Staying competitive in business requires understanding the challenges and embracing innovative solutions. We have seen how customer retention is the cornerstone of a successful enterprise in this article on the challenges of customer retention. This article will explore the game-changer that is embedded finance and how it addresses the customer retention challenges mentioned.

Embedded finance is not merely a trend; it is a seismic shift in the business landscape. It is about convenience, personalization, and, most importantly, keeping customers engaged and loyal. Financial transactions are no longer bound by traditional banking, and embedded finance opens new horizons. Join us in unraveling the transformative power of Embedded Finance.

Defining Embedded Finance

McKinsey & Company defines embedded finance as “the placing of a financial product in a nonfinancial customer experience, journey, or platform.” The idea is nothing new; banks have found ways to reach customers. Older forms of embedded finance include traveler’s checks, ATM networks, and financing options from car dealerships. These days, next-gen embedded finance gains remarkable strength from the seamless integration of financial products into the digital interfaces people engage with everyday. Almost everyone has used ride-hailing apps, digital wallets, food delivery apps, and e-commerce platforms where in-app payment solutions are provided.

Consumers and businesses have growing expectations for financial products and services to merge with their daily routines seamlessly. Consider scenarios like paying for parking as you enter a garage or securing real-time financing when making a purchase. These integrated experiences transcend the realm of mere “digital financial services” and propel us toward the next evolutionary phase in finance. Financial services are becoming an integral part of broader value chain experiences, marking a significant shift into the age of experiential finance.

How Embedded Finance Fits into Customer Retention

The transformative potential of embedded finance enhances customer engagement and loyalty. It is reshaping customer interactions by integrating financial solutions into everyday activities, ultimately boosting customer stickiness and satisfaction. This approach not only simplifies financial transactions but also deepens customer relationships.

Key benefits of embedded finance include offering tailored financial solutions, such as installment plans and buy-now-pay-later options, directly at the point of sale. This customization enhances the customer experience and fosters loyalty. Additionally, embedded finance enables real-time access to financial services, making transactions smoother and more efficient. It also supports cross-border payments, simplifying international transactions. Embedded finance is not limited to traditional banking but extends to industries like e-commerce, travel, and healthcare, expanding the scope of financial services.

Addressing Customer Retention Challenges

1. Embedded finance reduces churn rate

Embedded finance solutions empower businesses to create a seamless payment experience for customers and enhance the attractiveness of subscription and membership services. By reducing payment friction and offering value-added perks, embedded finance contributes significantly to reducing churn rates and fostering long-term customer relationships.

a. Seamless payment integration

Embedded finance integrates payment processing directly into the customer’s journey. Whether it is making a purchase online, renewing a subscription, or paying for a service, customers can complete transactions without switching platforms or navigating external payment gateways. This frictionless experience reduces the chances of customers abandoning a transaction due to a cumbersome payment process.

Embedded finance enables businesses to offer tailored payment solutions, such as flexible installment plans, digital wallets, or even cryptocurrency payments. This customization caters to a wide range of customer preferences, further enhancing the likelihood of completing transactions.

b. Subscription and membership services

Embedded finance empowers businesses to automate subscription renewals. This means customers can seamlessly continue their subscription or membership without manual intervention. This convenience not only reduces churn but also ensures a steady stream of recurring revenue for businesses.

Businesses can offer additional perks or tiered membership levels by embedding finance into subscription models. For example, customers who upgrade their subscriptions may gain access to premium content, exclusive discounts, or priority customer support. These value-added benefits incentivize customers to remain loyal.

Embedded finance tools provide businesses with valuable insights into customer behavior. This data can be leveraged to optimize subscription offerings, identify at-risk customers, and tailor marketing efforts to improve customer retention.

2. Embedded finance provides customized solutions

Personalization through embedded finance is about delivering the right financial products and services to the right customers at the right time. By harnessing data-driven insights and offering tailored financial solutions, businesses can create highly engaging and customer-centric experiences. This not only boosts customer retention but also fosters brand loyalty and long-term relationships.

a. Data-driven insights

Embedded finance tools collect and analyze vast amounts of customer data. This includes transaction history, spending patterns, preferences, and more. By leveraging advanced analytics and machine learning algorithms, businesses can gain deep insights into individual customer behavior.

Using these insights, businesses can segment their customer base into distinct groups based on various attributes and behaviors. For example, they can identify high-value customers, frequent purchasers, or those at risk of churning.

With segmentation in place, personalized product and service recommendations become possible. For instance, an e-commerce platform can suggest products based on a customer’s past purchases, improving the likelihood of additional sales.

b. Tailored financial products

Embedded finance allows businesses to design and offer financial products that cater to specific customer needs. For instance, a FinTech company could provide tailored investment portfolios based on an individual’s risk tolerance and financial goals.

Tailored financial products also extend to flexible payment solutions. Businesses can offer installment plans, buy now, pay later (BNPL) options, or credit lines based on a customer’s financial situation.

Personalized loyalty programs, driven by embedded finance, can reward customers for their engagement. Points, discounts, or cashback offers can be tailored to match customer preferences and spending habits.

3. Embedded finance expands payment options

The expansion of payment options through embedded finance is about offering customers the flexibility and convenience they expect in today’s global marketplace. By providing diverse payment gateways and facilitating cross-border payments, businesses can cater to a broader audience, reduce friction in the payment process, and ultimately boost customer retention. Customers are more likely to stick with companies that accommodate their preferred payment methods and make cross-border transactions hassle-free.

a. Diverse payment gateways

Offering a variety of payment gateways provides customers with options that align with their preferences and geographic locations. This convenience minimizes friction during the payment process, reducing the likelihood of abandoned transactions.

Diverse payment gateways enable businesses to cater to a global customer base. Companies can attract and retain international customers by accepting various payment methods, including credit/debit cards, digital wallets, bank transfers, and more.

Some customers may prefer specific gateways due to their reputation for security. Providing choices empowers customers to select the payment method they trust most, fostering a sense of security in financial transactions.

b. Cross-border payment solutions

For businesses eyeing international growth, embedded finance can facilitate cross-border transactions seamlessly. Cross-border payment solutions allow customers to make payments and transactions across different countries and currencies without complications.

Integrated currency conversion tools ensure customers can view prices and make payments in their preferred currency. This simplifies the shopping experience for international customers and minimizes the risk of cart abandonment due to unfamiliar currencies.

Compliance with international financial regulations is vital. Embedded finance providers often ensure that cross-border payments adhere to local and global financial laws, enhancing trust and reducing legal risks.

4. Embedded finance ensures data security

Data security in embedded finance is vital for maintaining customer trust and reducing churn. Robust encryption, multi-factor authentication, and compliance with data protection regulations all contribute to the security of financial transactions and sensitive information. Businesses that prioritize data security can assure customers that their financial data is well-protected, ultimately leading to higher customer retention rates.

a. Robust encryption and authentication

Embedded finance platforms employ robust encryption protocols to protect data during transmission. This encryption ensures that sensitive information, such as financial transactions and personal details, remains confidential and cannot be intercepted by malicious actors.

Multi-factor Authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of verification, such as passwords, fingerprint scans, or one-time PINs, before accessing their financial data or making transactions. This significantly reduces the risk of unauthorized access.

b. Customer trust

Trust is a fundamental component of customer retention. Businesses leveraging embedded finance must establish and maintain trust by safeguarding customer data. A breach of trust, such as a data breach or security incident, can erode customer confidence and lead to churn.

Open communication about data handling practices, privacy policies, and security measures can build trust. Customers appreciate knowing that their data is being handled responsibly and that the company is accountable for any issues.

Complying with data protection laws and financial regulations helps avoid legal repercussions and demonstrates a commitment to customer data security. This adherence fosters trust among customers who know their data is handled following established standards.

Businesses Benefitting from Embedded Finance

Diverse businesses across industries have harnessed the power of embedded finance to enhance customer retention and elevate their market presence. These case studies exemplify the potential of embedded finance in fostering loyalty, streamlining financial processes, and delivering exceptional customer experiences.

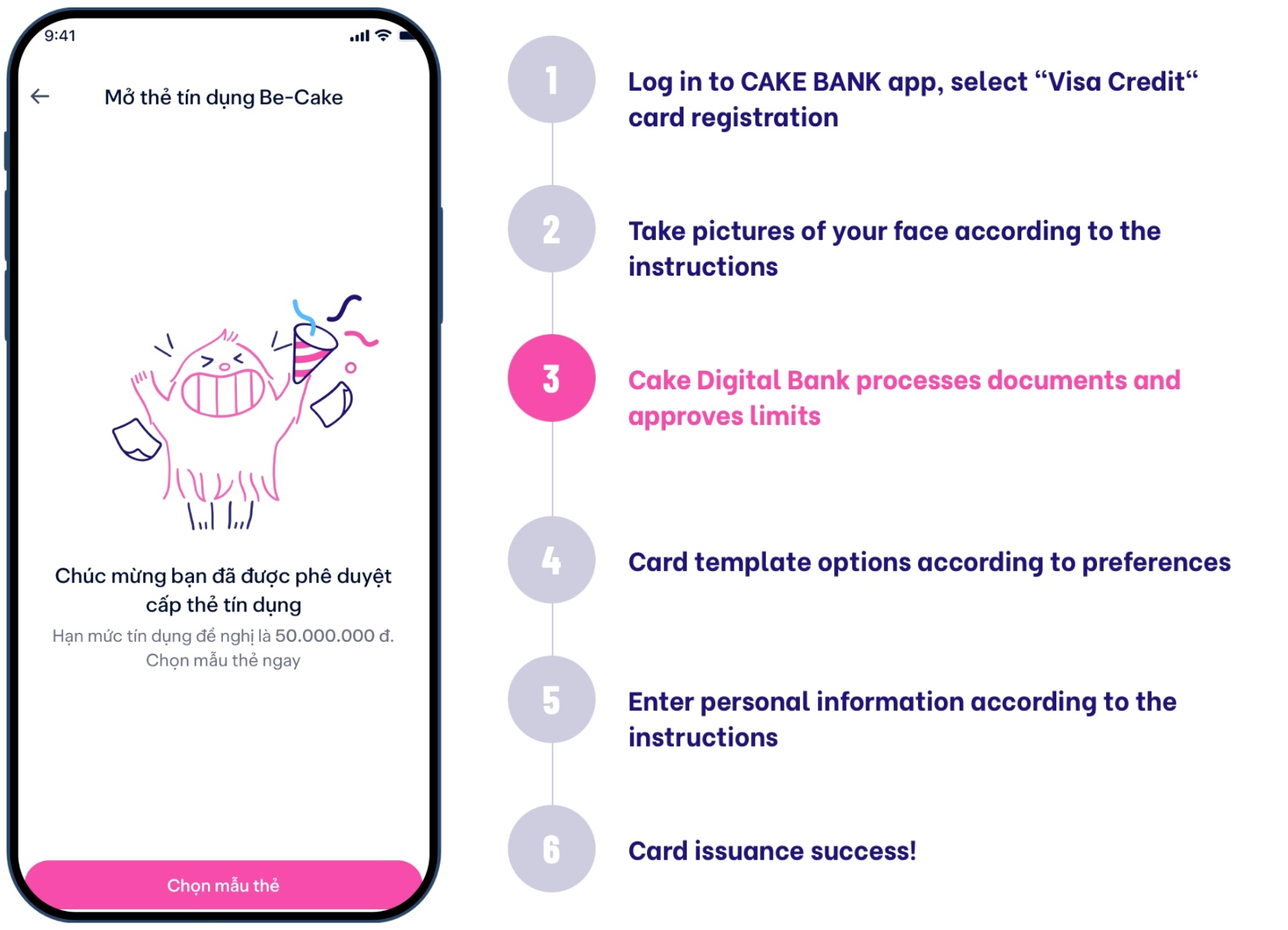

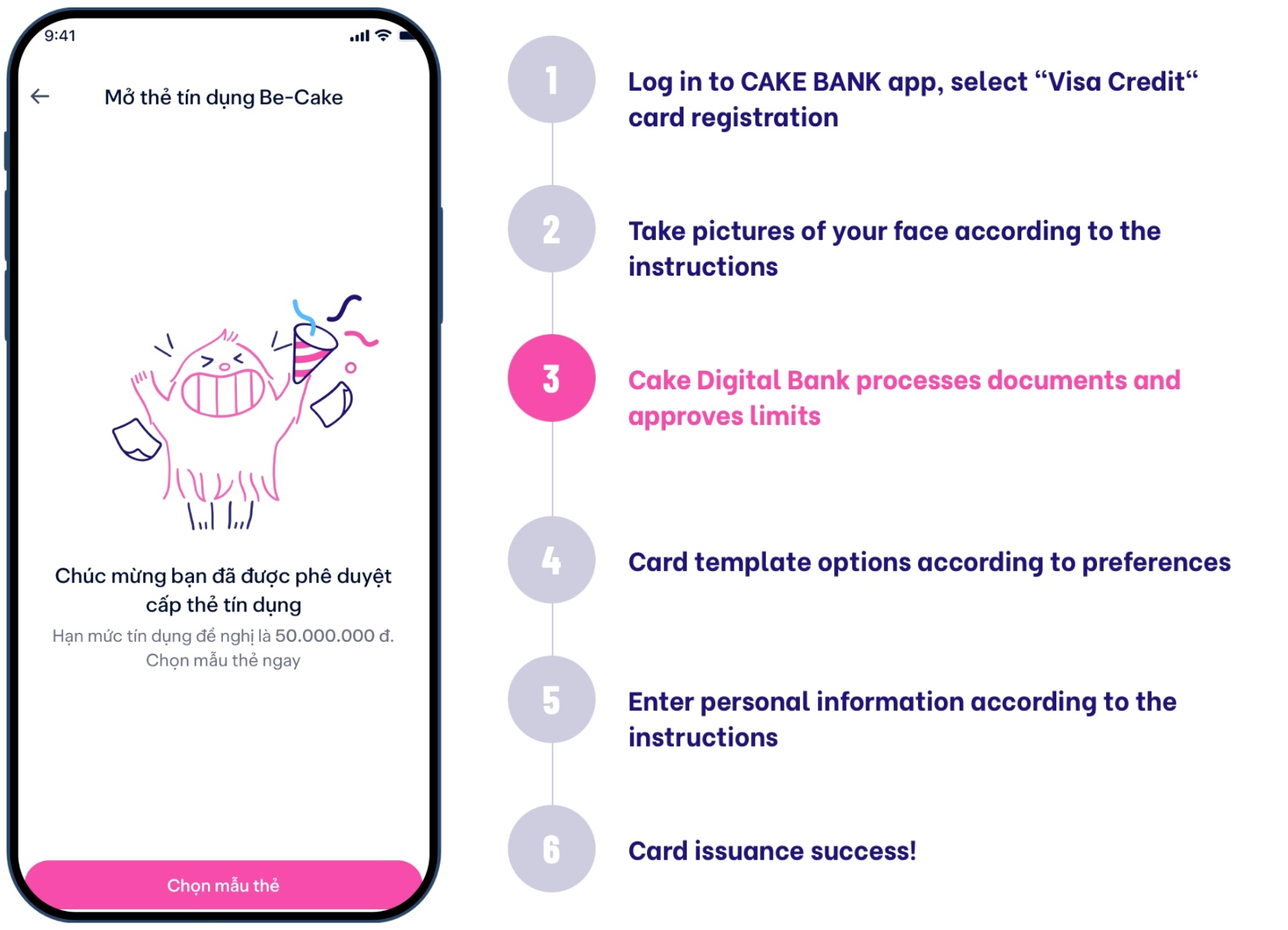

Cake by VPBank in Vietnam

Cake, in collaboration with the on-demand consumer platform Be, introduced a co-branded credit card that offers impressive cashback rates of up to 20% and delivers attractive payment experiences to customers. This innovative product garnered recognition with the “Pioneering Digital Partner in Rapid Credit Card Issuance” award from VISA. Thanks to Cake’s technology platform, customers can complete online registration in minutes and start shopping online immediately, even before receiving their physical card. Cake stands out as one of the few digital banks capable of issuing international credit cards within just two years of operation. The Be-Cake credit card not only offers a wide range of financial services, including payments, savings, lending, micro-investments, and credit cards but also provides a hassle-free online application process with only an ID card required. With impressive growth rates and more than 3 million users, Cake by VPBank has firmly established its presence in the market, processing transactions valued at over VND38 trillion (US$1.62 billion) as of April 2023.

Fibe in India

Fibe, a leading Indian consumer lending platform, introduced Buy Now, Pay Later (BNPL) services for various medical and cosmetic treatments. They implemented an engaging conversational UI-based onboarding process in their Fibe App version 3.0 to enhance user experience. The addition of a multilingual chatbot, robust security measures, and personalized customer journeys led to impressive outcomes, including a 20% increase in customer conversion rates and a remarkable 65% surge in repeat customers. Fibe’s digital-first approach, reducing loan registration time by 67%, garnered a 4.5 rating on the Play Store and boosted their Net Promoter Score from 60% to 72%, contributing to their expanded customer base of 5 million.

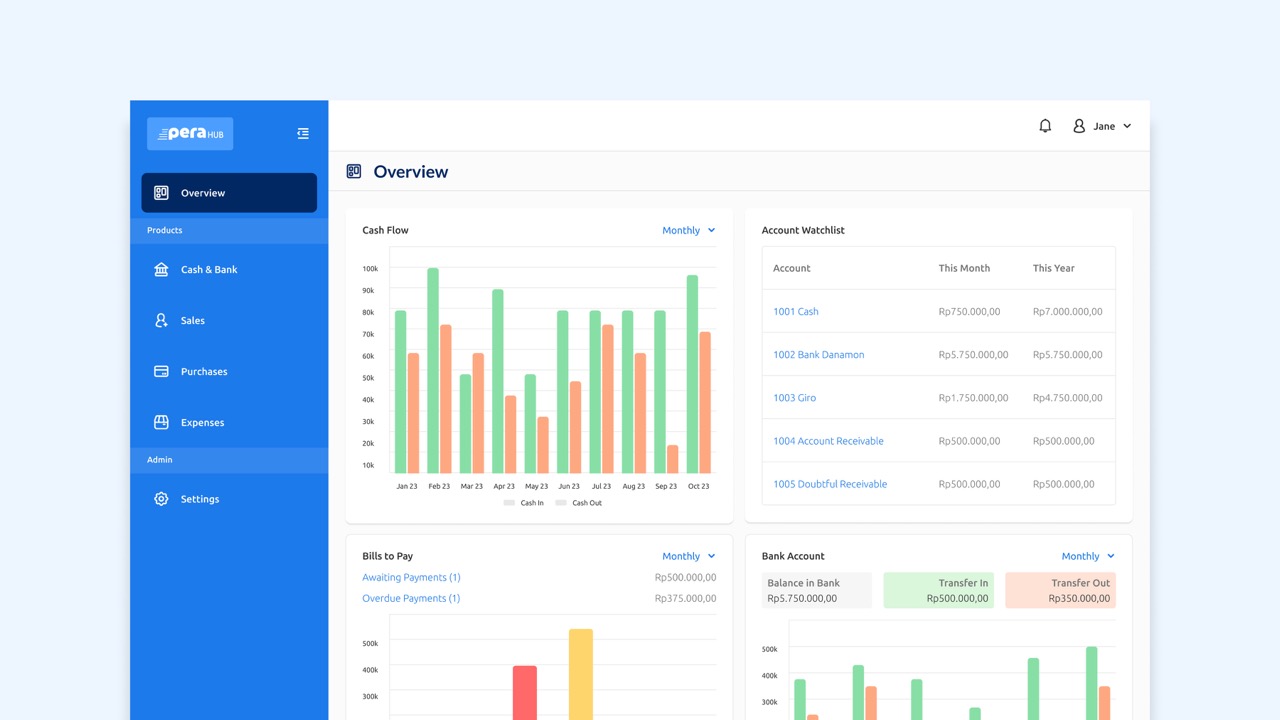

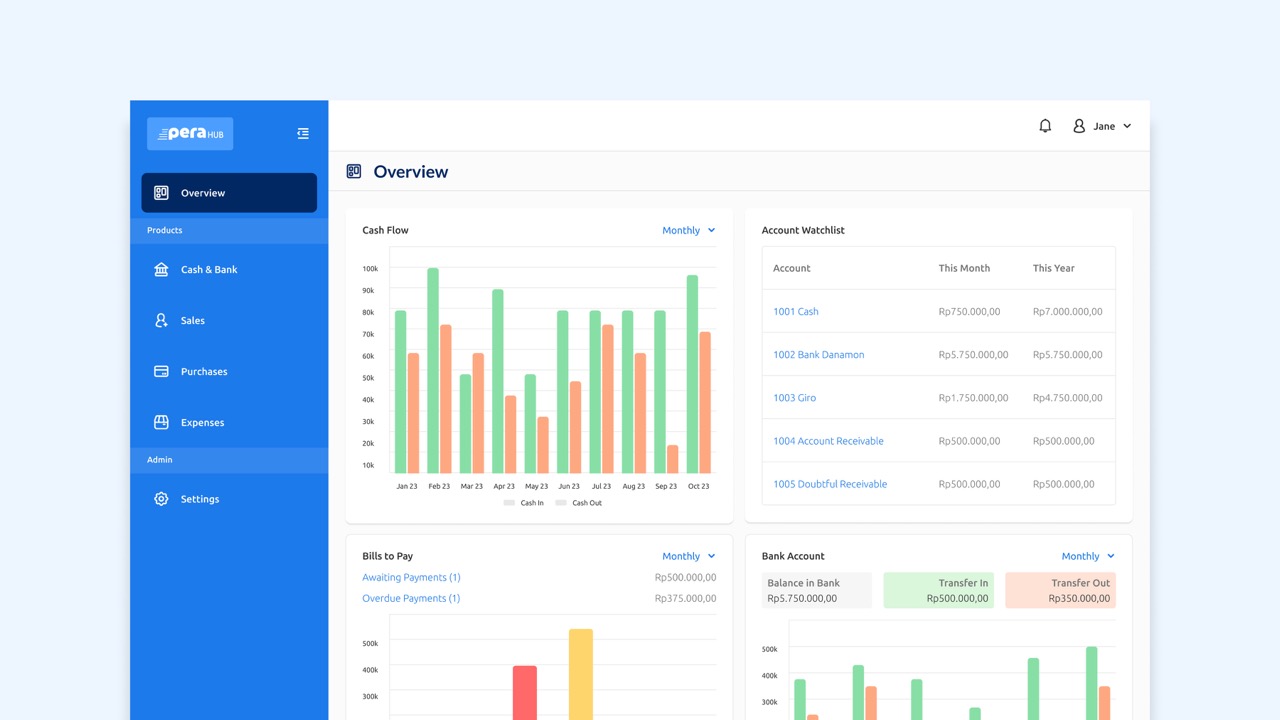

PERA HUB in the Philippines

PERA HUB, a prominent financial service provider in the Philippines under PETNET, collaborated with Brankas to introduce a Digital Remittance Platform that empowers the institution to share its API with various entities, including banks, remittance companies, wallets, and fintech partners. This partnership facilitated the provision of faster, more cost-effective, secure, and accessible financial services. The company established an open API hub that allowed partners to join effortlessly. This innovative approach allowed partners to seamlessly integrate into the core remittance system, granting real-time management of partner relationships and endpoints. Notably, the platform also streamlined Digital Sub-Agent (DSA) interactions, facilitating instant API consumption and expediting the review process for DSA applications.

Grab Holdings Limited in Singapore and Malaysia

Grab Holdings Limited, originally known as a ride-hailing platform, made significant strides by obtaining full digital banking licenses in Singapore and Malaysia via its digital banking venture, GXS Bank Pte. Ltd. The company harnessed embedded finance to offer its customers a wide array of services, encompassing shopping, food delivery, transportation, payments, savings, and investments. This transformation effectively turned Grab into a super app, resulting in heightened customer engagement, improved retention rates, and increased overall customer lifetime value.

Starbucks in the US

A prime example of how embedded finance can excel in loyalty platforms is Starbucks—they are the bank that sells coffee. Customers can effortlessly manage their funds, accumulate rewards, make payments, and even place orders through their smartphones. This approach played a major role in contributing to 55% of the company’s US operating revenue in Q4 2022, with over 28.7 million members just in the U.S. The platform has securely stored more than $1 billion belonging to its users—to put it in perspective, that is more than what 85% of U.S. banks hold in assets.

Facilitators of Embedded Finance

Various entities work together to make integrated financial services a reality. These facilitators play crucial roles in enabling businesses to smoothly incorporate financial products into their offerings.

FinTech companies serve as the technological backbone of embedded finance. They offer platforms that distributors can access and customize to provide a wide range of financial products. Some FinTechs, like Brankas, provide comprehensive platforms that encompass multiple financial services, including bank account opening, deposits, bank data, simplified bank-to-bank payments, and lending. Others specialize in specific financial categories, like card issuing.

Balance sheet providers (licensed financial institutions) are responsible for manufacturing embedded finance products. They also offer risk and compliance services, ensuring regulatory adherence. Moreover, they provide access to funds required for lending and deposit-related offerings. Collaboration between balance sheet providers and technology providers is customary.

The time for businesses to embrace embedded finance solutions is now. Whether you are a retailer, a digital platform, or a service provider, the potential for improved customer retention, revenue growth, and a more seamless customer experience is too significant to ignore. As technology continues to evolve and more facilitators enter the embedded finance landscape, the possibilities are boundless. As businesses increasingly intertwine financial services with their core offerings, they unlock unprecedented opportunities for customer engagement, loyalty, and revenue generation.

References:

https://www.mckinsey.com/industries/financial-services/our-insights/embedded-finance-who-will-lead-the-next-payments-revolution

https://www.ey.com/en_gl/banking-capital-markets/fintech-ecosystems/how-banks-are-staking-a-claim-in-the-embedded-finance-ecosystem

https://www.nium.com/resources/four-ways-embedded-finance-can-help-businesses-improve-customer-stickiness

https://www.bworldonline.com/economy/2023/06/25/530594/how-embedded-finance-elevates-the-customer-experience/

https://bfsi.eletsonline.com/transforming-the-credit-landscape-fibes-co-lending-initiatives-and-technological-advancements-reshape-borrowing-experience/

https://e.vnexpress.net/news/business/cake-digital-bank-wins-innovative-product-award-4610379.html

https://www.brankas.com/case-study/perahub

https://gtngroup.com/asia/insights/embedded-finance-driving-a-new-wave-of-fintechs-3/