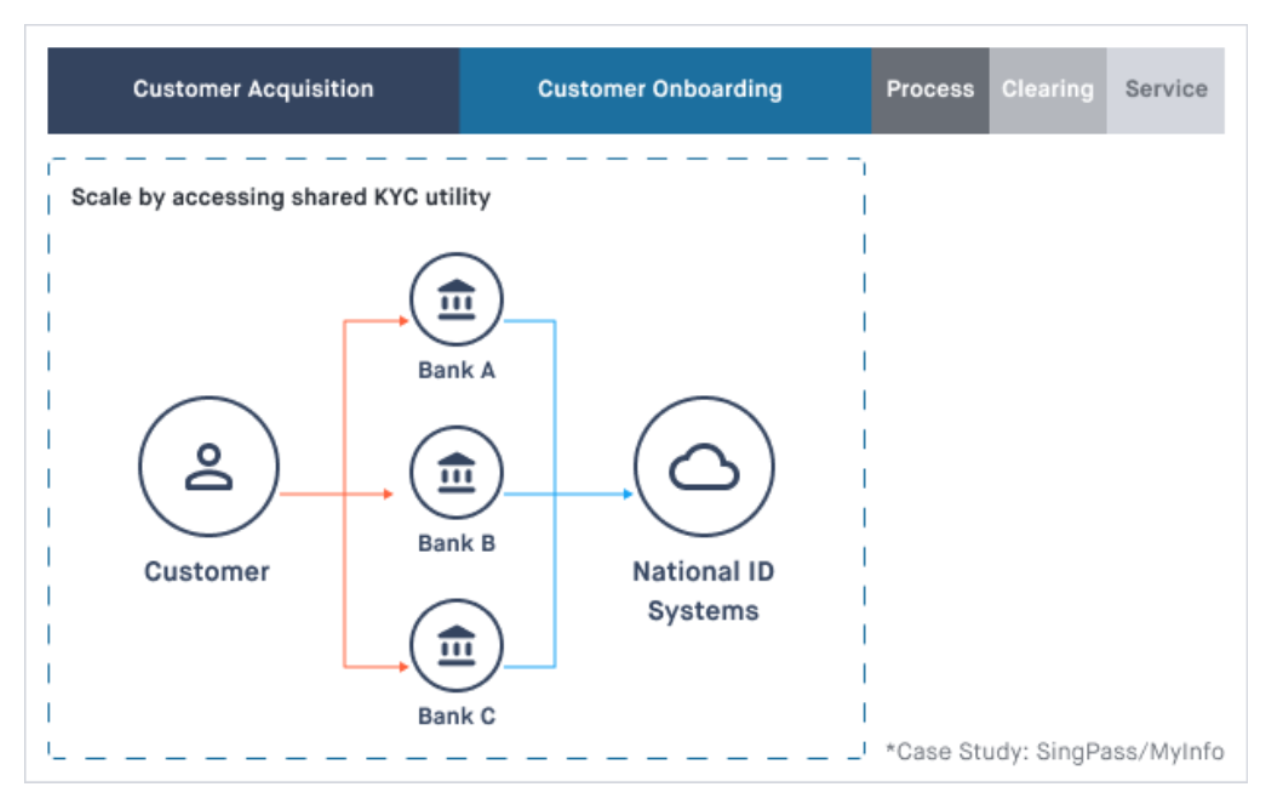

Open finance enables banks to expand access to underserved customers by lowering the cost of customer acquisition and onboarding. However, it is often costly to service customers in developing economies due to limited data for verification, high operational costs due to manual processes, and prohibitive cost barriers in rural areas with weak infrastructure.

In Indonesia for example, the cost of onboarding by traditional agent-assisted model can be as high as USD 14.80, almost 15x higher than a digitally assisted third party model. The high cost of onboarding can be attributed to the high cost of agent acquisition, particularly in rural areas with limited physical branches. The cost also factors in the investment in agent training and managing tedious paperwork. By contrast, digital enabled onboarding in partnership with third party vendors can significantly reduce the time and cost required to conduct KYC for prospective customers. In addition, applying a tiered risk-based approach to KYC where low-risk customers (i.e. customers with low value accounts) have reduced KYC stringency can help banks manage customer onboarding in a more cost-effective and streamlined manner.

Provide new product offerings

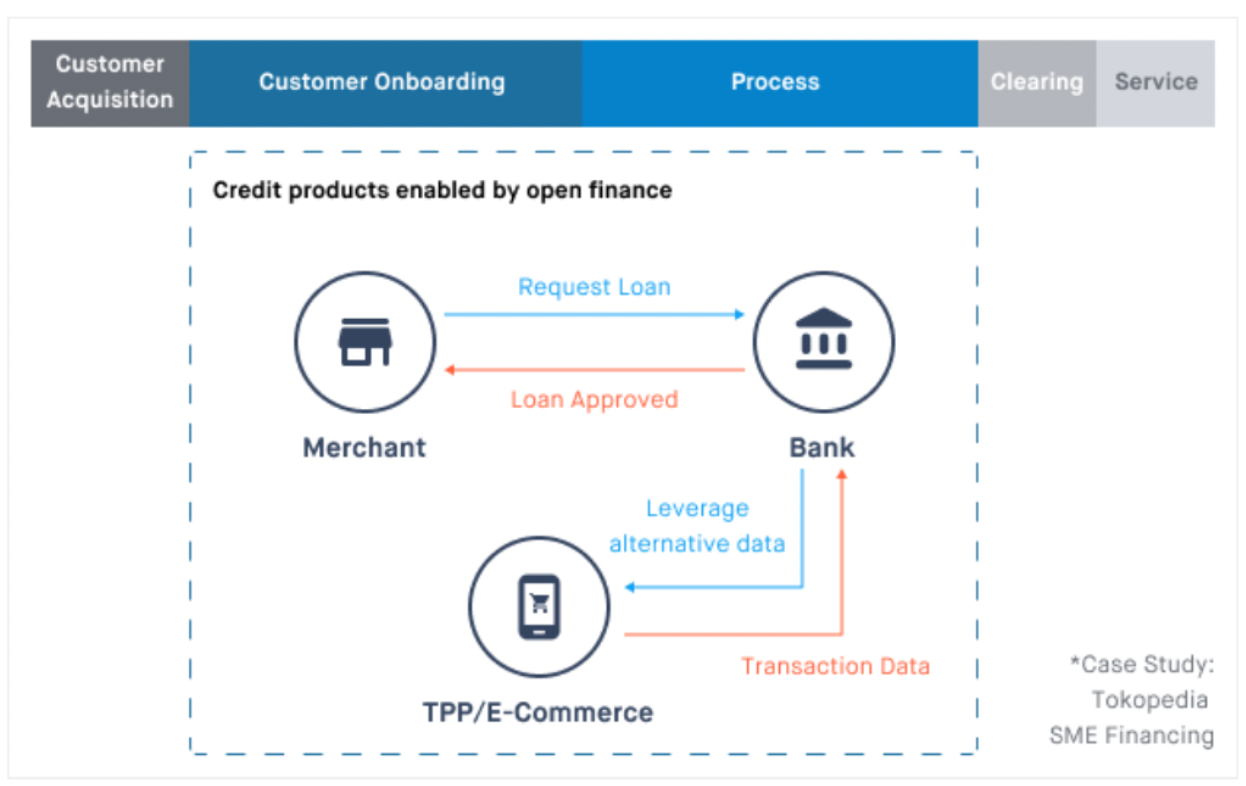

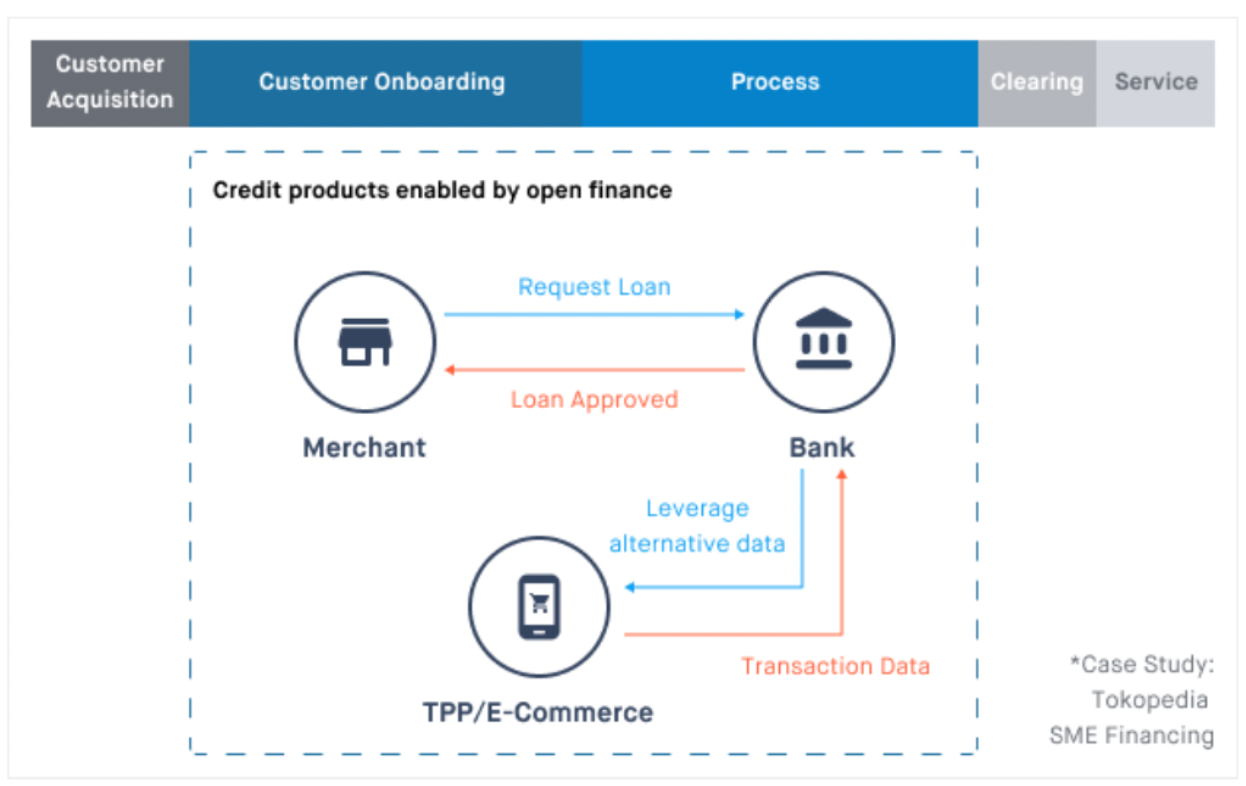

Open finance enables banks to leverage Banking-as-a-service (BaaS) to offer a wider range of digital financial products and services to meet the evolving needs of customers across different segments. Adopting BaaS allows banks to unbundle their banking stack while partnering with different third-parties to build new financial service solutions. Banks do not need to think of themselves as closed-loop, vertically integrated pipelines that oer traditional banking products directly to customers, but instead can leverage new partnerships and the broader ecosystem to open up banking products to partners who can then take these products to the customers.

In doing so, banks can unlock new revenue streams. Instead of depending on core banking services where the margins on interest fees are being eroded due to competition and innovation, banks can explore new models of revenue generation such as renting their license, or fee-sharing arrangements such as charging a percentage of transactional value, and API monetization where they can charge a fee for API usage.

Deliver quality customer experience

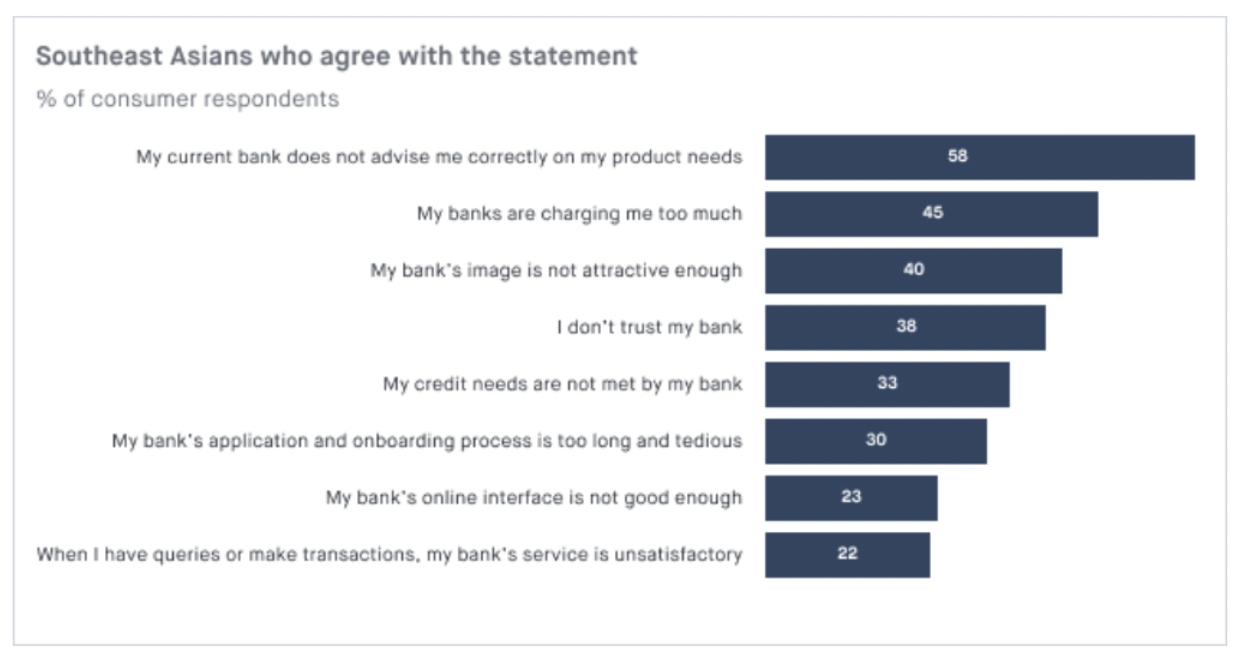

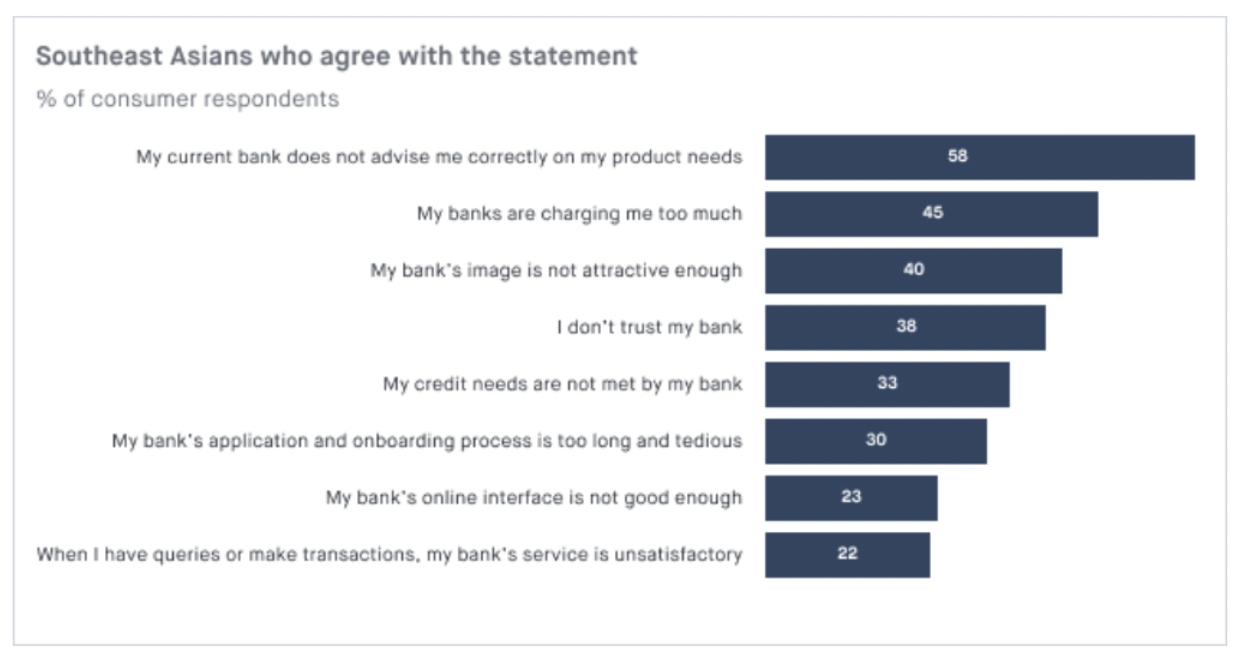

With the ubiquity of digital customer centric experiences across multiple industries outside of the financial services (the likes of Grab, Shopee, Facebook), customers are looking for financial institutions to offer a relational and personalized banking experience. According to BCG 2019 Center for Customer Insight Survey, lack of personalized advice, unattractive image and poor online interface are among the top reasons why consumers in Southeast Asia are not satisfied with their current banks.

Delivering quality customer experience will go a long way to position banks as trusted financial advisors through data-driven customer engagement. In 2019, Singaporean based UOB bank launched a digital banking subsidiary TMRW, a mobile only bank designed with a core focus on customer centricity for the Southeast Asian millennial market. UOB partnered with Meniga by using APIs to deliver personal finance capabilities such as having the TMRW app analyze and predict cash flow in accounts and patterns of upcoming payments. Other in-app features also include spend tracking which allows simple budgeting and spend notification, and smart saving functionality that offers personalized saving advice and gamification.

If you’re interested to know more about open finance in Southeast Asia, download the white paper today!

Join us on 19th Aug, 12pm GMT+8 as we discuss the the recently joint published white paper titled Embracing Open Finance in Southeast Asia. We will cover:

- The commercial opportunities for banks in open finance; new growth and distribution opportunities and new ways to create value

- Explore how banks and other financial service providers can overcome challenges to open finance adoption

- Practical next steps in embracing opening finance